Cardboard Paper Prices Likely to Slowly Move Up in H2 of 2024

Introduction: The cardboard paper market prices moved downward in H1 of 2024, mainly due to the prominent supply-demand imbalance and declined costs. H2 marks the demand peak season for cardboard paper. With concentrated holidays, end consumption is expected to improve, pulling up the demand for cardboard paper and thereby driving the prices up. However, considering the potential release of newly added capacity in H2, supply pressure may remain, and the price increase is predicted to be limited.

In H1 of 2024, the cardboard paper market prices fluctuated downwards overall, and the mainstream dealing prices moved down. The price trend was slightly different from the forecast in SCI’s 2023-2024 China Corrugated Paper and Cardboard Paper Market Annual Report. This was mainly because demand recovery did not meet expectations, supply-side pressure was high, and costs declined. After a downward adjustment in April, the cardboard paper prices stayed sideways at lows for a prolonged time, and the price decline was larger.

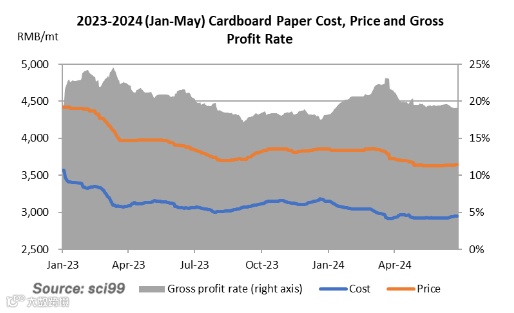

The price of cardboard paper mainly decreased in H1 of 2024. According to SCI, in H1, the average market price of cardboard paper in China was RMB 3,744/mt, down 8.75% Y-O-Y. The peak price was RMB 3,859/mt in early March, and the lowest price was 3,629/mt at the end of May. The price difference between the highest and lowest points was RMB 230/mt, and the price volatility was 6.34%. Looking back at the market, prices were mostly stable in January and February, with minor adjustments. Under the influence of traditional festivals, downstream packaging plants replenished their inventory intensively. Coupled with more maintenance downtime at paper mills, producers destocked easily. In March and April, the market prices dropped notably. After the Spring Festival, the restart time of packaging plants was 8-10 days later than that of paper mills, and the supply-demand imbalance gradually emerged. End demand recovery fell below expectations, and downstream packaging plants saw no apparent improvement in orders, aggravating inventory pressure on paper mills. In addition, the import volume from January to May increased by 22.64% Y-O-Y, and notably dropped waste paper prices gave weaker cost support, so cardboard paper market prices moved down. In May and June, the market trended sideways. During the traditional demand slack season, downstream packaging plants were inactive in buying. Small and medium-sized paper mills had more maintenance, and the inventory pressure persisted. As a result, the imbalance between supply and demand remained apparent.

Cardboard paper market dealing prices moved downwards in H1 of 2024, mainly due to increased supply pressure, less-than-expected demand recovery, and declined costs.

Output and import volume increased, aggravating the supply pressure.

In H1 of 2024, the market supply of cardboard paper increased to about 19,930kt, up 980kt Y-O-Y. The increase in supply mainly comes from output and imports. The output of cardboard paper was 13,950kt, up 5.05% Y-O-Y. The output growth was mainly due to the obvious increase in capacity. The newly added capacity was not much in H1, with only 150kt/a capacity released by Gansu Hongqi Packaging Materials. However, due to the significant increase in new capacity in H2 of 2023, the capacity in H1 of 2024 increased notably Y-O-Y. According to SCI, the cardboard paper capacity reached 45,370kt/a by the end of June, up 4.88% Y-O-Y. The import volume in H1 of 2024 continued to increase Y-O-Y. According to GACC, the cumulative import volume of cardboard paper from January to May was 2,450kt, and the estimated import volume in H1 of 2024 was 2,980kt, up 22.63% Y-O-Y. This was mainly due to the continuation of zero-tariff import policy and the gradual completion of layout in the overseas market of China’s paper mills, which resulted in some paper being diverted back to China. The abundant market supply was unfavorable for the price trend of paper.

Less-than-expected demand growth led to an expanded supply-demand imbalance.

As China’s consumption environment continues to improve, the market consumption of cardboard paper is in the recovery stage as a whole. The demand for cardboard paper in H1 of 2024 is expected to reach 16,700kt, up 880kt Y-O-Y. From the perspective of the end-user industries, the beverage, four major household appliances, express delivery, and furniture industries all showed a Y-O-Y increase in demand, bolstering the market demand. However, downstream packaging plants were inactive in purchasing and restocking, and most maintained essential procurement. Overall, the total supply and demand of cardboard paper in H1 of 2024 both increased, but the increase in supply was greater than that in demand, widening the supply-demand gap, and thereby pulling down the paper prices.

Cost support was insufficient, and industry profitability declined Y-O-Y.

In H1 of 2024, the trend of cost and price fluctuations of cardboard paper were basically consistent. OCC, one of the main feedstocks, saw a fluctuating downward price trend, with a Y-O-Y decline in the average price. Prices of other feedstock (pulp, starch, etc.) had different degrees of downward adjustments, and the overall cost decreased, making it difficult for paper mills to raise prices, thereby exerting a bearish impact on the cardboard paper market. The average profit margin of the cardboard paper industry in H1 of 2024 was 1.84 percentage points lower than that of the same period last year, among which the comprehensive cost was 6.47% lower, while the average price of cardboard paper was 8.72% lower. The decline in prices was greater than that in costs, leading to a Y-O-Y drop in the industry’s profit margin.

Looking ahead to H2 of 2024, with more holidays, the end-user consumption is expected to improve, which will drive the demand for cardboard paper up, benefiting the price uptrend. However, considering the potential releases of newly added capacity in H2, supply pressure remains, and the price increase may be limited.

From the supply perspective, the cardboard paper industry is scheduled to add about 2,950kt/a of capacity in H2 of 2024, intensifying market competition. In terms of output, producers may be active in production, resulting in slightly higher operating rates in H2. In addition, enterprise inventory may be high, and the import volume may remain large, so the market supply pressure will likely continue, unfavorable to the price trend. It is estimated that the total supply of cardboard paper in China will probably reach 21,430kt in H2 of 2024, an increase of 7.53% over H1.

From the demand perspective, the second half of the year is a traditional consumption peak season. The Mid-Autumn Festival, National Day, and e-commerce festivals have positive stimuli for end-user consumption in China, driving the demand for corrugated paper and benefiting the price trend. It is estimated that the total demand for cardboard paper will reach 18,280kt in H2 of 2024, an increase of 9.46% over H1. Overall, it is expected that the supply-demand imbalance may be alleviated in H2, but the oversupply situation may not change.

From the cost perspective, the consumption of OCC may first decline, then rise and decrease again in the second half of the year. This is mainly because September to November is the peak season for paper packaging demand, when paper mills’ finished paper sales may improve, and at the same time, the consumption of OCC will grow. As the market’s bullish sentiment heats up, some packaging stations may stockpile, which is not conducive to the increase in volumes of OCC delivered to paper mills. Overall, the OCC market may stage-wise present a supply-shortage situation, pushing OCC prices to fluctuate upwards. Therefore, the cost side may bolster the cardboard paper prices.

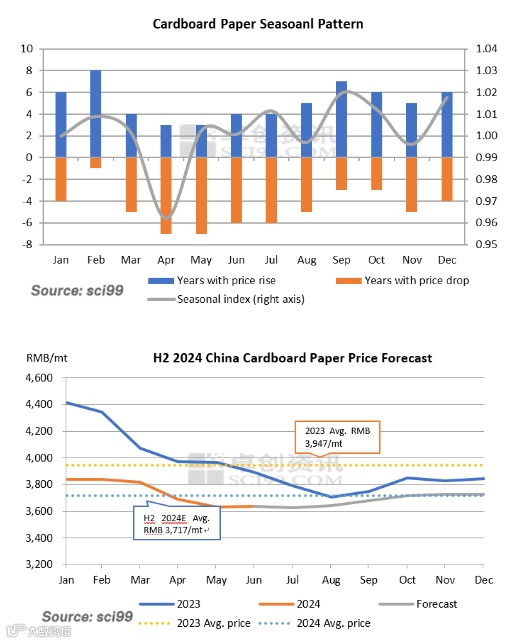

The price fluctuations of cardboard paper have seasonal characteristics, and the industry prosperity in H2 is higher than that in H1, mainly due to the favorable consumption in holidays, e-commerce festivals, etc. The probability of price rising in January, February, May to July, and September to December is higher, especially the probability of price rising in September, which is boosted by the consumption peak season, reaches 70%. Combining the changes in market prices of packaging paper and China’s economic recovery process, it is expected that the cardboard paper market will follow the seasonal fluctuation pattern in H2 of 2024.

In summary, SCI still holds the price trend forecast for H2 of 2024 in the SCI’s 2023-2024 China Corrugated Paper and Cardboard Paper Annual Report. The cardboard paper market prices may slowly move up in H2, with limited growth. In H2 of 2024, the average market price of cardboard paper is expected to fluctuate within the range of RMB 3,630-3,730/mt, with an average price of RMB 3,690/mt, down 1.44% from H1 and 2.82% Y-O-Y. Based on seasonal patterns, the price peak of the year is likely to occur in November, while the low point may appear in July.

Risk reminder: The international environment is complex and severe, and the world economy lacks growth momentum. China’s domestic economy is recovering, but the recovery progress is slow. New capacity release and the volume and price of imports remain uncertain.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.