OUR INSIGHTS

Nationwide Social Security Premium Reduction and Policy Trend

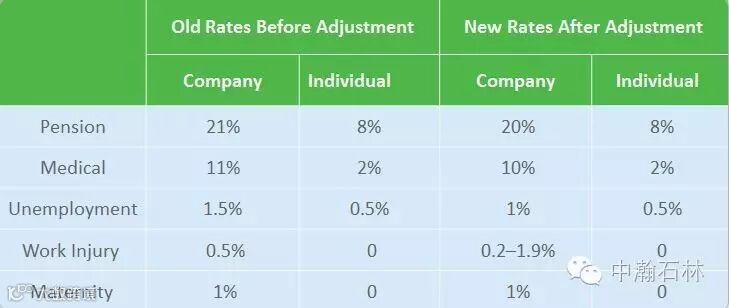

China’s Ministry of Human Resources and Social Security and Ministry of Finance jointly issued a notice recently on cutting social security premiums to reduce the burden on enterprises.

According to the notice, the employer’s contribution rate to the pension fund has been cut to 19–20% depending on conditions this year. In situations where the employer’s contribution to the pension fund is over 20% of the payroll, the rate has been lowered to 20%. In situations where the employer’s contribution is already 20%, the rate may be lowered to 19% in the next two years.

The required unemployment insurance payment rate, which was cut from 3% to 2% of the payroll last year, has been further reduced to 1–1.5%, with the individual’s contribution capped at 0.5%.

The average insurance contributions for work injuries and childbirth remain unchanged following respective cuts of 0.25 and 0.5 percentage point last year. However, the two categories may be combined in the future pending regulatory updates by the State Council, the notice said.

Different provinces, autonomous regions and municipalities are required to roll out specific plans accordingly. In response to the central government’s earlier call to reduce the burden on businesses, 12 provinces and municipalities have cut social security payment rates for employers and employees since end-March.

As an illustration, the new rates for Shanghai’s social insurance scheme, after adjustment, have been in effect since January 2016 and are shown below:

This may not be the final scheme for Shanghai; there is still room for further rate reductions in the future. Looking at the national policy trend, several factors might result in further adjustments to social security payment rates:

The government is considering the extension of pension benefits in Shanghai to the rest of the country. If this plan is implemented, pension benefits would be similar across difference provinces in China. This means many Shanghai residents who originally came to the city from other provinces might return to their home town instead to seek new employment and enjoy comparable pension benefits after retirement. Consequently, this would reduce the pension burden on employers in Shanghai.

The government has proposed the combination of maternity insurance and medical insurance, which, if implemented, may lower the social insurance contributions by employers.

As the economy grows, the government may lower social insurance contribution rates further, reducing the financial burden on enterprises in this area.

TAX

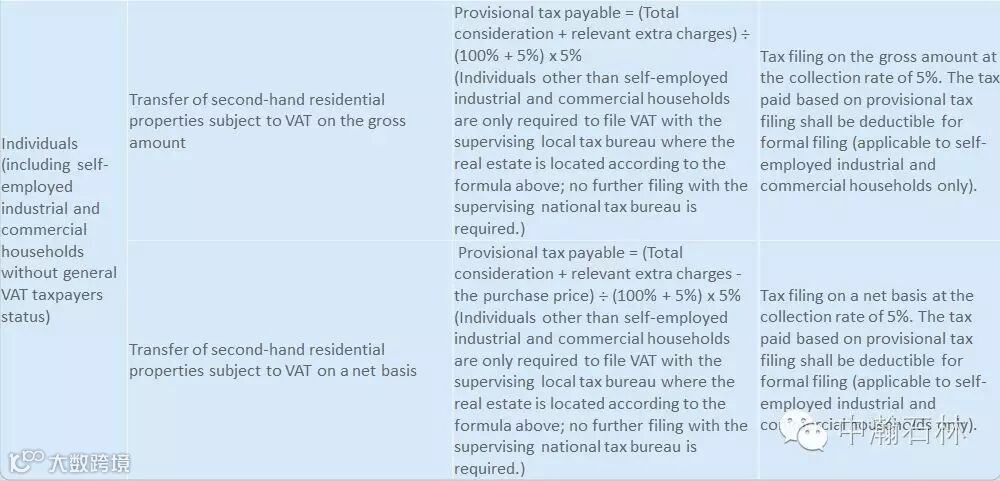

Interim Administrative Measures for Real Estate VAT

On 31 March 2016, the State Administration of Taxation announced interim administrative measures for the collection of real estate value added tax (VAT) from taxpayers. These measures have been in effect since 1 May 2016 and are described in the table below.

Corporate Advisory

Corporate Advisory

Administrative Measures for Private Equity Investment Fundraising

Asset Management Association of China announced administrative measures for private equity investment fundraising (the “Measures”), which will take effect from 15 July 2016.

The Measures stipulate a comprehensive set of industry standards and commercial rules in relation to the fundraising parties, fundraising procedures, account supervision, information disclosure, determination of qualified investors, risk disclosure, cooling-down period, confirmation on return visits, and legal liability of the fundraising institutions and their employees involved in the process of private fundraising.

We are of the view that these Measures will promote the healthy development of the PRC private equity funds industry.

Agreement on Avoidance of Double Taxation between China and Indonesia

The State Administration of Taxation recently announced an Agreement on the Avoidance of Double Taxation between the People’s Republic of China and the Republic of Indonesia (the “Agreement”).

The Agreement has been in effect since 16 March 2016 and applies to income obtained on and after 1 January 2017. It is expected to help in the reduction of tax burdens on enterprises and facilitate economic and trade cooperation between China and Indonesia.

Human Ressource

Interim Residence Permit Regulations for Non-native Citizens

At the end of 2015, the State Council issued interim regulations governing residence permits for non-native citizens in Shanghai, which have been in effect since 1 January 2016. Many areas in China, such as Hebei, Jilin, Tianjin, and Jiangxi, also implemented these regulations in April this year. According to recent proposals by the government, these will also apply to the rest of the country in the future.

Non-native citizens in Shanghai are citizens from other provinces who come to the city to work and do not have a permanent resident address there. In general, non-native citizens holding a residence permit in locations under the interim residence permit regulations will enjoy the same benefits as native citizens in the following areas:

Compulsory education;

Basic public employment services;

Basic public health and family planning services;

Public cultural and sports services;

Legal aid and other legal services;

Application for a driver’s licence;

Processing formalities of entry and exit clearance in accordance with rules and regulations of the People’s Republic of China;

Processing formalities of replacement or issuance of new ID cards in accordance with national rules and regulations; and

Other basic public services as prescribed by the Chinese government

The regulatory requirements that applicants must meet to acquire the “Hukou” (permanent residence) status vary from city to city depending on the local population size. These requirements cover areas such as social benefit contribution, age, educational background, employment status, and technical qualifications.

CONTACT US

Website: www.SBASF.com

Email: Info@SBASF.com

Tan Lee Lee (Ms), Director

T +86 21 6186 7602

tanleelee@SBASF.com

Yeo Lee Soon, Director

T +86 10 8591 1900

yeoleesoon@SBASF.com

Rita Boyle (Ms), Director

T +86 21 6186 7692

ritaboyle@SBASF.com