Will the PP Inventory Keep High in the Short Run?

Highlights

The PP inventory at PetroChina and Sinopec remained high from last week, and the inventory consumption speed was slow. The PP inventory continued being high this week. With high supply pressure and weak downstream demand, the PP market remained weak.

The PP market prices fluctuated downwards during the week ended July 19, and they remained in a downtrend until this week. Taking raffia-grade PP in East China as an example, the mainstream prices dropped from RMB 8,750/mt to RMB 8,700/mt. Copo PP prices dropped by RMB 230/mt from RMB 8,950/mt to RMB 8,720/mt. Thus, the price spread between PP raffia and copo PP diminished. Usually, the price spread between raffia and low-melting copo PP was RMB 300-400/mt.

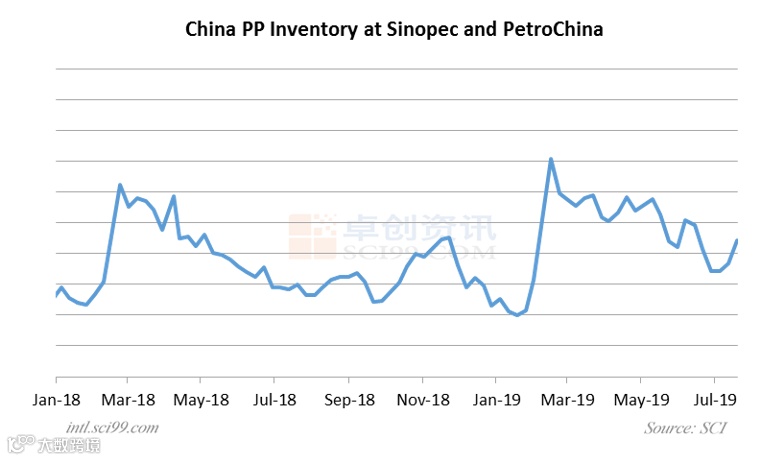

On the supply side, PP producers cut their inventories slowly last week. During the third week of July, the PP inventory at Sinopec and PetroChina hovered at 780kt. After last weekend, the inventory broke through 800kt.

With the PP futures fluctuating downwards, spot PP market prices slipped, weighing down the market sentiment. In the PP market, the purchase behavior was weak, and downstream enterprises bought on a need-to basis. Then PP producers suffered high inventory pressure.

The loss volume of output caused by maintenance was about 48kt last week, down 12.04% W-O-W. The first new line at Fujian Refining & Petrochemical resumed production last week. The old production line at PetroChina Dushanzi Petrochemical underwent an overhaul, and Yan’an Oil Refining Plant shut its new line down temporarily last week. The units at Sinopec Jiujiang Company and Shenhua Yulin Energy as well as the new line at PetroChina Dushanzi Petrochemical underwent maintenance this week. Accordingly, SCI predicts that output loss will rally this week.

Although maintenance eased PP supply pressure, it was limited. As seen from the above table, downstream operating rates were largely unchanged. The overall operating rate in plastic weaving and BOPP industries hovered at 60%, which was the lowest level in the recent five years. Downstream enterprises mostly maintained basic purchases as they suffered scarce orders. Besides, the PP market remained weak. The PP futures remained in a downtrend, aggravating the bearish sentiment.

In total, the PP inventory keeps high at present. Even if the maintenance eases the supply pressure to some extent, the newly added capacity is released in succession. In the long run, the supply pressure is supposed to rise. In addition, the downstream demand for PP will not improve noticeably, so it is hard to enhance the PP market trading atmosphere in the near term.

.......

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6090596