Hong Kong is an undisputed global financial centre, but its commodities market remains underdeveloped. However, Hong Kong has the right ingredients to become Asia’s commodities pricing centre, given its unique position as a gateway to one of the world’s largest commodities consumers, Mainland China, its world-class financial infrastructure and talent and its international status as an offshore Renminbi centre. Further product development and market infrastructure enhancement would not only help transform Hong Kong into an all-round financial centre with multi-asset class capabilities, but also give enterprises and investors in the commodities sector a unique access to liquidity in both China and global markets.

HKEX’s Chief China Economist’s Office and Commodities Development have jointly published two research reports that give an overview of the current status of the Hong Kong commodities market and examine the initiatives taken by HKEX to build Hong Kong into a global commodities trading centre, including new products development and infrastructure connectivity. We have also looked at potential opportunities for collaboration with other exchanges and industrial organisations to elevate Hong Kong’s international status as a global commodities trading centre.

Hong Kong Futures Exchange (HKFE, a subsidiary of HKEX) is Hong Kong’s only exchange to offer commodity derivatives trading. In the past decade, HKEX has rolled out 16 exchange-traded commodity futures contracts for precious, ferrous and base metals, and 6 non-tradeable gold indices. Acting within the Mutual Market Access programme and the “buy-and-build” strategy, HKEX acquired the London Metal Exchange (LME) in 2012 and established the Qianhai Mercantile Exchange (QME) in 2018. It also aims to replicate the Stock Connect model for commodities trading and clearing, bringing together the prices formed in the Mainland and international commodities markets by linking LME and QME.

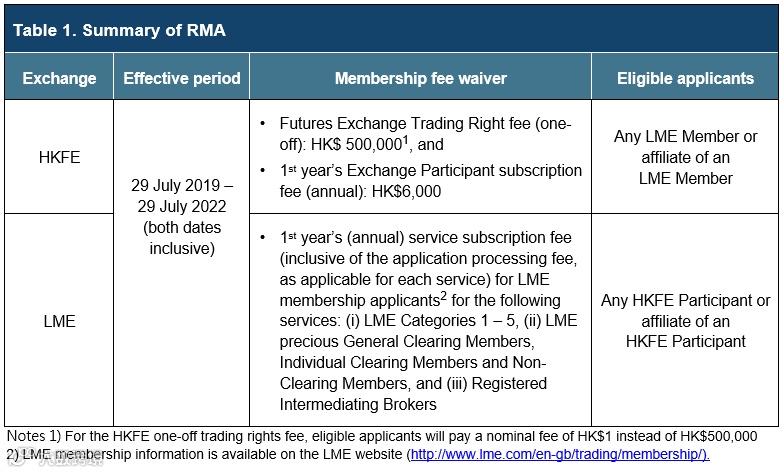

A Reciprocal Membership Arrangement has been introduced in order to encourage LME members to join the HKFE, and vice versa. The exchanges will waive their membership fees for members or affiliates of the reciprocal exchanges.

Furthermore, HKEX has signed Memoranda of Understanding with a number of Chinese Price Release Agencies and industrial organisations to enhance cooperation and promote mutual business development in the financial and commodities markets as well as strengthen the international influence of Mainland China’s commodity prices.

All these initiatives, and the ones to come, will help build up and solidify the HKEX connectivity platform for effective connection between the Mainland and the world’s commodity markets.

Tap Read More for the full reports.