Butadiene PBR Pirce Correlation Analysis

Snapshot: PBR futures and options were listed for trading on the Shanghai Futures Exchange. Players pay more attention to the butadiene industry chain industry. PBR is mainly produced from butadiene. In the past, the price correlation between the two was relatively high. Yet, with the butadiene supply being loose, changes in feedstock butadiene price may have a weaker impact on the PBR price gradually.

The price correlation between butadiene and PBR is gradually weakening.

PBR is polymerized from butadiene monomer, and the unit consumption ratio is around 1.02. Against frequent butadiene prices and ample PBR supply, the cost impacted the PBR price. In terms of the price trend of butadiene and PBR in the past five years, the correlation coefficient between the two was 0.84. However, it can be clearly seen from the chart below that after 2020, the correlation coefficient between butadiene and PBR has weakened somewhat, in the wake of dipping butadiene prices. Since 2020, their correlation coefficient has dropped to 0.63. However, before 2020, it reached 0.95. The price correlation between butadiene and PBR waned, stemming from the dropping butadiene price and change in the PBR supply-demand structure. In the coming days, how will the price correlation between butadiene and PBR change? What are the main drivers affecting the price fluctuation of butadiene?

The butadiene price is greatly affected by its supply and demand.

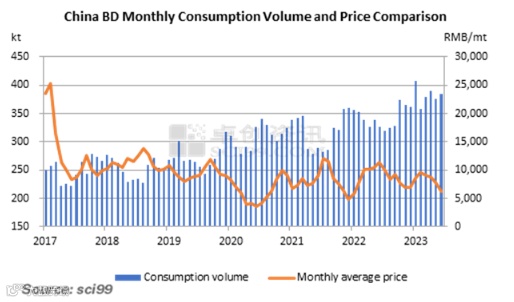

Butadiene is in the middle of the industrial chain, which belongs to a by-product of ethylene crackers. Meanwhile, it is also the main feedstock for synthetic rubber, resin, latex, adiponitrile and other products. The relationship between upstream and downstream products is relatively stable. As a by-product, the cost has a relatively limited impact on the butadiene price, which is mainly affected by its own supply and downstream demand.

From the perspective of product supply, import and export trades coexist in the butadiene industry, and the butadiene supply covers China’s domestic output and imported resources. Factors affecting domestic output mainly include the startup and shutdown plan of butadiene units as well as changes in the operating rate of crackers according to the profitability of ethylene and propylene units. Besides, at present, 90% of China’s butadiene resources are not circulated in the market, so changes in units at butadiene enterprises with available resources impact the butadiene price notably. The butadiene import status is mainly affected by foreign supply-demand changes in major import origins. Players should pay attention to the changes in import volume caused by the adjustment of the price spread between China and foreign markets.

From the perspective of demand, it also covers China’s domestic consumption and exports. In terms of China’s domestic market, players should pay attention to changes in the operating rate of the downstream industry. Apart from units’ routine maintenance, whether there is profit in the downstream industry is also an important factor affecting the units’ loads of downstream enterprises. Therefore, it’s also necessary to pay close attention to the downstream operating status brought about by the price spread between butadiene and downstream products.

What’s more, 90% of the butadiene supply is contracted supply, and 90% of China’s domestic demand is satisfied via contracts. Thus, the operating rate change of units at major butadiene enterprises with spot supply has a relatively obvious impact on the price of butadiene, mainly involving some private enterprises of PBR, ABS, synthetic latex, etc. For butadiene’s export market, players should focus on the changes in supply and demand of major export destinations, as well as the adjustment of the price spread between China and foreign markets due to changes in supply and demand.

As seen from the above four charts, the output and import volume of butadiene, especially the latter one, showed a notable negative correlation with the butadiene price. The correlation coefficient is around 0.5. However, the demand and export volume of butadiene presents an obvious positive correlation. Especially, the correlation coefficient between export volume and butadiene price is 0.6.

In the future, there will be much fresh capacity released in the butadiene industry. Yet, against the slowdown in demand growth, China’s butadiene resources may be more sufficient. Therefore, the average market price of butadiene may see a further drop. However, as seen from the PBR sector, newly added PBR units may be limited in the future. Besides, as a futures product, the market price of PBR may be more easily affected by the macro environment. The impact of feedstock price fluctuation on PBR price may weaken from previous periods. Yet, the PBR price may be influenced by other factors in the future. If fundamentals see no obvious change, the butadiene price may be affected by the PBR price. The correlation between the two will still exist. Thus, in the future, the price correlation between butadiene and PBR will still exist, but the impact of changes in feedstock on PBR price may ebb gradually.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.