Please Click ''MoversRelocation'' above to follow us!

1.About moving to UK

TOR-01 – THE APPLICATION PROCESS

In order for an individual to qualify to import their used personal belongings free from duty and tax, an online application under Transfer of Residence (ToR) relief needs to be made by the importer (which we recommend is

done at least 10 days prior to shipping) using the TOR01 application form at the link below:

https://www.gov.uk/government/publications/application-for-transfer-of-residence-tor-relief-tor01

NOTE: This is an “application” process to use the ToR relief heading, it is not a clearance request.

Once completed the form should be printed, signed and emailed with all applicable supporting documentation to

nch.tor@hmrc.gsi.gov.uk

NOTE: Customs may require additional information to be presented after receipt of the application, it is

therefore imperative that a valid / active email be provided to HMRC.

Supplementary items required to accompany the ToR01 Application to HM Customs:

• Copy Passport

• Visa if applicable

• National Insurance number if applicable/available

• Packing list / survey list of the goods being imported

• Any proof of purchase or value for the goods you have (especially for higher value items)

• For any goods that purchase receipts are not available we suggest to include a written declaration informing this to be the situation, and detail estimated their current (second hand) value (please note this should not be the replacement / insurance value)

• Proof of ownership for vehicles – registration documents older than 6 months

• Proof that have lived out of the EU for last 12 months – Utility Bill/Bank statement with address on.

• Employment contract if applicable and or employer’s statement Work permit if applicable

• Tenancy or purchase agreement for home in the UK if applicable. If living with family state this.

UNIQUE AUTHORISATION CODE

Once HM Customs & Excise are fully satisfied that the full criteria for ToR relief has been met they will issue the

applicant with a “Unique Authorisation Code”. It should be noted that the issue of this code from H.M Customs & Excise simply authorises that individual to import goods their personal goods under this relief heading.

NOTE: This should not be mistaken for the grant of Customs clearance.

Once issued, the Unique Authorisation Code should be provided to EuroGroup International Movers without delay to facilitate the customs clearance entry that will be made once the goods have arrived at the destination

port / airport. DUTIABLE AND RESTRICTED / PROHIBITED ITEMS

A separate written declaration of any prohibited, restricted items and or any goods that are excluded from ToR relief should be provided directly to the destination Movers. This will then be submitted in addition to the Customs entry made under the Transfer of Residence Relief.

NOTE: Dutiable items include alcohol, tobacco products, items that are less than six months old

The written declaration should detail:

• A list of the items

• Their individual value

• For any alcohol - the number of bottles, type, size of each bottle (if half full then adjust accordingly),

alcohol percentage and the value of each.

• For Tobacco - provide the weight and value

• For Cigars – provide the weight and number of cigars along with value

• For Cigarettes – provide the number of individual cigarettes with the value.

Any Customs duties and taxes levied as a result of this declaration will be advised to the client accordingly.

PLEASE NOTE:

The information contained within this sheet is intended to act as a guide only. The exact process for ToR applications and Customs clearance processes are subject to change and interpretation, particularly at this time. We expect some amendments will be applied to the process and forms for a while after the new procedure is implemented and improvement needs are identified. We cannot be held responsible for notifying of any changes, so it must be made clear the importer/owner of the goods is responsible for making themselves aware of the procedures to follow for shipments to the UK and what is required of them.

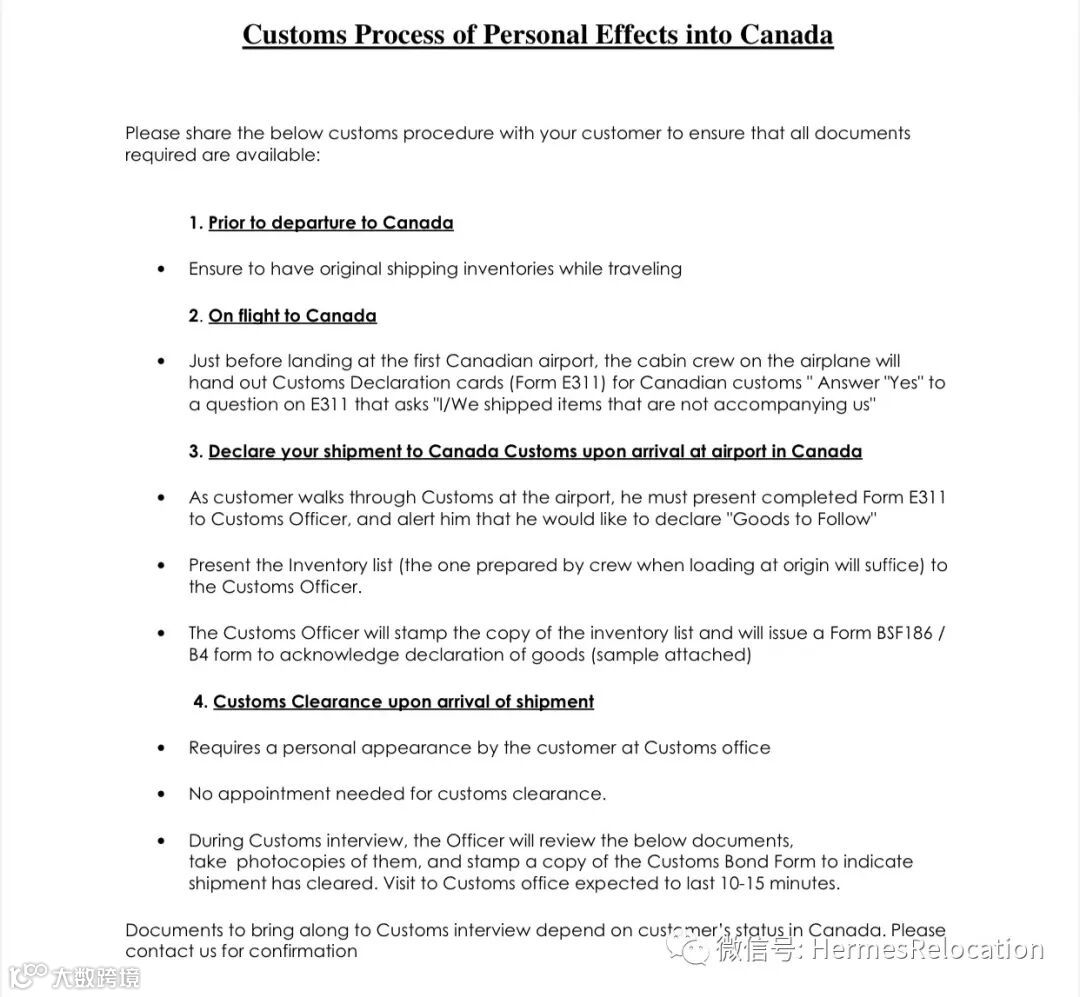

2.About moving to Canada

Documents Required

Copy of Passport (photo page only)

Proof of Residency abroad for at least 1 year (bank statements, utilities, rent receipts, income tax statement, etc. for first and last month of 12-month period) (returning citizens)

Detailed inventory / Packing list in English or French

Receipts for new items

Original Bill of Lading (OBL) / Air Waybill (AWB)

Liquor Permit, if applicable

Immigration papers, if applicable

Work Permit / Student Visa holders, if applicable

Proof of residence in Canada (copy of Deed / Sales Agreement / Lease Agreement) (seasonal residents)

Copy of Death Certificate (import of inheritance items)

Copy of Will or Letter from the Executor of an estate (import of inheritance items)

Obligation for Privilege from the Canadian Ministry of External Affairs (Diplomats)

Preparation for customs clearance process:

Aboove all for your kind consideration, if you need more information and help about moving and relocation, please feel free to contact us.

Hermes International Moving Company-Hermes Relocation is a relocation company based in Shanghai. It has been set up for 10 years and have served many clients all over the world.

We have served clients from HP, JLL,KIMBERLITE DIAMOND, O’MELVENY&MYERS LLP, CITIC CAPITAL, THE CANVAS, LINDEGROUP, SAATCHI & SAATCHI, M+W GROUP, DNV.GL, REGO, CHANEL, ALSCO, and CHARLTON CONSULTING, COTY, INDITEX, TRW, TATA GROUP, BLUE NILE,SUZLON,YCIS, DYSON and so on.We have moved and handled shipments from and to BRAZIL, SINGAPORE, INDIA, PHILIPPINES, PAKISTAN,SAUDI ARABIA, ISRAEL, LEBANON, GERMANY, RUSSIA, AUSTRALIA, USA, THAILAND, MALAYSIA, SPAIN, CANADA, NEW ZEALAND, UK, SWEDEN, MEXICO, JAPAN, CROATIA, FINLAND and other European and American countries.

Hermes International Moving Company is still a "new" company to many of you, we aim to be your relocation consultant and your moving partner. We will do our best to put it into practice. If you have any needs about relocation and moving, please feel free to contact us.

We are open to every good ideas and capable people. If you have any idea and interest about the Hermes Relocation's developing and future, please feel free to contact us, everyone is welcomed.

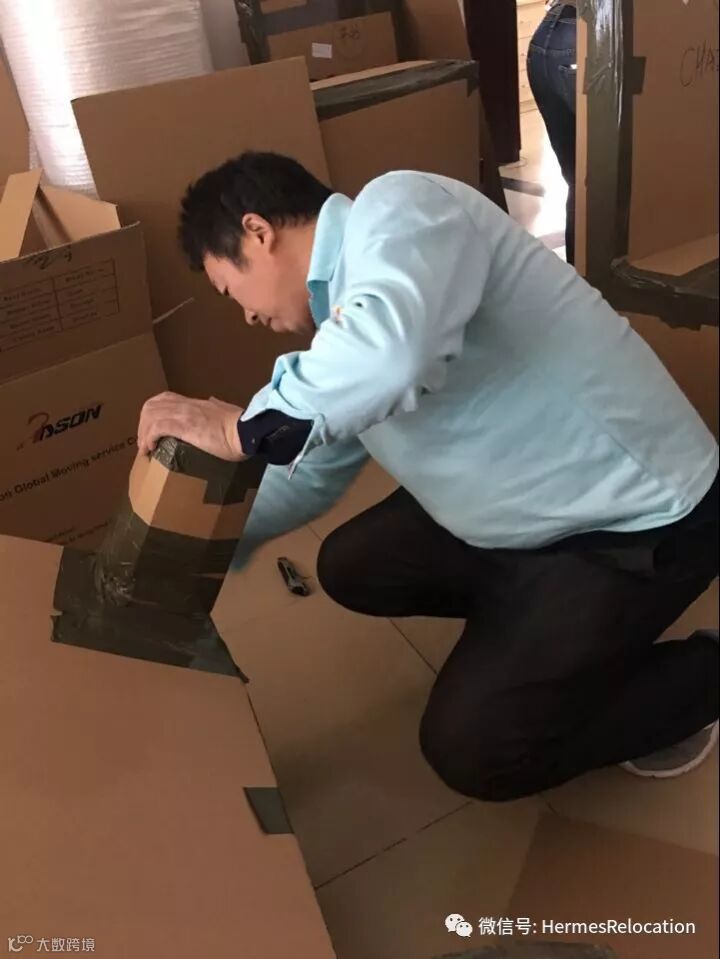

Our professional packing materials

Our Professional Packing

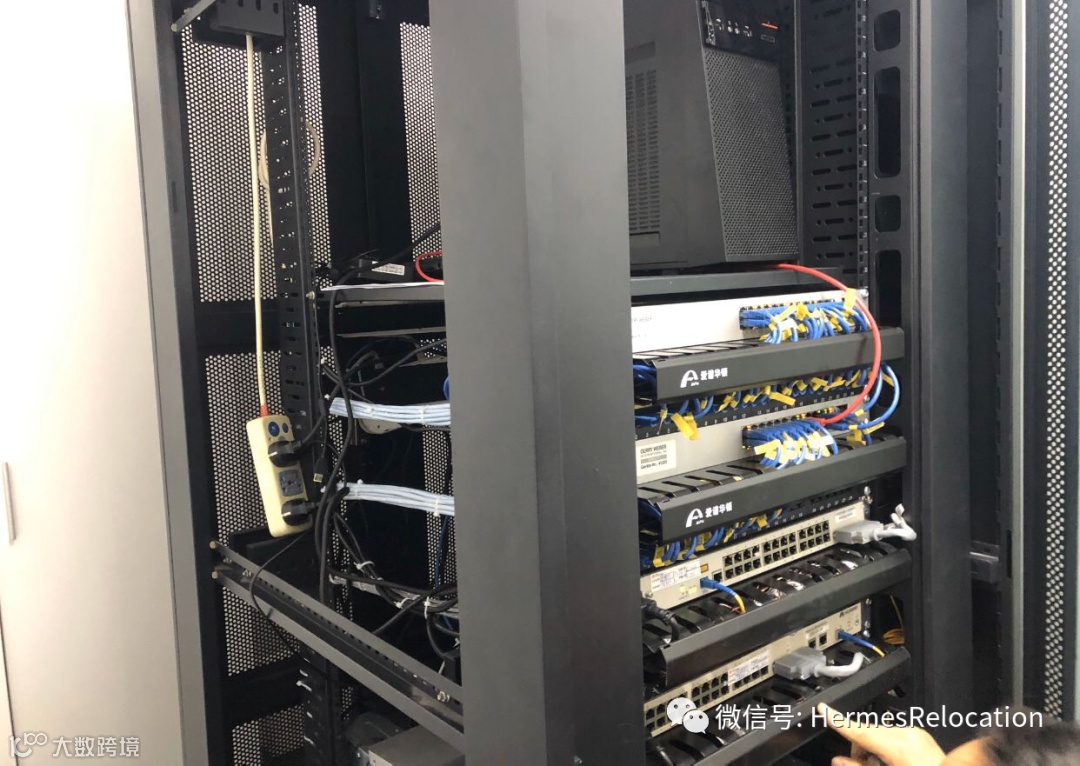

Our Office Move Services

Office Air Treatment

Office IT System Set Up

Our Hanging and flat Wardrobe

Our Local Move after Arrived New Home in Shanghai

Our trucks

After Packing at Origin and Before We Left Client's Home

LCL shipment after packing and delivered to our storage

Making pallets for the LCL goods.

LCL shipemnt load into the container

FCL shipment in our Storage

Load into container for FCL shipment

Our Destination Delivery

LCL Shipment

FCL Shipment

40ft Container Arrived in Paris, France, Delivery with Shuttle Services

If you want a free survey and quotation for your move please call us on 86 21-50591173, 18019371571 or send an email to info@hermesrelocation.com

Hermes International Moving Company

Website:www.hermesrelocation.com

WeChat : HermesRelocation

E-mail: info@hermesrelocation.com

Phone : 021-50591173 18019371571

For more information,photos of packing site, and customer feedback, please check out www.hermesrelocation.com

You can scan below QR code to follow us to get more aritcles about the visa policy, events and news about life in Shanghai in the history of our official account-HermesRelocation