PX Supply and Demand to Stay Tight in Q4, 2022

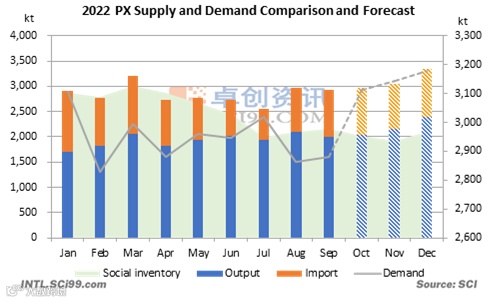

In the third quarter, against the background of increased volatility of cost drivers, the impact of supply and demand on the PX market was gradually strengthened. Owing to more-than-expected maintenance, China’s domestic PX inventory fell to a relatively low level. However, the support from the supply-demand pattern will wane in the future, along with the release of newly added PX units. After then, the inventory of PX will begin to pile up.

In Chinese mainland, the intensive PX unit maintenance will come to an end in the fourth quarter, and some newly added units will come on line. Shenghong Petrochemical Group’s 2 million mt/a unit will be put into operation in October. The 1 million mt/a unit at Dongying Weilian Chemical will also come on line in the second half of October. Since it is equipped with 2.5 million mt/a PTA capacity, part of the PX it produces will be for self use. In addition, the 2.6 million mt/a unit at Sinopec Guangdong Petrochemical will be put into operation in December. At the same time, with the oil blending demand in the U.S. ended, MX exported from South Korea to the U.S. will flow into China again. Therefore, Qingdao Lidong Chemical, Dalian Fujia Dahua Petrochemical and some producers that cut down operation load in lack of MX will increase production. As a result, the effective production of PX will be significantly improved in the fourth quarter.

Apart from the Chinese mainland market, some PX plants are expected to cut back or suspend production in the end of the third quarter or in the fourth quarter, including the 4 million mt/a unit at India Reliance Industries, the 1.3 million mt/a unit at South Korea SK, the 580kt/a unit at Taiwan (China) FCFC, the 900kt/a unit at India ONGC (Oil and Natural Gas Corporation), as well ad the 1.34 million mt/a unit at Saudi Arabia Aramco. However, from the export from South Korea in August (350kt to China, 40kt to Taiwan, China, 10kt to the U.S. and 5kt to Japan) and the export in July (260kt to China, 130kt to the U.S., 30kt to Taiwan, China and 5kt to Japan), it is obvious that PX exported from South Korea to the U.S. has flowed back to the Chinese market. Therefore, it is estimated that China’s monthly import of PX in the fourth quarter will return to 850kt-950kt.

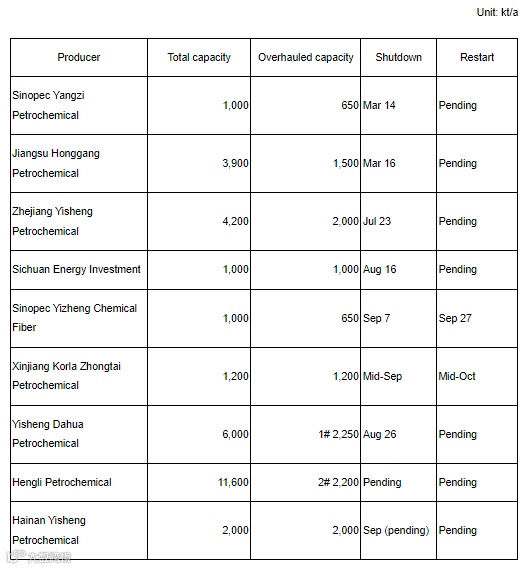

China PTA Unit Turnaround Schedule

In the fourth quarter, China’s PTA supply will once again exceed demand, thus driving up the demand for PX. Although China’s PTA units are still under maintenance with no specific restart time, a total of 7.5 million mt/a new capacity will be put into production from October to December, among which 2.5 million mt/a will come on line at the end of 2022. Therefore, from October, China’s PTA output will rise notably compared with the previous month, and the PTA inventory will return to the rising channel. In November, the PTA output is expected to hit a historical high. Moreover, the profits of PTA producers will be repaired after the production cut in August and September, which also supports the PX demand indirectly.

Based on the above expectations, the PX market will continue the tight balance pattern in the fourth quarter of 2022, and the tight supply is not expected to ease until the end of the year. This is mainly due to the fact that there are still some maintenance plans for PX units in Asia, and the release of new capacity will be counterbalanced by the demand side increment. Therefore, the PX inventory will still be at a low level. Currently, the cost fluctuation is still the main driving factor affecting PX prices. However, the global economic recession is still worrying, thus the effect of cost on PX prices in the fourth quarter is relatively limited, and the PX market may encounter short-term sharp fluctuations due to supply and demand changes.

All information provided by SCI is for reference only,which shall not be reproduced without permission.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.