PP Prices Varied Among Regions

Preamble: China’s PP market faced certain pressure, and prices fluctuated downwards to the annual lows. Various regions saw different price performance affected by supply-demand fundamentals. The analysis of market differentiation among regions in China was as followed.

PP Mainstream Prices Inched Down

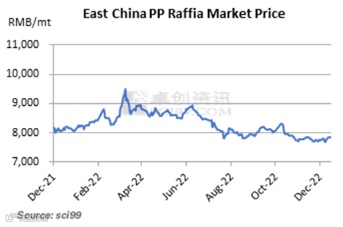

China’s PP market prices dropped after rising in November, and then the prices recorded a low. The monthly average price of PP raffia in East China was RMB 7,860.28/mt in November, down 2.67% M-O-M. PP prices climbed at the beginning of this month on the back of stronger crude oil prices and PP futures prices. PP raffia prices rose from RMB 7,800/mt to RMB 7,925/mt in East China. However, PP supply-demand fundamentals stayed soft, and crude oil prices and the PP futures prices pulled back, dragging down PP market prices. Meanwhile, logistics were still restricted in a lot of regions, affecting the circulative efficiency of goods. PP prices fell from highs in H2 November and closed at RMB 7,755/mt on November 23, which was the yearly low in 2022. At the end of November, PP market prices rebounded slightly, as the PP futures prices mounted up, and downstream users stockpiled at lows. But after that, PP prices fluctuated marginally within the range of RMB 7,750-8,000/mt.

PP prices Saw Different Downward Ranges in Various Regions

PP prices performed poorly mainly because of lackluster demand. PP production and sales are still separate now. Northwest China and Northeast China were net out-flow markets. PP goods there were not only self-consumed but also consumed by Central China, Southwest China and coastal areas. Therein, PP production and sales were combined in Central China and Southwest China, where coal-based PP goods flowed from Northwest China. North China, East China and South China witnessed an inflow of a large number of PP goods, as production and sales were both active, and PP demand was strong there.

In November, the monthly average prices of PP in North China, East China and South China fell by different ranges under the influence of weak demand, which was also consistent with our overall price trend throughout the month. However, the gap between supply and demand in those regions showed differences. The supply and demand fundamentals in North China and South China were weak. The supply in East China mounted up, while demand decreased. Therefore, PP average prices all declined in those three regions. Fewer goods arrived in North China because of the obstruction of coal chemical product transport. PP availability also decreased in South China, affected by transport costs and circulative efficiency. The imbalance between supply and demand in East China was severer than that in North China and South China, so the downward range of prices in East China was wider. The price decrease in South China was the narrowest.

Market players focus on the East China market, as East China has lots of upstream and downstream enterprises, major ports and an active trading atmosphere. The gap between supply and demand in East China continued to widen in November because PP supply continued to rise with less maintenance and demand was weak. Comparatively, the increase in PP supply in North China and South China was unobvious. For the demand side, orders from downstream users all improved limitedly in those three regions under the demand dull season.

PP Supply-Demand Fundamentals to Confront More Serious Imbalance

SCI predicts that the PP supply will continue to pile up in December with the startup of new units and restart of closed units. Closed units for maintenance will be restarted successively, and only PetroChina Lanzhou Petrochemical and Qingdao Jinneng New Material plan to arrange maintenance in December. Besides, PetroChina Guangdong Petrochemical may release fresh capacity in end-December. The downstream demand for PP is supposed to weaken gradually in December amid the dearth of orders from end users. Downstream enterprises will probably experience slack sales and replenish the inventory limitedly. In November, downstream enterprises have shown poorer appetites for purchasing low-priced forward-month feedstock, reflecting their bearish outlook for the future PP market. SCI estimates that PP demand will continue to underperform between January and February 2023, hindered by colder weather, heating season and slow business resumption of downstream processors after the Spring Festival holiday. However, PP supply may mount up because a lot of units will be put into operation in Q1, 2023, suggesting that the supply-demand imbalance will be exacerbated.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.