2023 SBS Key Data Interpretation

Snapshot: With severer oversupply, the SBS market price hovered at lows most of 2023, and the profits of SBS production slid notably.

1. In 2023, the annual average SBS market price fell by around 8% Y-O-Y.

From 2019 to 2023, China’s SBS market price fell first, then rebounded and finally fell again. In the past five years, it was highly affected by capacity expansion and changes in demand. Meanwhile, the cost had an increasingly stronger impact on the market price in H2 of the last five years. In 2023, China’s SBS market price showed an N-shaped trend. Besides the supply-demand relation, the cost had a stronger influence on the SBS price. As of December 29, the annual average price of Baling 792E in Jiangsu market was RMB 12,696/mt, down around 8% Y-O-Y.

2. The annual average profits of SBS production slid by around 45% Y-O-Y.

In 2023, the profits of SBS production decreased notably. According to SCI’s profit model, as of December 29, 2023, the annual average profits of SBS production were around RMB 698/mt. In H1, 2023, the profits were fairish, but they decreased notably in H2, 2023. The main reason was as follows. In H1, 2023, the SBS price closely followed the butadiene price trend. Yet, in H2, the cost was hampered to transfer to downstream industries affected by the oversupply. The increment in the SBS price was smaller than that in the feedstock prices, leading to a fall in the profits.

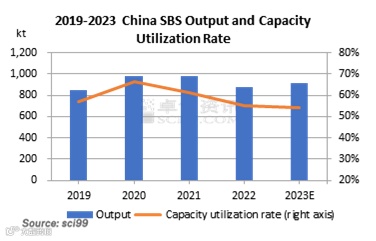

3. The SBS output is predicted to rise by around 4% Y-O-Y, and the import volume is expected to increase by 179% Y-O-Y.

In 2023, China’s total SBS output was 910kt, up around 4% Y-O-Y, and the capacity utilization rate declined. The reason for the rise in the SBS output was as follows. First, driven by demand, the existing and newly added capacity was further released. Second, there were fewer unexpected unit shutdowns in 2023. The rise in the SBS output led to a severer oversupply, so the annual average SBS market price decreased. In 2023, China’s SBS import volume is predicted to increase by 179% Y-O-Y. The prices of some European SBS resources were relatively low in 2023, bringing some cost advantages. Besides, the international trade flow changed somewhat. Thus, China’s SBS import volume rose notably.

4. The downstream consumption volume of SBS is expected to increase by 6% Y-O-Y, and the export volume may rise by 8% Y-O-Y.

In 2023, China’s downstream consumption volume of SBS is expected to be around 900kt, up around 6%. The major downstream application of SBS is the road bitumen modification industry. In 2023, China’s output of modified bitumen was around 7,950kt, up around 3%. As for the SBS export volume, it is expected to increase by around 8%. As China’s SBS resources were ample, and there was some arbitrage space for export, some SBS producers sold their SBS resources to the overseas market.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.