How Will the NBR Market Evolve Amid Strong Expectation and Weak Fundamental

Introduction: Commodity price fluctuations are mostly driven by the impact of expected changes. After the Spring Festival, the NBR market price was boosted by the expected supply reduction. However, market prices fell from highs starting in the middle of February affected by actual downstream demand.

Market Prices Fell from Highs

Taking the price of 3305E in East China as an example, by February 28, the closing price was RMB 17,000-17,400/mt, which decreased by about 3% from the high point in early February. On the one hand, the downstream demand recovery failed to meet expectations. The operating rate at most large-scale downstream producers was passable, but small and medium-sized downstream producers’ production enthusiasm was curbed by end orders, so they were cautious about feedstock procurement. On the other hand, some low-priced inventory was left to be cleared in the intermediate link, and the consumption of this inventory was relatively slow due to poor downstream demand. Therefore, some goods holders sold goods at low prices. What’s more, given the limited consumption of feedstock based on rigid demand, some downstream producers sold some of the feedstock they had stocked up at low prices.

Price Bottom Was Underpinned

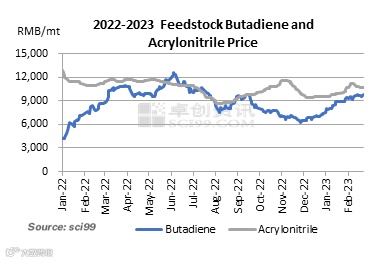

In terms of feedstock, butadiene and acrylonitrile prices remained high. By February 28, the butadiene market price increased by 28% from early January, and the acrylonitrile increased by 11%. Butadiene units at Zhejiang Petroleum & Chemical (Phase II) and Sinopec Zhenhai Refining & Chemical were under maintenance, and some units at Shanghai Secco Petrochemical, Liaoning Bora Petrochemical and Sinopec Beijing Yanshan Petrochemical were planned to be overhauled in Q2. Therefore, the butadiene price was expected to remain high, lending relatively strong support to the NBR price from the cost side. In terms of supply, the NBR unit that was shut down on February 22 at Ningbo Shunze Rubber was estimated to be restarted around March 20. In February, China’s domestic NBR output decreased by about 10% M-O-M. PetroChina Lanzhou Petrochemical plans to shut down its NBR units for maintenance from mid-June to end-July, and resources for distribution in the trade link are expected to be further curtailed next month. Therefore, the newly added supply is anticipated to be limited. Overall, despite the market price decline from the high level dragged by poor demand, the cost and supply underpin the bottom of the NBR price.

Forecast

It needs some time to clear the low-priced inventory of NBR, and a long time is required for downstream demand to achieve appreciable recovery. Therefore, the poor demand is estimated to be a constraint for NBR price increase in the short term. However, in the medium-to-long run, relatively strong expectations for cost and supply may boost some market players’ trading mentality to be cautiously optimistic.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.