PP Prices Bulge Consecutively in Q3 but to Dip in Q4

Preamble: China’s PP market prices realized consecutive increases in Q3, and the upward range was enlarged step by step. From July to August, PP prices ramped up due to the extensive maintenance and periodical demand release, and then prices continued rising on the back of higher costs in September. However, deals weakened later, as the downstream demand improved limitedly and downstream users showed more resistance to high-priced feedstock. As a result, PP prices dropped in late September. SCI predicts that PP market prices will probably drop in Q4 amid a severe imbalance between supply and demand, but high costs may underpin PP prices somewhat.

PP prices remained in an uptrend on improved fundamentals and high costs.

China’s PP market prices continued rising in Q3, 2023, while the growth rate increased gradually and recorded a yearly high in September. However, the PP price stood at a relatively low level over the past six years. In Q3, PP prices grew from RMB 7,120/mt in early July to RMB 8,080/mt in late September, and the price of RMB 7,120/mt hit a new low since May 2020. The average price of PP raffia in East China was RMB 7,517.11/mt in Q3, 2023, up 3.04% Q-O-Q but down 7.20% Y-O-Y. At the same time, PP copolymer market prices averaged RMB 7,733.52/mt, up 0.67% Q-O-Q but down 7.95% Y-O-Y.

Besides brightened fundamentals and high feedstock costs, the introduction of macro policies also lent support to the market sentiment and PP prices. PP supply declined a lot amid intensive unit maintenance, while the downstream demand improved, pushing up PP market prices. However, downstream users showed poor interest in stockpiling after PP prices went up, and deals were mainly based on rigid demand. In addition, higher crude oil and propane prices, as well as stronger futures prices bolstered the PP production costs and players’ stances. In conclusion, PP market prices mounted up in Q3, 2023.

Specifically, the market maintained a logical operation from July to August dominated by supply and demand, supplemented by costs. In summer, the PP industry encountered the maintenance peak season. Meanwhile, the commissioning of most fresh units was postponed, so the overall PP supply pressure was alleviated. Meanwhile, downstream users maintained basic purchases of PP, leading the major producer inventory to decline. In addition, crude oil values appreciated, and the PP futures prices rebounded, boosting the market sentiment and spot PP prices. Entering September, PP prices extended gains due to the high costs and brightened demand, but downstream buyers stockpiled at a slower rate given slack end orders and limited profitability after PP prices moved higher. Besides, the downtick in the PP futures prices dampened the market sentiment in late September, and spot PP prices fell from highs.

In summary, the major factors affecting PP price trends in Q3 were as follows: First, changes in fundamentals and costs dominated market trends and PP price fluctuation ranges. Second, macroeconomics determined the operating tone of the commodity market. Third, the stance of industry players affected the intensity of market transactions.

Downstream demand for PP was still softer than that in the same period of last year, even though it improved gradually.

The downstream demand performed poorly from July to early August, but then it mounted up from late August to September as the PP industry entered the demand peak season. That pushed up PP prices. In detail, plastic woven products saw price declines amid sluggish sales and fierce competition in July, and profits were scant accordingly. In early August, some plastic woven plants reduced production to alleviate the price decrease, while this operation cut the consumption of PP a lot. From end-August to September, plastic woven enterprises enhanced operating rates slightly due to the demand improvement which was stimulated by China’s Mid-Autumn Festival and National Day holidays, as well as more orders for corn and grain bags. That reflected slightly higher demand for PP, but the demand was still weaker compared with the same period of last year.

At BOPP enterprises, operating rates grew a lot in Q3 from Q2, but they were still lower than that in Q3 of last year. The daily average order was 105.42mt, up 16.37% Q-O-Q. SCI learned that orders for BOPP film began to perk up noticeably in July. The growth of orders slowed down in August and September, but the number of undelivered orders kept rising, indicating favorable demand for PP.

At injection product enterprises, new orders for daily necessities, turnover boxes and trays were passable, and the demand for PP was stable-to-rising from end-August to September. Generally, the PP demand performance in Q3 was in accordance with historical seasonal laws. The improvement in downstream consumption promoted PP market prices to level up.

Overseas demand picked up periodically, but the soft macro environment failed to underpin the long-term PP market.

China’s PP export volume is likely to achieve a Y-O-Y increment in Q3, 2023. According to GACC, PP exports were 95.7kt and 93.9kt respectively in July and August, and exports in September were supposed to remain largely stable. The overall export volume was estimated to be around 280kt in Q3, down 70kt Q-O-Q but up 50kt Y-O-Y. In July, overseas demand for PP was sluggish, rendering arbitrage economics in the export market unworkable. Buying indications were notably different from selling indications, and the competition in the export market was fierce. In August, PP demand in India and Southeast Asia remained favorable, and PP USD prices kept climbing, which brought a business opportunity for China’s PP export market. The export arbitrage window opened gradually after mid-August, and some overseas units underwent maintenance, promoting the export order to warm up. In late September, the overseas demand weakened, while that in South Asia remained flat. Downstream users showed average interest in stockpiling with resistance to high-priced feedstock and relatively ample supply. In Southeast Asia, a lot of downstream processors cut back operating rates given high feedstock costs and poor profitability, reflecting a slight decrease in PP consumption. Generally, China’s PP export volume will probably edge down in Q3, 2023 from Q2 amid certain pressure from the macroeconomic environment and insipid demand.

PP supply grew, but unit maintenance underpinned the PP market periodically.

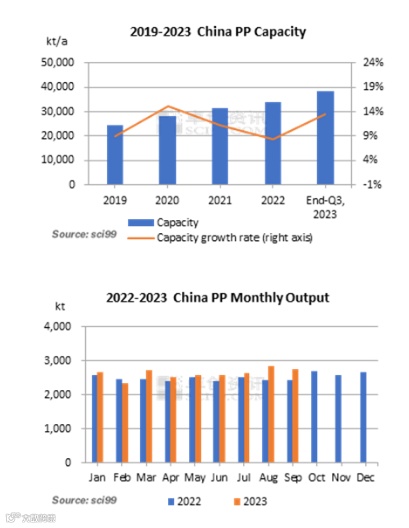

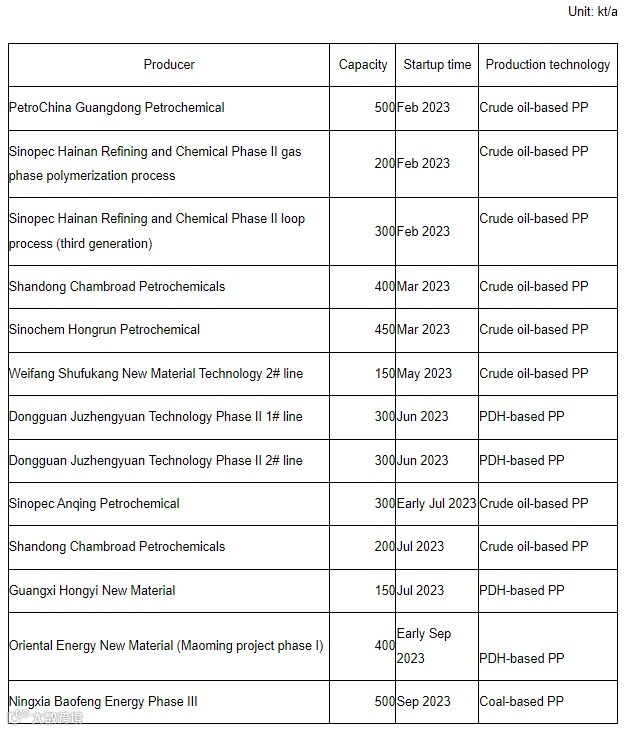

China’s PP supply and demand both mounted up in Q3, 2023. Capacity expansion and unit maintenance decrease pushed up the overall PP supply, but the arrangement for unit maintenance buoyed the PP market periodically from the supply side. According to SCI, China’s PP output totaled 23,717.5kt from January to September 2023, up 6.87% Y-O-Y. PP output was 8,263.4kt in Q3, 2023, up 7.15% Q-O-Q. Therein, the capacity release played a prominent role in the output growth. It was learned that there were fresh units at Sinopec Anqing Petrochemical, Shandong Chambroad Petrochemicals, Guangxi Hongyi New Material, Oriental Energy New Material (Maoming project phase I) and Ningxia Baofeng Energy Phase III in Q3, 2023, and PP capacity has increased by 13.41% as of now.

China’s PP capacity grew rapidly in Q3, 2023. The capacity reached 38,490kt/a from Q1-Q3, with fresh capacity of 4,550kt/a. Therein, the newly added capacity was 1,550kt/a in Q3, impacting the PP market noticeably.

Q1-Q3, 2023 China PP Newly Added Units

The overall operating rate of PP units recorded a low in July with intensive maintenance, which bolstered the PP market temporarily. Crude oil, coal and methanol prices mounted up in July, aggravating the profit losses at PP producers, and unscheduled maintenance increased a lot. Later, operating rates rallied after extensive maintenance ended gradually. The output loss caused by maintenance and operating rate reduction was 790.8kt in July, reaching a peak and leading to a limited increase in PP output. In Q3, 2023, the average operating rate was 79.97%, lower than the past five-year average level, and specifically, operating rates increased but then dropped between July and September. The average operating rate in Q3, 2023 rose by 1.69 percentage points Q-O-Q but dropped by 0.92 percentage points. In Q3, the lowest monthly operating rate was 77.04%, hitting the lowest level over the past five years. The output loss caused by maintenance and operating rate reduction was 2,069.2kt in Q3, down 7.94% Q-O-Q but up 18.38% Y-O-Y.

Remarks: MA = maintenance, OR = operating rate

China’s PP import volume hardly rose notably with narrow arbitrage space.

China’s PP import volume in Q3, 2023 registered a Y-O-Y downtick. According to GACC, PP imports were 327.9kt and 353.7kt respectively in July and August. In September, China’s PP prices stood at a global low, and there were new arrangements for overseas unit maintenance, so overseas suppliers still provided sparse quotations to China. Thus, it was predicted that PP import volume may slide in September. SCI predicts that China’s PP import volume will probably rise to 1,010kt in Q3. In July, the import arbitrage window opened again with the exchange rate of RMB against USD climbing to around 7.13. Meanwhile, overseas suppliers were active in selling given ample supply and enhanced the number of quotations to China slightly, so the overall trading atmosphere warmed up. In August, PP USD prices leveled up on the back of high futures prices and feedstock costs. The import arbitrage window was closed with China-origin PP prices lower than overseas prices. The exchange rate of RMB against USD fell to 7.18 and then fluctuated narrowly. Overseas producers provided sparse quotations to China with an intention of selling more cargoes to other countries for more profits. The buying indications were far different from selling indications, leading to soft deals. In September, PP imports changed marginally and remained basic, affected by a long-term narrow arbitrage window and sufficient supply in China. China’s PP self-sufficiency further grew with continuous capacity expansions, suggesting a lower import dependence degree. Generally, China’s PP import volume registered a Y-O-Y brief dip in Q3, 2023.

High values of crude oil and steam coal underpinned PP prices from the cost side.

PP production profits via various feedstock sources improved, and coal-based profits even turned positive temporarily, but the overall profit stayed negative amid high feedstock costs. In particular, crude oil values refreshed a one-year high of $95.38/bbl because of tight supply and geopolitics, indicating higher production costs for PP producers. In terms of steam coal, its prices fell to a certain extent due to the increase in Australian coal imports and the stability of China’s domestic supply, and the coal-based PP production costs were reduced accordingly, leading to notable increments in profits. Comparatively, PP prices mounted up, but the upward range was within RMB 500/mt. Meanwhile, PP downstream plants faced scant new orders, softer processing profits and fewer exports, so they maintained low operating rates, inhibiting the PP production profits. In Q3, 2023, crude oil-based PP production profit declined by 58.90% Q-O-Q to RMB -1,427/mt, while coal-based one rose by 77.83% Q-O-Q to RMB -136/mt.

PP producer inventory was at a medium level, buoying PP prices.

In Q3, the PP inventory at major producers stood at a medium level, reflecting limited supply pressure. As of end-September, PP inventory at major producers declined by 10.26% Y-O-Y. In July, extensive maintenance of units alleviated the inventory pressure, and downstream basic purchases contributed to the smooth consumption of producer inventory. In August, PP output and operating rates inched up, as some previously stopped units resumed production. That enhanced the inventory pressure on PP producers. Meanwhile, the PP industry was facing the demand slack season, during which the inventory consumption slowed down, but the inventory pressure was lower than that in the same period of last year. In September, PP output decreased with more units undergoing accidental shutdown, and downstream users stockpiled on a hand-to-mouth basis, causing passable inventory consumption. Generally, PP producers controlled inventory effectively in Q3, driving PP prices moderately.

Favorable macro policies have been introduced successively, which may underpin the PP market.

Since July, favorable macro policies have been released frequently, and the market operation logic has gradually shifted to strong macro expectations. The July 24 meeting released an obvious signal of stabilizing growth. After the meeting, stimulus policies related to real estate, consumption and capital markets were introduced one after another. In terms of the real estate market, policy incentives spur new, pre-owned home purchases. The introduction and implementation of a series of favorable macro policies have certain support for the sentiment of market participants. In addition, preferential and subsidy policies for car purchases and home appliance replacement subsidy policies, including other consumption stimulus policies, have strengthened market expectations and improved the trading atmosphere. This is also the most important factor supporting the PP price growth in the third quarter.

PP prices are supposed to trend downwards in Q4, 2023.

SCI estimates that China’s PP market prices will probably fluctuate downwards in Q4, 2023, mainly affected by the change in supply-demand fundamentals. China’s PP capacity is expected to expand in Q4. Meanwhile, previously added units will probably run steadily, and unit maintenance is likely to decrease, so PP supply may grow gradually in Q4. But as for the demand, it may weaken with the industry entering the demand slack season, which may aggravate the supply-demand imbalance. Hence, PP market prices will probably lose ground in Q4.

PP supply will probably increase with capacity expansions and maintenance declines.

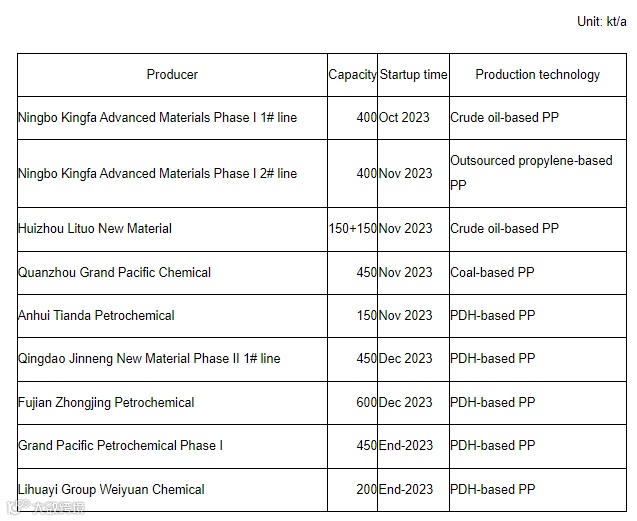

The commissioning of some units was postponed because of poor profits. As of the end of Q3, China’s PP capacity reached 38,090kt/a. Many units are projected to come on stream in Q4, 2023, and fresh capacity may be 2,750kt/a. PDH-based PP capacity may take up the largest proportion of total new capacity, and new capacity may be concentrated in East China and South China.

Q4, 2023 China PP Capacity Expansion Plans

PP market may be pressured by the demand slack season in Q4.

From the perspective of macro data, CPI continued to rise by 0.2% in September, and consumer demand is gradually recovering, but the overall recovery is still in a weak state. That may support the commodity market atmosphere to a certain extent in the short run, but that may buoy the market confidence and demand limitedly because the consumption recovery is still in its infancy.

In October, the PP industry is still in the demand peak season, but it is seen from the downstream operating rates and orders that PP demand may not improve notably. After China’s National Day and Mid-Autumn Festival holidays, plastic woven and BOPP film enterprises faced decreases in new orders, which weighed down the stance of participants. The industry is supposed to enter the demand off-season from November to December, during which the demand for PP will probably weaken further. Accordingly, PP market demand is projected to be limited in Q4. It is recommended to focus on the demand resilience after consumption and real estate-related policies are implemented.

In summary, China’s PP mainstream prices moved upwards and even hit a new high in Q3 on the back of stronger feedstock costs, favorable supply-demand fundamentals and improved macro environment. In Q4, PP prices are predicted to fluctuate downwards gradually amidst an imbalance between supply and demand, as PP supply will probably increase, but the demand may perform poorly under the traditional demand peak season.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.