PDH Capacity Expansion Slowed Down

Highlights

In recent years, the PDH technology developed rapidly in China and gradually became one of the most important resources of propylene. However, the capacity expanding speed of PDH units slowed down obviously in 2017. But concerning margins performance, more margins were made in the PDH industry in 2017, with great development potential.

The capacity continued being released, but it was unexpected that expanding speed slowed down.

The PDH unit with capacity of 600kt/a at Tianjin Bohai Chemical Group was put into operation in October 2013, marking that PDH industry started officially. After that, PDH units increased in China, especially in North China, East China, etc. Meanwhile, alkane mixture dehydrogenation units also appeared. As of now, total capacity of PDH units (including alkane mixture dehydrogenation units) reached 5,135kt/a, occupying 15.4% in total capacity of propylene, with rapid development speed.

However, the expanding speed of PDH capacity slowed down obviously in 2017. Up to now, only an alkane mixture dehydrogenation unit at Shandong Dongming Petrochemical was put into operation, while there was no new PDH unit. The reasons why this situation appeared were as follows. First, the scale of PDH unit was large. And with high investment and long construction period, the PDH units were built intensively in previous years, and the follow-up PDH units were still in construction. Secondly, the production technology was from foreign countries, and the propane basically depended on import. Thus, there were limited companies that could put PDH units into operation. Lastly, the propylene capacity extended greatly in recent years, so propylene prices were notably lower than those in previous years. All in all, putting new PDH units into operation would produce some negative effects for companies.

The propylene industry met some difficulties, but profits were fine.

In previous years, propylene prices remained high, and there was large gap in supply-demand fundamentals, which attracted many participants. Under this background, PDH units arose step by step. However, from H2, 2014, propylene prices slipped sharply and even collapsed to the lowest level in 2015, causing dismal market sentiment. But producers with PDH units continued gaining fine profits.

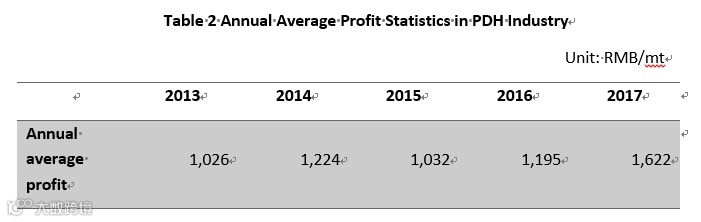

According to Table 2, the annual average profit in the PDH industry was higher than RMB 1,000/mt in recent years, which didn’t impacted a lot by the sharp decline of propylene prices. Up to now, the annual average profit in 2017 reached RMB 1,622/mt, up 36% from 2016. Overall speaking, the development of PDH industry still had huge potential.

According to incomplete statistics, there will be more than 7,000kt/a propylene capacity from PDH units adding and prevailing in North China, East China and South China. Most of planned PDH units have downstream units, so the propylene from the PDH units will be used in their own production. In the future, PDH units will be the major part in the expansion of propylene capacity in China, and profits they brought will maintain at highs in the long run, with huge development potential. Market players should focus on the building and operation of new units.

For more information please contact us at

overseas.sales@sci99.com

+86-533-6296499