China MEG Prices Hit an 18-Month High

Preface: From December 2023, China’s MEG units underwent maintenance. In addition, geopolitical conflicts aggravated, which affected the profitability of foreign units and transportation. Thus, some foreign units were shut down intensively. With the drop in MEG supply, market sentiments warmed up. MEG prices rose to around RMB 4,700/mt, hitting an 18-month high.

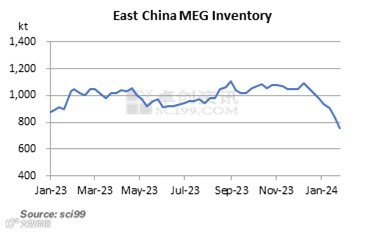

MEG prices climbed constantly with the port inventory decreasing.

From December 2023 to January 2024, affected by geopolitical conflicts in the Red Sea, market participants were worried about global crude oil supply and the import market in Saudi Arabia. In addition, more Chinese and foreign MEG units were shut down for maintenance or planned to undergo overhauls. Therefore, MEG market prices rose constantly. Up to January 25, negotiation prices of MEG spots hovered at RMB 4,670-4,715/mt. The basis was at a discount of RMB 20-25/mt to MEG futures contract 2301.

Downstream enterprises showed higher interest in stockpiling stimulated by increasing MEG prices and worries about the stability of supply. In January, as MEG arrivals at ports were limited, port inventory in East China shrank further. Up to January 25, MEG inventory in East China was 756.5kt, down 85kt W-O-W and 336kt from early December. In January, the daily average delivery volume was about 10,013mt in Zhangjiagang, which was 26% higher than that in December. The constant drop in MEG port inventory boosted the MEG spot market.

Expectations for weakened fundamentals may weigh on the MEG price increment.

On January 25, a 320kt/a MEG unit was shut down briefly, influencing the supply to some extent. However, its operating rate remained low, and the maintenance time may be short. Thus, the influence on the market was limited.

In recent years, profits from producing MEG were in the doldrums amid fierce competition. Some MEG units were shut down or switched to other production. Most 200kt/a syngas-route MEG units that were put into operation in the earlier stage have been in a long shutdown. Soft profits also were the reason for a couple of MEG producers held operating rates relatively low. Thus, the influence degree of unplanned maintenance on the market declined.

In Q4, 2023, profits from production MEG were improved notably. MEG producers showed higher production enthusiasm. Some producers raised operating rates. Maintenance plans of some units were delayed or canceled. Thus, the MEG supply began to move up.

In end-January, downstream plants began to halt production with the Chinese New Year holiday approaching. PET plants began to take overhauls, dragging down the demand for MEG. On the whole, MEG fundamentals may weaken, which will weigh on the increment in the MEG market.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.