Feb Chemical Market Expected to Edge up

Preface: China’s chemical market went upward in January 2024. International crude oil prices rose, supporting the prices of chemicals, while the supply-demand imbalance in the chemical market curbed the extent of their price rises. As for February, crude oil prices are predicted to keep firm. The chemical market demand may drop notably, while supply is also expected to weaken. Thus, the chemical market may continue to rise slightly in February.

In January, among the 53 major chemicals that SCI monitors, 30 products saw rises in their monthly average prices, taking up 56.6% of the total, while 23 products saw price drops, accounting for 43.4% of the total. As for products with price rises, the top three were VAC (19%), MMA (14%) and MEG (13%). As for products with price declines, the top three were acetic acid (-7%), DMC (-6%) and phenol (-6%).

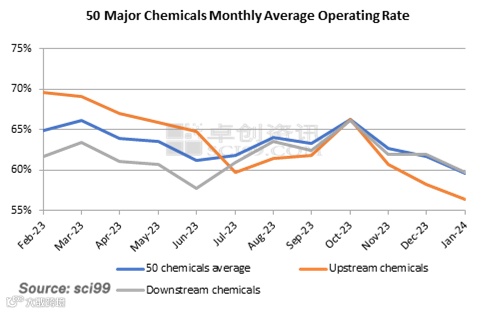

The major influencing factors for the chemical market in January are as follows: 1. International crude oil prices advanced due to supply disturbances. The WTI monthly average price rose by 1.73%, providing cost support to chemicals, especially upstream products. 2. The supply of most chemicals was loose, as the operating rates of upstream products remained high, while those of downstream products continued to slide in the demand slack season. The overall supply-demand mismatch still pressured the prices of chemicals.

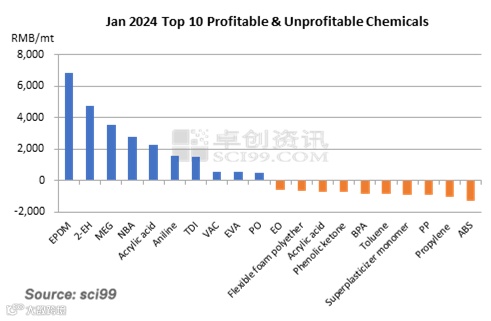

In January, the number of chemicals with negative profits decreased slightly, and the overall profit improved. International crude oil prices went up, but most chemicals saw larger price rises, so their profits rallied notably. However, for some downstream products close to end markets, large feedstock price rises squeezed their profits further.

February forecast: The chemical market may fluctuate upwards, but the extent may be limited. China’s domestic and overseas macroenvironment is anticipated to continue recovering. International crude oil prices may rise further amid OPEC+ production cuts and a weaker dollar, supporting the chemical market to some extent. In addition, the influence from fundamentals may be limited, as both market supply and demand are expected to slacken with China’s Spring Festival approaching.

The overseas economy remains resilient. The operating environment of commodities may be weak in the short term but tends to be stronger in the medium and long term. In December 2023, the global manufacturing PMI was 48%, flat M-O-M. Under the influence of inflationary pressure and geopolitical conflicts, the global economy in 2023 presented weak recovery stability and insufficient recovery momentum. The Asian manufacturing PMI in 2023 averaged 50.7%, unchanged from last year, showing the relatively strong resilience of Asian economic growth. Under the background of the Fed’s upcoming interest rate cut cycle, the US dollar has continued to weaken and entered the downward channel, which will support commodities in the long run. Overall, the macro environment of chemicals tends to become stronger in the medium and long term.

Economic resurgence is still on the way, and the overall operating environment of China’s domestic chemical market is slowly recovering. January PMI indicators improved, ending the consecutive three months of decline trend in Q4, 2023, and the chemical industry prosperity rallied to above the threshold. The focus of policies is on resolving risks, and the effect is gradually appearing. From the perspective of monetary policy, the first RRR reduction in 2024 will be landed in February when 1 trillion yuan of liquidity will be released. The advanced disclosure of the RRR reduction policy aims to stabilize market expectations, and based on adjusting the deposit reserve ratio, structural tools will be used to support agriculture-related, small and micro areas. Approaching the Spring Festival, the demand side is weak, and the support for chemicals has weakened, but with the landing of relevant policies, the market demand is expected to recover gradually after the festival.

In February, international crude oil prices are expected to continue fluctuating upwards, but the rise may be moderate. After entering February, OPEC + will implement a new production cut quota. Although it is a voluntary production cut, Saudi Arabia and others announced that it will be strictly implemented and even extended to the second quarter, which may further support oil prices. In addition, market players hold different opinions on the Fed’s rate cut time and intensity, but the future direction of interest rate cuts will not change, and the USD dollar appreciation will be blocked, bolstering the rebound of oil prices.

The operating rate of the chemical industry edged down in January. According to SCI’s monitoring of 50 major chemicals, the monthly average operating rate was 59.62% in January, down 2.12 percentage points M-O-M and down 3.38 percentage points Y-O-Y. The operating rate decline of downstream products was larger, signifying relatively weak demand.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.