Oct 2024 China LPG Import Arrivals See M-O-M Drop of 5.01%

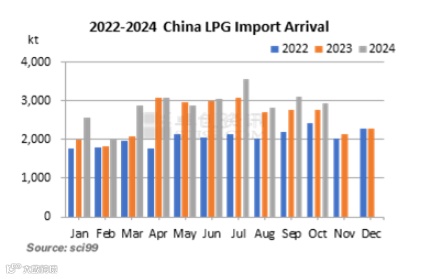

According to SCI’s shipment data, China’s LPG import arrivals were about 2,940.5kt in October 2024, down 5.01% M-O-M, and mainly influenced by import costs, operating rates of deep-processing units, etc. China’s LPG import costs were relatively high, but the overall LPG demand may be sluggish. Accordingly, it is estimated that China’s LPG import arrivals may continue to decline in November 2024.

According to SCI’s shipment data, China’s LPG import arrivals were 2,940.5kt in October 2024, down 155kt or 5.01% M-O-M, and up 169.5kt or 6.12% Y-O-Y.

According to SCI’s alkane deep-processing unit operating rates, the monthly average operating rate of butane dehydrogenation units reached 78%, and that of PDH units and MA units was 76.13% and 46.65% respectively. Meanwhile, operating rates of light ends crackers reached 86.04%, down 6.39% M-O-M. Operating rates of most alkane deep-processing units went down notably, so the demand from the deep-processing industry weakened.

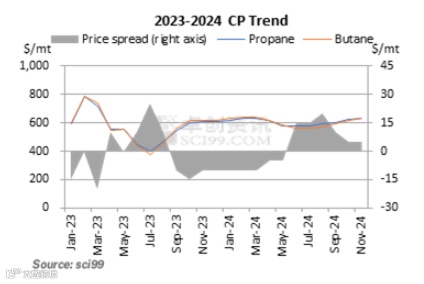

Taking the PDH industry as an example, the PDH industry experienced a monthly average profit loss of RMB 625/mt in October 2024. China’s propane prices went up with CP increments. At the same time, sales at propylene producers performed well with the expectation for supply cut, so propylene prices hovered at high levels, supporting PDH unit profits.

In terms of the LPG import arbitrage, China’s LPG import arbitrage remained negative in October. As of October 31, 2024, China’s LPG importers experienced an average import arbitrage of RMB -185/mt. China’s LPG import costs further increased in October. Meanwhile, some state-owned refineries sold more civil-use gas to the market, hitting the import market. The improvement in downstream demand was lower than expected, so selling prices of imported LPG declined from high levels.

China’s LPG import costs in October 2024 went up. The propane and butane CP reached $625/mt and $620/mt respectively. The demand for civil-use gas in India was favorable, lifting LPG spot prices. Moreover, the LPG supply in the Middle East inched down in the wake of crude oil production cut, giving support to CP. Besides, the loading of LPG in the U.S. was delayed, curbed by hurricane and port maintenance. Backed by these bullish factors, China’s LPG import costs kept rising. However, the import enthusiasm was limited, so China’s LPG import arrivals declined in October 2024. Meanwhile, most importers consumed inventory, dragging down LPG port inventory.

It is estimated that China’s LPG import arrivals in November will probably drop M-O-M. The international LPG prices remain high due to the tight supply, and the overall spot trading was limited. Meanwhile, China’s LPG import arbitrage underperforms in the wake of high import costs. Accordingly, the overall import enthusiasm may sluggish, and most importers may still consume inventory. Overall, it is estimated that China’s LPG import arrivals may decline to about 2,700kt in November 2024.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.