Jul PBR Imports Remained Rising While Exports Dropped Slightly

Snapshot: In July, China’s PBR import volume continued rising. The major increment was still credited to the imports from Russia. As for the receipt place of imports, the import volume in Shandong accounted for a higher proportion of the total. However, the PBR export volume remained falling. The change in China’s PBR imports and exports in July and its reasons were analyzed as follows.

In July, China’s PBR import volume continued rising.

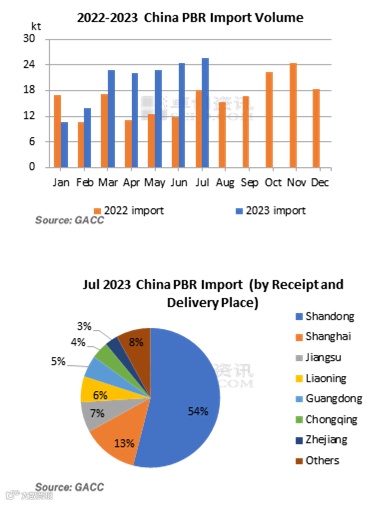

According to GACC, China’s PBR import volume was 25,637.905mt in July 2023, up 5.02% M-O-M and up 41.16% Y-O-Y. From January to July, the total import volume was around 142,304.40mt, up 44.54% Y-O-Y. In Jan-Jul 2023, the operating rate at China’s tire enterprises mainly trended at highs, and the overall gross profit of the PBR industry was relatively low. As cost failed to support the PBR market, the price of China’s PBR resources remained lower than the historical monthly average price for seven consecutive months. But the imported resources still had price advantages. Especially the price of PBR resources imported from Russia was much lower than that from traditional channels. Thus, the PBR import volume remained high in July. From the perspective of trade partners, the increment in China’s PBR imports in July mainly came from Russia. As for the receipt place of imports, the PBR imports in Shandong accounted for a higher proportion of the total.

As seen from the receipt place of imports, Shandong and Shanghai were the top 2 in July. Therein, the imports in Shandong accounted for a higher proportion of the total. The import volume of PBR in Shandong was around 13,891.44mt, up 75.39% Y-O-Y and up 52.07% M-O-M, accounting for 54% of the total. Shanghai ranked second. The import volume of PBR in Shanghai was around 3,428.06mt, up 316.84% Y-O-Y but down 36.06% M-O-M, taking up 13.37% of the total. In July, PetroChina Daqing Petrochemical, Shandong Wintter Chemical and Zibo Qixiang Tengda Chemical shut their units for maintenance to different degrees. Market players worried about the short supply of PBR resources. Particularly, the PBR units in Shandong took turnarounds intensively. Shandong is the major production area of tires. Therefore, tire enterprises in Shandong used more imported PBR resources, leading to a higher proportion of the imports in Shandong.

As for Russia, China’s import volume of PBR from Russia was 15,269.94mt in July, up 9.83% M-O-M and up 74.79% Y-O-Y. On the one hand, the price of the PBR imported from Russia was relatively low. On the other hand, the structure of Russia’s export trade partners changed. According to GACC, the average import price of the PBR from Russia was $1,386.95/mt, which still had some cost advantage. Besides, there was some transit trade in the market, driving up the import volume.

The export volume dropped slightly.

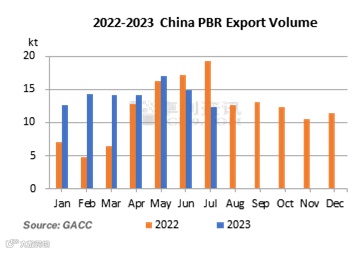

According to GACC, China’s PBR export volume was 12,389.87mt in July 2023, down 16.76% M-O-M and down 35.9% Y-O-Y. The total export volume from January to July was around 99,465.55mt, up 18.68% Y-O-Y.

In August and September, China’s overhauled PBR units may be restarted in succession, and the demand in the market is likely to further warm up. Thus, the operating rate of the downstream tire industry is predicted to remain high and stable. The inventory of finished products is expected to be fairish. Besides, the imported PBR resources have notable price advantages. It is projected that China’s PBR import volume in August and September may mainly climb. As for the exports, China’s PBR export volume is predicted to hover at highs in August and September, driven by the ample supply of Chinese-made PBR and the recovery in overseas demand.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.