Coated Paper Market Rebounded Amidst Better Sentiment

Intro: Since July, the coated paper market has rebounded slightly from the bottom. Some of the orders from May and June were delayed to July, and the order status at paper mills improved. As a result, paper mills posted price increase notices which boosted market sentiment. Lastly, the uncoated woodfree paper market price also rebounded, facilitating the price hike in the coated paper market.

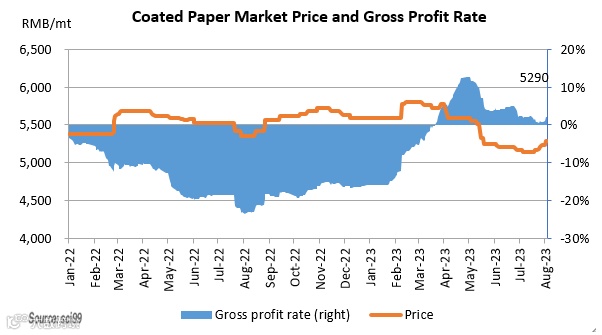

Market Price Rebounded as Operating Profit Droped to Low Levels

Since July, with the bottom fluctuation of the coated paper market and fluctuations in the upstream pulp market, the profitability of coated paper gradually came down near the marginal cost. As of August 8, the gross profit of the coated paper industry was 2.04%, down 10.75% from the peak in May. Due to the pressure in earning a profit. In order to secure the stability of their own production and sales, paper mills became more active in raising prices.

The coated paper market first dropped and then bottomed out in May. Although some price increase notices were posted in mid-July, the price hike attempt was hardly implemented because of the tepid market demand overall. At the end of the month, the demand picked up, and in addition to the successful implementation of price hikes in the uncoated woodfree paper market, and some distributors in North China actively attempted to implement the price hike, the coated paper market headed up. At the start of August, paper mills were determined to raise the price, and distributors also followed the hike. Thus, low-priced resources became less available in the market.

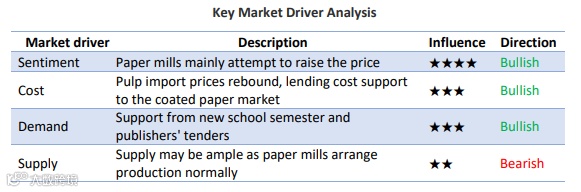

Coated paper price to remain firm against multiple factors

Sentiment: Currently, paper mills are still determined to raise the price, which lends some support to the sentiment of market players.

Cost: Players in some regions reflected tight spot availability, and sellers tend to hold offers firmly. In addition to the import offer hikes of $10-20/mt, the pulp market may receive more solid cost support. Besides, after the port strike, future shipments are to normalize, and the supply pressure may continue. In the short term, the pulp market may remain relatively from, which will lend support to the coated paper market.

Demand: Orders for the printing of general publications are improving entering August, and the market demand may continue to pick up at the end of the month benefiting from the start of the new school semester. In the meantime, publishers’ tenders for textbook printing of the next spring semester are to provide extra demand support, and paper mills may continuously attempt to raise the price.

Supply: The stability of coated paper production is relatively high as most players are large in scale, but there is no capacity expansion plan within 2023. Because the profitability of other paper grades is also meager, paper mills are less incentivized to swing production. Therefore, the coated paper supply may remain stable. The operating rate of the coated paper industry may hover at around 70%, with a limited fluctuation range.

In conclusion, price hikes at paper mills may gradually pass down to the market, and distributors tend to follow the price hike to ensure their own profitability. In addition to the demand recovery near the new school semester, the market demand is also expected to be bullish. Thus, the coated paper market is more likely to remain stable in August, and the implementation of price hikes may be determined by downstream order release and paper mills’ strategies.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.