如果您希望第一时间收到推送,别忘了加“星标”!

如果您希望第一时间收到推送,别忘了加“星标”!

北京时间3月23日(周四)凌晨,联储3月FOMC决议加息25个基点、基准利率升至4.75%-5.0%区间,释放一定鸽派信号,决议声明软化了加息的前瞻指引,承认曾考虑过3月不加息,但点阵图指示未来还有一次加息,2023年不降息。

核心观点

北京时间3月23日(周四)凌晨,联储3月FOMC决议加息25个基点、基准利率升至4.75%-5.0%区间,释放一定鸽派信号,决议声明软化了加息的前瞻指引,承认曾考虑过3月不加息,但点阵图指示未来还有一次加息,2023年不降息。缩表方面,美联储仍然维持月度950亿美元(600亿国债+350亿MBS)的缩表速度。议息决议公布后,标普500及纳斯达克综指分别下跌1.7%和1.6%,2年期和10年期美债收益率分别下降23bp和17bp至3.93%和3.43%,美元指数下跌0.7%至102.5。会后市场的加息预期变动不大,预计5月有48%的概率加息25bp,加息终点达到4.93%,下半年降息75bp(图表1)。

鲍威尔认为通胀位于高位,就业市场表现好于预期,但银行风波降低了软着陆的可能性。近期数据反映通胀压力回升(continue to run high);尽管工资增长有所缓和,但劳工需求仍远超供给。近期的银行风波将导致信贷紧缩(tighter credit conditions)拖累增长和通胀,不利于实现软着陆,但对具体的幅度还难以估计(too early to say)。鲍威尔称,增长低迷将持续(subdued growth to continue),但仍然追求软着陆的可能性。鲍威尔强调,美国银行体系稳健而有弹性,贷款计划有效地满足了银行的需求,准备动用所有工具保障银行系统的稳定。

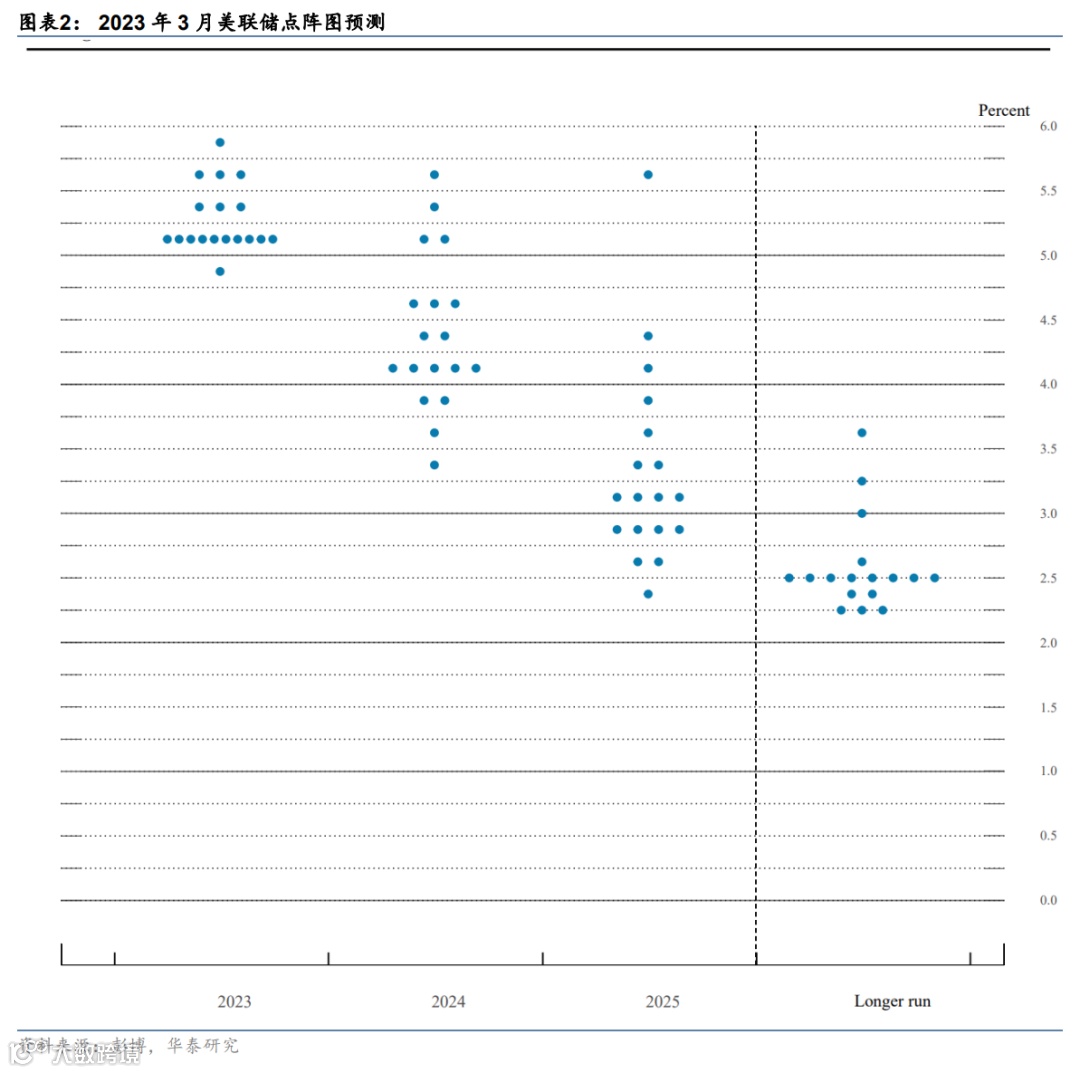

加息路径方面,美联储软化前瞻指引,但鲍威尔强调基准情形下2023年不降息。鲍威尔称,3月会议曾考虑停止加息,但增长和通胀保持强劲,委员会一致支持加息25个基点。美联储软化前瞻指引中的表述,不再预计持续加息(ongoing rate increases),而是强调额外紧缩(some additional policy firming)可能是适当的,为停止加息保留了灵活性,更加接近停止加息。但鲍威尔强调,降息不是2023年的基准情形(rate cuts are not in our base case),具体路径将取决于数据,这与市场的降息预期存在巨大分歧。3月点阵图显示美联储指示美联储2023年不准备降息,18位委员中17名联储官员预计2023年利率超过5%,10位委员预计2023年底利率为5.1%,基本持平于去年12月的预测(图表2)。

美联储小幅下调近期增长预测,并上调通胀预测。2023-24年四季度GDP增速预测下调至0.4%(-0.1pct)和1.2%(-0.4pct),2025年四季度GDP增速预测上调至1.9%(+0.1pct);2023-24年四季度核心PCE预测均上调0.1个百分点至3.6%和2.6%;2023年四季度失业率预测下调0.1个百分点至4.5%(图表3)。此外,联邦基金利率的中位数预测显示,2023-25年年末的利率分别为5.1%、4.3%和3.1%,2024年上调了0.2个百分点,2023年和2025年保持不变。

往前看,银行风波影响的不确定性导致美联储坚持不降息的判断,二季度美联储可能采取加息+提供额外流动性的组合,但下半年联储或仍有必要降息。美联储坚持不降息的判断与市场隐含的利率路径存在巨大分歧,部分是因为银行风波影响幅度存在较大不确定性。我们认为,美联储下半年或仍有必要降息。一方面,地方银行所面临的挤兑风险并没有完全消除。财长耶伦称,不考虑大幅提高存款保险额度及其覆盖面,而美联储当前所采取的加息+扩表的组合并不足以消除挤兑风险以及金融体系所面临的潜在压力。另一方面,利率在1年内快速上行,利率曲线倒挂也近一年,加息和利率倒挂对实体经济的累计效应或在下半年达到最大。美联储降息最早可能是Jackson Hole会议或四季度。不排除降息时点比我们预期更晚,但这也意味着金融体系和实体经济所面临的压力可能会倒逼联储降息。

风险提示:美国银行事件发展超预期、联储政策收紧超预期。

附录:美联储 FOMC声明相较 2月 FOMC的变化

Recent indicators point to modest growth in spending and production. Job gains have picked up been robust in recent months, and are running at a robust pace; the unemployment rate has remained low. Inflation has eased somewhat but remains elevated.

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains Russia’s war against Ukraine is causing tremendous human and economic hardship and is contributing to elevated global uncertainty. The committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4 1/2 to 4-3/4 to 5 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may on going increases in he target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.

文章来源

本文摘自:2023年3月23日发表的《3月FOMC:变鸽派、但或仍不够鸽》

易峘 研究员 SAC S0570520100005 | SFC AMH263

胡李鹏 联系人 S0570121120091

免责声明

华泰证券宏观研究

欢迎关注华泰证券宏观研究,感谢您的支持!我们将与您一同剖析宏观经济、关注资本市场!