Q3, 2023 Review: China PE Price Improved Limitedly

Summary: In 2023, the macro economy at home and abroad was bearish, and the global economy was under great pressure affected by continuous interest rate hikes by the Fed. Although the demand recovered in Q3 amid multiple policies to promote economic growth in China, exports of plastic products improved limitedly amid sluggish overseas demand, giving thin support to the PE price. Therefore, the PE market price trended up first and then dropped.

In Q3, 2023, China’s PE market price increased first and then trended down, while average prices of all products trended up from Q2.

From May to August, a number of PE units in China took overhauls, and it took some time for transportation after units were restarted, so the spot supply in some markets was tight in Q3. As for the demand, the PE demand improved during the traditional demand peak season in September and October. In addition, high crude oil prices gave certain support to the PE price from the cost side, so the market price fluctuated upwards from July to August. The continuously rising price squeezed the profits of downstream enterprises, so they showed limited buying appetites for high-priced feedstock and replenished their stocks before the National Day holiday. Moreover, most PE units resumed normal production in H2 of August after maintenance, improving the supply pressure, so the PE market price trended down in September.

Macro: As for the macro environment, the macro economy at home and abroad was bearish in 2023, and the global economy was under increasing downward pressure affected by continuous interest rate hikes by the Fed. Although the demand recovered in Q3 amid multiple policies to promote economic growth in China, exports of plastic products improved limitedly amid sluggish overseas demand, giving thin support to the PE price. Therefore, the PE market price showed an overall downtrend from 2022.

Capacity: According to SCI, China’s PE capacity kept expanding in 2023, and it may reach 31,558kt/a, up 2,850kt/a or 9.93% from 2022.

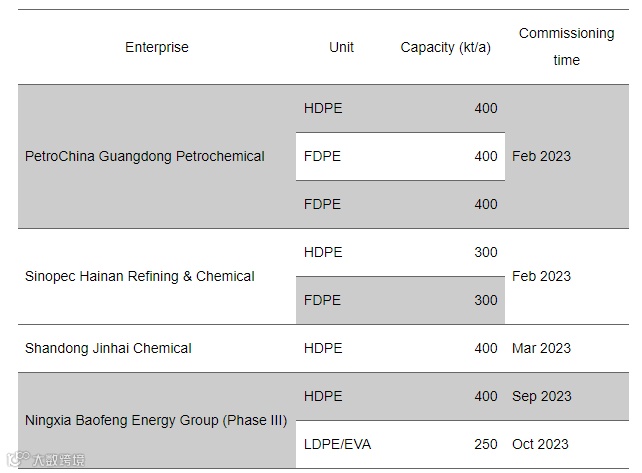

2023 China PE Newly Added Capacity

In Q1, newly added units at PetroChina Guangdong Petrochemical, Sinopec Hainan Refining & Chemical and Shandong Jinhai Chemical were put into production. In Q3, Ningxia Baofeng Energy put its 400kt/a HDPE unit in operation and the 250kt/a LDPE/EVA unit is estimated to be put into production in Q4.

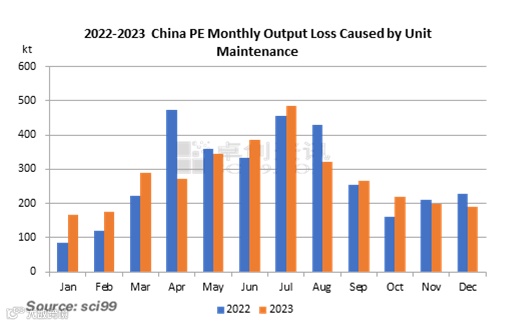

Output: In Q3, China’s PE output loss caused by the unit maintenance was 1,070.9kt, up 6.7% from Q2. From May 2023, the unit maintenance increased notably, and the output loss reached a yearly high in July with units at PetroChina Lanzhou Petrochemical, PetroChina Daqing Petrochemical, Yan’an Energy & Chemical Group and Sinopec Zhongke (Guangdong) Refinery taking overhauls. In August, with most units resuming production, the intensive unit maintenance came to an end. In Q4, it’s estimated that the output loss caused by unit maintenance will stay at a low level.

In Q3, 2023, with the output loss dropping after a rise, both the monthly PE operating rate and output trended down first and then increased, and the output in Q3 rose by 1.53% from Q2. In Q4, the output loss will likely stay at a low level, and the newly added units at Ningxia Baofeng Energy will contribute to the output, so it’s estimated that the monthly PE output will improve.

Imports: From January to September 2023, China’s PE import volume was 9,828.75kt, down 1.38% Y-O-Y. Affected by the delayed customs clearance during the Spring Festival and China’s economic recovery, the bullish sentiment improved traders’ importing appetites, so the import volume in February and March stayed at a high level in H1 with the intensive arrival of imported resources at ports. In April, the supply from the Middle East trended down caused by unit maintenance. Meanwhile, China’s PE self-sufficiency rate continued to increase, and the supply was relatively sufficient. In addition, the demand slack season dragged China’s LDPE market price down to a global low. Some imported resources were internally digested or flowed to other regions with more arbitrage opportunities, and traders showed decreasing buying appetites. With the demand peak season in Q3, some imported resources arrived at ports in August and September, while the import volume will likely trend down gradually in Q4 with weakening demand.

Exports: From January to September 2023, China’s PE export volume was 647.62kt, up 19.41% Y-O-Y. China’s exports improved notably in H1 by around 30kt or 31.39% Y-O-Y. Although the export volume of LDPE increased significantly, the overall export volume was still at a low level, giving thin support to China’s PE price. The major export destinations were Vietnam, the Philippines, Egypt and Saudi Arabia. The main reason for the increment in exports was that the LDPE price of LDPE was higher in the overseas market, granting China more arbitrage opportunities. In addition, the exchange rate of USD continued to rise, dampening China’s imports, so traders intended to expand exports. With the demand improving in Q3, China’s domestic trading increased, dragging down exports accordingly.

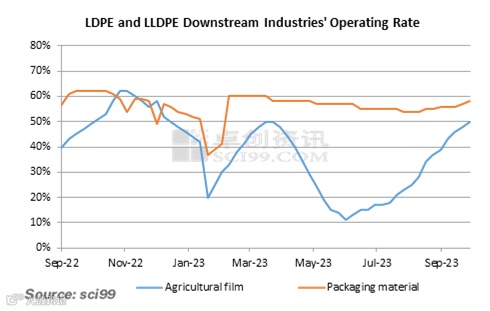

Demand: As for the demand, it was the traditional demand slack season in July and H1 of August, so the demand was weak in China. Taking the agricultural film as an example, in July, the demand improved later than that in 2022 and orders were limited, so the operating rate underperformed. In August, the demand was entering a peak season, and operating rates improved, but it gave limited support to the PE market due to the wait-and-see sentiment of film enterprises. From late August to September, with increasing orders for the Mid-Autumn Festival and National Day holiday, both orders and profits at enterprises improved. With the overall PE demand trending up from Q2, downstream operating rates increased gradually. However, the increment in prices of downstream products was slower than that of feedstock, so profits improved slowly. On the whole, the demand was aligned with the seasonality in Q3, while orders underperformed from previous years, and prices of downstream products hardly rose, so the overall downstream profits narrowed.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.