PE Mainstream Price Moved up in H1, 2021

In H1, 2021, China’s PE market prices showed an N-shaped trend. The fluctuation range was wide, and the mainstream prices moved up compared with 2020. In H2, the demand will pick up, while the supply side may come under pressure with the commissioning of newly added units and the reduced maintenance at China’s producers. The PE market prices are predicted to fall.

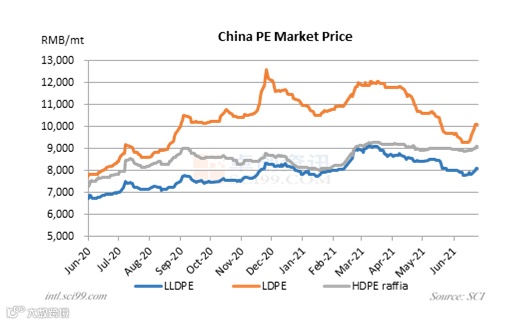

China’s PE market prices showed an N-shaped trend

In H1, 2021, China’s domestic PE market price showed an N-shaped trend. The price fluctuation range was wide, especially LDPE. The highest price of LDPE was RMB 12,000/mt, while the lowest price was RMB 9,300/mt, leading to a spread of RMB 2,700/mt. It can also be seen from the chart that the PE mainstream price in H1, 2021 rose noticeably compared with 2020. In H1, 2021, the average price of LLDPE, LDPE and HDPE raffia was RMB 8,354/mt, RMB 10,869/mt and RMB 8,851/mt respectively, up 23.6%, 42% and 19.2% Y-O-Y respectively.

After the Spring Festival holiday, the LLDPE futures market was driven up by the inflow of capital. The inventory at producers was at a three-year low, so the sales pressure was not high. In the meantime, some petrochemical companies in North America suspended production due to the cold wave, which boosted the USD prices of PE. Producers lifted the EXW prices considerably, driving up the market prices greatly. LDPE and LLDPE prices increased to annual highs. Entering March, the market was stalemated amid the contest between high cost and lower-than-expected demand. Dragged down by the sluggish end demand, PE prices started to fall from mid-March. China’s PE output kept increasing, in line with the commissioning of the units at Ningbo Huatai Shengfu Polymer, Lianyungang Petrochemical, Heilongjiang Haiguo Longyou Petrochemical, etc. However, the downstream industry operating rate saw limited changes, presenting limited consumption of feedstock PE. PE market prices kept fluctuated on the mismatch between supply and demand. In H2 June, sources said that the LDPE import volume will diminish as resources from one Middle Eastern country will reduce. The spot PE prices went up amid the speculation atmosphere, especially LDPE. Users showed low buying sentiment and mainly purchased feedstock based on the standing demand, which provided limited support to the PE market. By the end of June, the rising momentum slowed down.

...

Please click "Read more" for more information