As the world’s largest economy, the United States is still the land of opportunities: an innovative and productive workforce, excellent infrastructure, appropriate legal protection and a predictable regulatory environment.

作为世界第一大经济体,美国为海外投资者提供了众多机会---创新以及高效的生产力,绝佳的基础设施,全面的法律保护以及可预期的市场环境。

If considering entering the US market or already there, two key components of a company’s business plan are its IP strategy and its tax strategy. With the recent changes in the US, is your organization equipped with the latest information to ensure the most effective IP and tax strategies? Join us for an informative session with Dr. Li Kening from Duane Morris and Mr. Robin Park from Squar Milner where we will touch on:

无论是正在考虑进入美国市场还是已经在美国设立企业,有两个不可忽略的考虑因素:知识产权策略和税务策略。特别是在最近的美国税改以及中美贸易摩擦之后,您是否充分了解这些事件的影响?本次活动特别邀请了美国德茂欣律所的李克宁博士和Squar Milner会计师事务所的合伙人Robin Park先生为我们分享以下话题:

Legal and tax considerations for IP management

知识产权管理的法律及税务考量

Global Expansion: Tax consideration after the recent US tax reform

美国税改之后的税务考量

Venue

SBA Stone Forest conference room

5th Floor, Yangtze Center, No. 2111 Yan'an Road (West), Shanghai

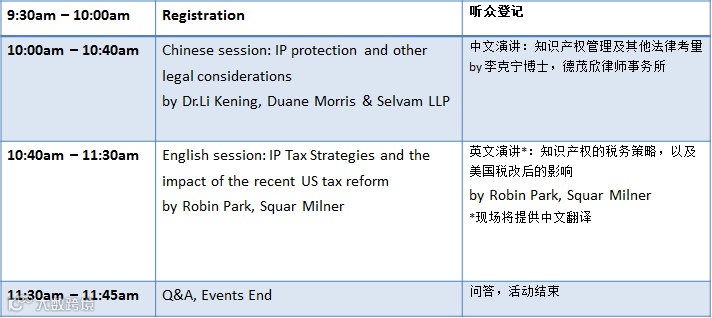

Agenda

Speakers

Kening Li, Ph.D. 李克宁博士

Partner & Head of IP Practice, China

合伙人 & 中国知识产权业务组主管

Duane Morris & Selvam LLP

德茂欣律师事务所

Robin Park

Partner, International Tax Group

合伙人,国际税务服务

Squar Milner

RSVP

Please contact Ms. Lisa Ye for RSVP

活动报名请联络叶女士

Email: Lisaye@sbasf.com

Tel: +86 21 6186 7959

Please click "Read more" to get more information on this event.

点击“阅读原文”可获取关于此次活动的更多信息。