Growing Oil Blending Demand Overseas Fuels up BTX Prices

Since the second half of 2023, the prices of the aromatic hydrocarbon industry chain have remained at high levels in the past five years, with demand growth exceeding supply growth being the main driver. The demand for oil blending has increased overseas, and the rapid deplouyment of domestic downstream capacity has promoted an improvement in the industry’s supply and demand environment. Under the guidance of relative policies and positive terminal demand expectations, the consumers’ demand for the upstream products is showing a positive trend. In addition, benzene, toluene and xylene are both by-products of refining facilities, and the demand differentiation and price difference-driven product arbitrage also make the price linkage stronger.

Demand growth exceeding supply growth drives the high prices.

In the past five years, the demand growth rate for toluene and xylene has significantly exceeded the supply growth. The average annual growth rates of apparent demand for these two chemical products reached 18% and 23%, respectively, far higher than the 12% and 18% growth rates of supply. Despite the capacity growth rate of PX reaching 26%, the market is still in short supply, and the import dependence rate remained at around 22% in 2023.

In the benzene-styrene-ABS, PS and EPS industry chain, the compound capacity growth rate of styrene reached 18%. At the same time, the consumption of benzene by styrene continued to increase. Although the capacity growth of downstream ABS, PS and EPS markets is slower than that of upstream markets, under the positive terminal demand expectations, the support from downstream consumption for upstream markets remains positive.

Increasing overseas demand for oil blending pushes up BTX prices.

Due to the conflict in Europe, the price of crude oil increased globally. This, in turn, increased the demand for gasoline and oil blending materials, which forced domestic aromatics companies to continuously optimize their BTX production ratio and drive up the price of benzene. BTX, as by-products of refining units, are crucial raw materials used in the chemical industry. Since the escalation of the geopolitical situation, the international oil price has continued to rise. Along with the U.S. demand prior to the travel season, there has been a significant increase in the export of gasoline and various oil-blending materials, primarily MTBE, toluene, and ethylbenzene. This has increased domestic demand for oil blending and raised the prices of related goods.

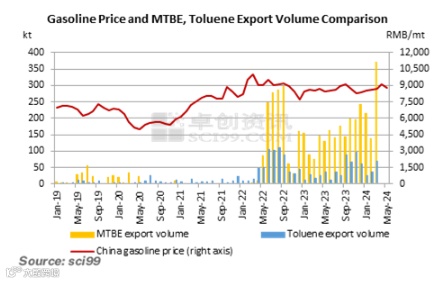

As shown in the chart below, by March 2022, the average price of gasoline in China had risen to over RMB 10,000/mt, and overseas demand also continuously increased, which continued to drive the export of toluene. In August 2022, China’s export volume of toluene exceeded the highest level in nearly five years, reaching about 110kt. Although the export volume of toluene declined slightly in 2023 and 2024, it remained at a relatively high level. The increase in export volume provided significant support for the domestic price of toluene, thereby promoting the optimization of the BTX production ratio by domestic aromatic enterprises. This increased the domestic consumption of toluene and xylene and reduced the output of benzene, thereby pushing up the price of benzene.

The impact of tight supply on the benzene market is equally significant. Since the second half of 2023, the domestic demand for benzene has maintained a stable growth rate, while the supply has tightened, thus the price of benzene has continued to rise. Compared to toluene and xylene, benzene has a substantially stronger increasing tendency through 2024. The price of benzene in Asia has grown as a result of increased exports from Asia to the U.S. due to a constrained supply in the U.S. and strong demand for ethylbenzene blending oil locally. This has also restricted China's imports of benzene, which has led to a shortage of benzene supply and a price increase.

The BTX prices are anticipated to remain hefty.

Crude oil prices have an impact on BTX markets through altering cost, mindset, and demand for oil blending. Global oil prices display enormous amplitudes and high-frequency variations due to a variety of factors, including supply and demand dynamics, US dollar exchange rates, and the policies of oil-producing nations. Demand for oil blending is directly correlated with fluctuations in oil prices. The US travel season and China’s peak fuel usage season in summer are two examples of factors that will cause fluctuations in both China’s and international demand.

The American and European markets are experiencing a shortage of supply in 2024. Enterprise maintenance takes place primarily in May, June, and the fourth quarter in Asia, particularly in China. Furthermore, the newly acquired capacity, which is mostly concentrated in the second part of the year, is less than the level in 2023. This will lead to a relative balance between the overall supply and demand of BTX, thereby forming stable support for their prices.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.