Ethylene Price to Fall in Q4, 2022

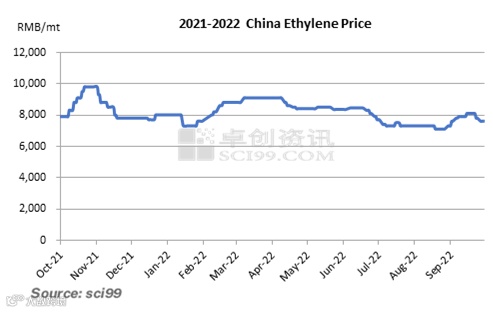

Preface: China’s ethylene price increased first and then declined in September, mainly affected by the supply, demand and overseas prices. From October to December, the cost will fluctuate within a narrow range. With the arrivals of imported resources, the increasing supply may weigh down the price.

In September, China’s ethylene prices increased first and then declined. Early this month, affected by the news of overseas unit maintenance and limited trading resources in China’s domestic market, the overseas prices increased notably. The increment in ethylene price (CFR NE Asia) reached RMB 90-110/mt within one week. The price in China’s domestic market followed the uptrend as well, while the increment was curbed as downstream users purchased cautiously. In H2, as the unit maintenance at Gulei Petrochemical and Hengli Petrochemical came to an end and LUXI Group raised its operating rate, the spot availability increased, dragging down the prices at home and abroad.

As of September 29, the listed price of ethylene at Sinopec in East China was RMB 7,600/mt, unchanged from early September, and the average price was RMB 7,865/mt, up 8.65% M-O-M and 1.31% Y-O-Y.

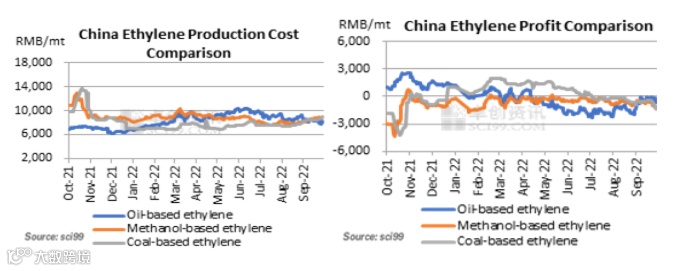

As of September 29, the production costs of oil-based ethylene declined, while that of methanol-based and coal-based ethylene improved, mainly affected by the feedstock price changes. The cost of oil-based ethylene declined to RMB 8,248/mt, down 4.36% M-O-M. That of methanol-based ethylene was RMB 8,136/mt, up 2.28% M-O-M. That of coal-based ethylene rose to RMB 8,490/mt, up 11.75% M-O-M.

The profits of ethylene produced via different processes differed due to the changes in costs and prices. The profit of oil-based ethylene was RMB -369/mt, up 73.3% M-O-M, while remaining negative. That of methanol-based ethylene averaged at RMB -258/mt, and that of coal-based ethylene fell to RMB -611/mt.

Forecast:

Supply-demand: LUXI Group, Zhejiang Petroleum & Chemical, Satellite Chemical, Sinopec Maoming Petrochemical and Sinopec Shanghai Petrochemical will restart their crackers or raise their operating rates. Sinopec Zhenhai Refining & Chemical will shut down its Phase II units in November. In addition, the cost of imported resources will be high in November, which will give some support to the market. Meanwhile, some low-priced imported resources are estimated to arrive at ports in October and November. With the profits of downstream products improving, the production enthusiasm will increase, and the planned unit maintenance may decline, which will push up the consumption of ethylene.

Cost: In October, it is estimated that the international crude oil prices will fluctuate within a narrow range, and market participants need to pay attention to crude oil supply change and Eastern European market. It is expected that Saudi Arabia may cut crude oil output to underpin the international crude oil prices, and the energy supply in Eastern Europe is likely to influence the international crude oil market. On the whole, the international crude oil prices will probably see frequent fluctuations in October. In Q4, 2022, it is predicted that the international crude oil prices will gradually rise from low levels, mainly backed by the output cut, high natural gas prices and easing macro pressure.

In October, the prices of imported resources, arriving at ports in October, will not be high, while the intensive arrivals of some resources from the U.S. and the Middle East will weigh on the market. From October to December, Sinopec-SK (Wuhan) Petrochemical and Sinopec Zhenhai Refining & Chemical will shut their Phase II units down while Sinopec Maoming Petrochemical, Sinopec Shanghai Petrochemical and Satellite Chemical will raise their operating rates. Therefore, the overall supply will improve. The downstream demand is expected to rise due to the improving downstream profits and declined unit maintenance. On the whole, it’s estimated that the price will fluctuate downwards from October to December.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.