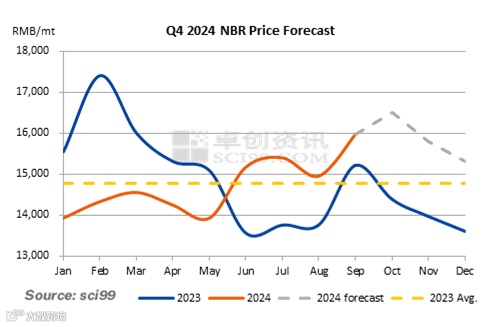

Q4 2024 NBR Prices to Correct Downwards from Highs

Highlight: In Q4, feedstock butadiene prices are likely to move down, and the NBR fundamental support may also weaken. Therefore, NBR market prices are predicted to correct downwards from highs in Q4.

Looking ahead to Q4, SCI reckons that the NBR market price may correct downwards from highs.

China’s domestic supply of butadiene may gradually increase, and the support from the cost end may gradually weaken. From the cost side, butadiene prices may continue at high levels in the first half of October due to limited market supply. Besides, downstream plants have low inventory, and their rigid demand may underpin the NBR prices. However, with the arrival of imported cargo and the expectation of trial operation for new units, market sentiment may weaken in the second half of October, and NBR prices may also decline. Nevertheless, considering the scheduled maintenance shutdowns of butadiene units in the middle and late part of October in Central China and Southern China, some downstream players may purchase externally, which may restrain the decline in butadiene prices. Thus, a downward trend of butadiene prices is expected, but the decline may be relatively limited. The cost end will still provide some support to the butadiene market in October. Looking ahead to November and December, the maintenance shutdowns of butadiene units in China will likely be fewer, and new units are also expected to gradually produce goods, thus the supply support is expected to gradually weaken, so butadiene prices may gradually decline. Accordingly, NBR prices may slide amid softened cost support.

The increase in NBR supply may be greater than that in demand, and the fundamental is expected to weaken, which will be bearish for the NBR market price. From the supply side, only Zhenjiang Nantex Chemical Industry has a maintenance shutdown plan in Q4, and some plants in East China are expected to expand capacity, so the domestic NBR output is expected to increase by about 18% in Q4. From the demand side, although the sentiment in the commodity market has enhanced recently with a series of favorable economic policies, and the expectations for future demand have improved, the shift from policy to the real economy still needs time and real-world verification. The drag from real estate investment as a whole and the slowdown in infrastructure investment growth still restrict the growth of NBR demand. Therefore, it is expected that the supply-demand gap in the NBR market may be prominent in Q4, which may put pressure on NBR market prices.

In conclusion, the increase in NBR demand is expected to be limited in October, and the tight supply of some spot goods may ease, leading to a weakening of fundamental support and a downward movement in the NRB market price. However, feedstock butadiene prices may still be high, so the downward movement of the NBR market price may be limited by the high cost. In November and December, NBR output is expected to rebound, and the butadiene price is expected to decline gradually, which may drag the NBR market price down. Based on the fundamental analysis and seasonal characteristics, SCI predicts that the NBR market price may gradually decline in Q4 of 2024.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.