Jun Chemical Market Likely to Stable-to-Rising

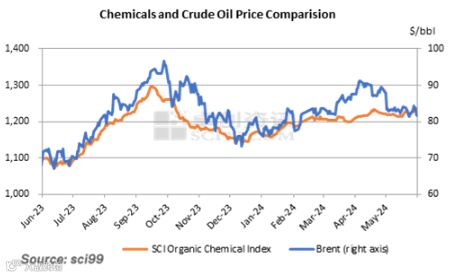

Preface: China’s chemical market edged up in May 2024. International crude oil prices dropped, forming an obvious drag on the prices of chemicals. However, market demand recovered gradually, with the terminal industry showing a favorable growth trend. The support from supply-demand fundamentals offset the negative influence of crude oil price declines to some extent, so market prices rose slightly overall.

In May, among the 41 major products that SCI monitors, 17 products saw rises in their monthly average prices, taking up 41.46% of the total, while 24 products saw price drops, accounting for 58.54% of the total. As for products with price rises, the top three were MMA (+6.40%), acetone (+3.86%) and 2-EH (+3.30%). As for products with price declines, the top three were WTI (-6.84%), Brent (-6.79%) and MTBE (-5.93%).

The major influencing factors for the chemical market in May are as follows: 1. International crude oil prices fluctuated downwards amid the expectation of delayed Fed interest rate cuts and strong US dollars. The WTI monthly average price dropped by 6.84%, forming an obvious drag on the prices of chemicals. 2. Market demand recovered gradually, with the terminal industry showing a favorable growth trend. The Y-O-Y declines in the floor spaces of buildings newly started and under construction narrowed, and the household appliance industry performed well. 3. The production of major raw materials was stable, and the startup of many newly added units was expected to be delayed. The support from supply-demand fundamentals offset the negative influence of crude oil price declines to some extent, so market prices rose slightly overall.

In May, the theoretical gross profits of chemicals changed limitedly. Among 40 major chemical products, the number of products with negative profits took up 62.5% of the total, flat from last month, and the average gross profit rallied slightly. International crude oil prices fluctuated downwards, dragging down the prices of most upstream products. However, some downstream industries were supported by favorable policies, and market sentiments kept improving. The price declines of most products were smaller than cost reductions, and average gross profits rose somewhat. However, the number of products with negative profits didn’t decrease, as costs were still at a high level.

June forecast: The chemical market is predicted to be stable-to-rising. In June, crude oil prices are expected to be relatively strong, providing stronger cost support for chemicals. The good performance of demand may continue. With related real estate policies to be implemented gradually, the demand for feedstock is projected to increase. In addition, the upcoming mid-year promotion will also boost consumption in the home appliances and chemical fiber industries. What’s more, with the inventory cycle entering the destocking phase, it tends to favor prices.

Global economy is under mild recovery, and the expectation of Fed interest rate cuts has weakened.

In April 2024, the global manufacturing PMI was 49.9%, down 0.4 percentage points from the previous month, but basically continued a moderate recovery trend, and Asia was still an important supporting force for the stable recovery of the global economy. The inflation level in Europe and the U.S. is still high. The European Central Bank may take the lead in cutting interest rates in June. Due to the good performance of the employment data in the U.S., it is more likely to maintain the current high interest rate based on the pressure of inflation recovery, which objectively leads to the increased risk of currency depreciation in other countries and causes turbulence in the international financial market. This in turn will affect the stability of the global economic recovery.

China’s domestic economy has recovered steadily, and relevant support policies have been implemented.

China’s manufacturing PMI was 49.5% in May, down 0.9 percentage points from the previous month. Although there has been a correction in the index, there is still a basis for a stable economic recovery. Major indicators such as industry, export, employment and commodity prices have generally improved. New drivers of growth have maintained rapid growth. The national economy has continued to pick up, and positive factors have accumulated. The central bank issued policies to adjust the interest rate of individual housing provident fund loans and cancel the lower limit of interest rates of commercial personal housing loans; the central bank and the General Administration of International Supervision and Administration issued a notice to reduce the down payment ratio of the first and second homes, indicating stronger policies to support the real estate market.

It is estimated that international crude oil prices may fluctuate upward in June, but the price increment may be limited. The gasoline consumption in the U.S. is likely to increase in summer, and most market participants may adopt bullish attitudes in the short term. Moreover, market participants pay attention to the OPEC+ crude oil production cut conference, and it is expected that Saudi Arabia and other countries may continue to cut production until Q3, 2024 or even the end of 2024, strongly underpinning the international crude oil prices.

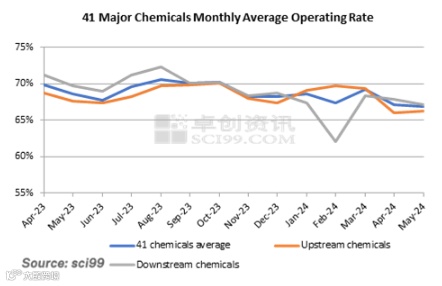

The operating rate of the chemical industry edged down in May. According to SCI’s monitoring of 41 major chemicals, the monthly average operating rate was 66.82% in May, down 0.48 percentage points M-O-M and down 2.66 percentage points Y-O-Y. The operating rates of upstream products were relatively low and below those of downstream products, indicating that market supply was slightly weaker, favoring market prices.

Remarks: The number of major chemicals has changed from 50 to 41 since this issue.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.