2019 Imported Methanol Prices for Long-Term Contracts on a Decline

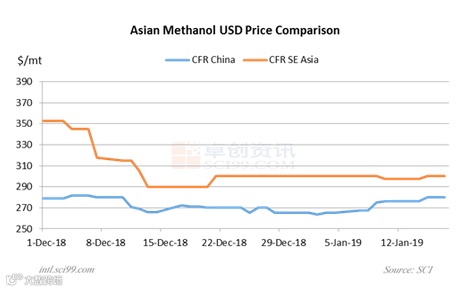

Supported by the downstream purchasing and the speculation demand, the USD prices of imported methanol rose quickly in China after the New Year’s Day holiday with the foreign suppliers raising offers actively. 20kt of end-January to mid-February arrival Iranian cargoes were traded at a premium of 0.5%-1%. Forward month arrival imported cargoes were negotiated at $275-285/mt, and 5-8kt of February arrival non-Iranian cargoes from the Middle East were dealt at $281-282/mt. The offers for January and February shipment non-Iranian cargoes from the Middle East were lifted to a premium of 1.5%-2%. A few February arrival non-Iranian cargoes were traded at a premium of 1.5%. Last week, the reference prices for imported methanol were $270-282/mt CFR China, $5-11/mt higher than the weekly average price before the holiday. Influenced by this, the premium of the USD prices for a few long-term contracts of non-Iranian cargoes from the Middle East rose by 0.5% after the holiday. However, on the whole, the premium of the prices for non-Iranian cargoes in 2019 dropped by 0.5%-1% Y-O-Y. The long-term contracts for Iranian cargoes were still under negotiation, as the price spread between the sellers and buyers was large. The market players should pay attention to the lasting influence from the U.S. sanctions against Iran.

The RMB prices for the long-term contracts of spot methanol in 2019 also declined from 2018. In Q4, 2018, the import prices were higher than the domestic prices. Meanwhile, the delivered prices of inland resources remained higher than the spot prices at ports. The players in the coastal market suffered obvious profit losses in Q4, 2018, so some traders and downstream plants preferred to negotiate for spot goods. Under this background, some methanol producers and large traders took the initiative to lower the prices for long-term contracts to promote the transactions.

In addition, some methanol units with the total capacity of 1,840kt/a in the Middle East and Southeast China are scheduled to undergo maintenance in late February and March. In Europe and the U.S., the capacity loss caused by the unit maintenance is predicted to be 3,400-3,500kt/a from January to March. Meanwhile, the operating rates of a few important methanol units in South America are not high recently. Therefore, most players anticipate that the methanol prices in Southeast Asia, Europe and the U.S. may rally reasonably in end-Q1 and Q2, 2019, which may promote the negotiation of long-term contracts in these areas.

……

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499