Click Blue Characters "Wowcommerce" above to enter and follow resource center

This $2.4 Billion Singapore Firm Is Betting Everything on China

APS Asset Management Pte is going all-in on China.

The $2.4 billion Singapore-based firm will shut its non-China-focused strategies with about $250 million of outdoor money to center of attention solely on Asia’s greatest economy, it stated in a declaration Tuesday. Clients will either be capable to get their capital back or cross into the China strategies.

“Although we have generated enormous alphas in different markets within Asia, we experience that our clients are best served by us devoting all our time and power to generating the great returns in China,” Founder and Chief Investment Officer Wong Kok Hoi said. “APS henceforth will be a China house — live, breathe and suppose China.”

Why Is There a Shift?

The shift in the center of attention had been underway for some time. Exposure to China already makes up 90% of the firm’s property underneath management, and Wong partly relocated to Shanghai about six months ago. APS was once one of the earliest Asian managers to win a mandate to exchange yuan-denominated shares in China, too.

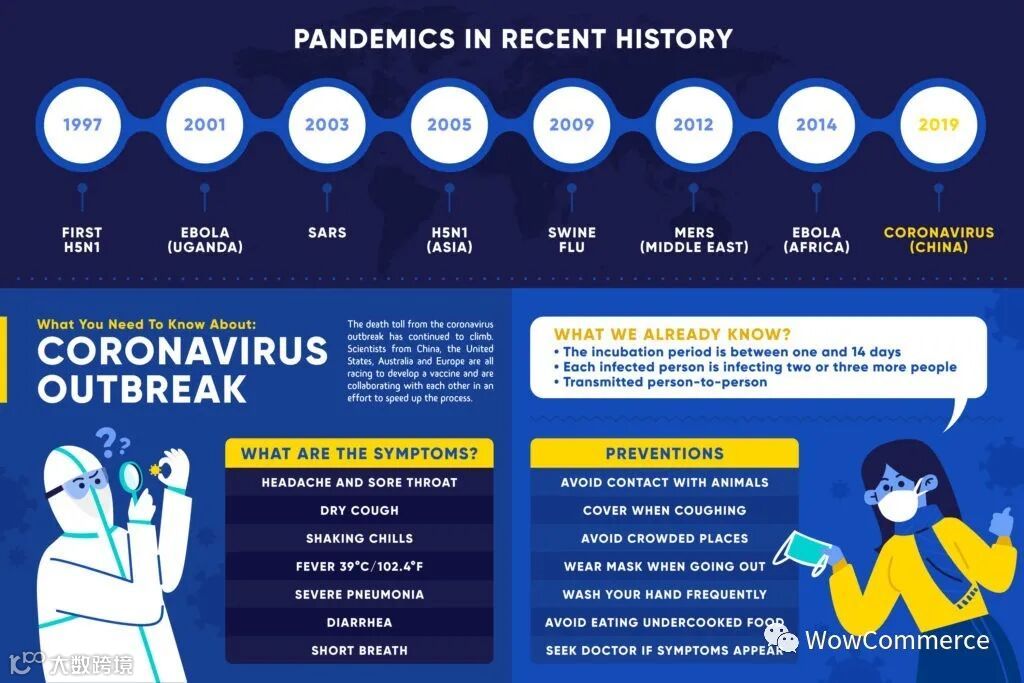

Will The Coronavirus Outbreak Affect Long-term Market?

But it also comes as Western sovereign wealth, endowment and pension money seem to make bigger their publicity to China, preferably via noticeably large, mounted operators. While the non-permanent outlook has been damaged by means of pro-democracy protests in Hong Kong, the coronavirus outbreak and home deposit tightening, most market watchers agree that the nation’s financial system and neighborhood consumption will continue to grow over the longer term.

Asset managers like hedge money are also going through rising redemptions as consumers question the value of paying high charges at a time when index funds are delivering robust returns.

APS’s major promoting point is its in-depth China market research; most of its assets are centered in long-only China-focused funds, such as shares in groups that change on the mainland Chinese and Hong Kong stock exchanges, as nicely as U.S.-listed ADRs.

The Shift Was Not A Reflection of The Overall Performance

President of North America and Europe, Ken Chung, stated the shift wasn’t to do with cost-cutting or a reflection of the overall performance of non-China strategies. The firm’s Asia-Pacific long-short approach has generated an annualized return of about 12% given that inception in 2008, he said.

Some of the group’s best-known strategies have been contrarian takes on large Chinese groups such as JD.com Inc. Its China A long-only strategy gained 33.1% in 2019 and has delivered an annualized return for the reason that inception of 17.8%.

Read More: China Records Massive Growth in Foreign Capital Despite Viral Outbreak: Report

If you have any questions, you may contact us here