China Butadiene Market Lost Ground Recently

Snapshot: From mid-September, China’s butadiene market price began to slide and trended at lows till November. China’s butadiene resources were sufficient with low-priced imported shiploads replenished. In the short run, the overall butadiene market will hardly improve notably for a lack of decent demand.

China’s butadiene market price trended at lows after falling.

In early September, China’s butadiene market price fell from highs, as most downstream users showed resistance to high-priced butadiene and import prices crashed. Until October, China’s butadiene market price trended at lows. With the butadiene price going lower, the profit of some downstream industries recovered, driving up their operating rates. Thus, the rigid demand bolstered China’s butadiene market to some extent. Besides, in November, new PBR and ABS units will conduct a test run, so the expected increase in demand will bolster the butadiene price. Therefore, in mid-to-late October, the decrement in butadiene price slowed down. As of end-October, the delivered price of butadiene in the Jiangsu and Zhejiang market was around RMB 7,600/mt, down 21.65% from early September.

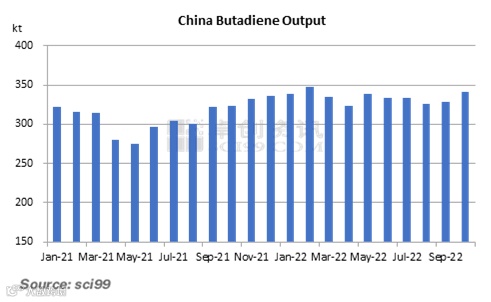

In October 2022, China’s butadiene output was almost close to the peak in two years.

According to SCI, in October, China’s butadiene output reached around 341.4kt, up 4.5% M-O-M. Within this month, the number of butadiene units under routine maintenance declined notably. 3 butadiene units via butene ODH units remained shut. Only 3 butadiene units via C4 extraction technology took maintenance, so the losses caused by the units’ shutdown dwindled from last month. Chinese-made butadiene supply ramped up from the early days. In a long cycle, the butadiene output in October 2022 was at a relatively high level, failing to bolster the butadiene price from the supply.

The import price was lower than China’s butadiene price, driving up the import volume.

Remarks: The import volume in October refers to the estimated value.

According to sources, in October, China’s butadiene imports will advance notably. SCI reckons that the import volume of butadiene in October is estimated to be around 25kt, up 252% M-O-M, which will replenish China’s butadiene market notably. On the one hand, the import price of butadiene was lower than the domestic butadiene price. On the other hand, the import volume surged, weighing on China’s butadiene market. From September, with available butadiene resources rising in Southeast Asia, etc., the Asian butadiene market price crashed, lowering China’s butadiene market. As the import price was higher than China’s prices from January to August, the import volume of butadiene in China was mostly below 10kt. Increasing imports also dragged down players’ sentiment in the market.

China’s butadiene market will hardly improve notably amid slack demand.

In November, China’s butadiene market supply will still be sufficient. The number of butadiene units under routine maintenance will continue to drop. China’s butadiene supply may see a yearly high. In terms of imports, there are limited favorable factors in the Asian butadiene market. China’s butadiene supply will be sufficient, with some Southeast Asia-origin shiploads replenished.

In terms of demand, with the butadiene price dipping, the profit of some downstream industries may recover somewhat. Yet, in November, the operating rate at some tire enterprises in the northern region may decline, dragging down sales of synthetic rubber. The production enthusiasm for synthetic rubber will be curbed, failing to bolster the butadiene price. Although the new units conduct a test run ahead of time, it takes some time for units to run normally. Thus, the demand will be curbed, and the output release of new units will be determined by the end demand status. In the short run, the increment from new units will be limited.

In December, a new butadiene unit is expected to be released. Meanwhile, new downstream units will be conducted for a trial run. China’s butadiene supply and demand will both see increments. According to SCI, it is estimated that there will be 200kt/a new butadiene unit released. 1,100kt/a new downstream units will conduct a trial run (ABS unit: 400kt/a and 2 adiponitrile units: 600kt/a; estimated butadiene consumption: around 390kt under full load). However, according to the current demand and historical experience, the growth rate of butadiene supply will be higher than that of demand. Especially in the adiponitrile industry, its operating rate will hardly improve in the short run. Besides, end demand will remain slack, curbing the release of downstream demand. The market price of butadiene may hardly rise to a high level, for lack of many bullish factors from the fundamentals.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.