Tight Supply to Bolster EPDM Prices in June

Snapshot: From January to May 2024, the total supply of Chinese-made and imported resources in China’s EPDM market was estimated to increase slightly Y-O-Y. In June, it is unlikely for the EPDM market supply to significantly increase due to maintenance shutdowns of domestic units, and the limited availability of some resources is expected to keep market prices stable.

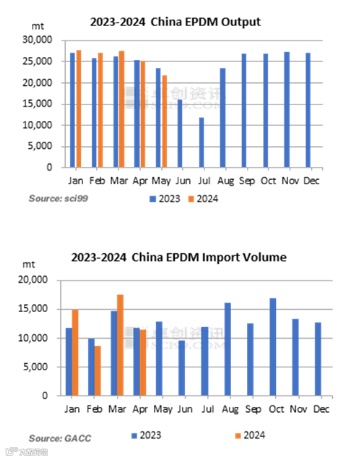

From January to May 2024, the total volume of Chinese-made EPDM was estimated at around 130kt, up 1% Y-O-Y. During these months, most of the five domestic EPDM producers maintained high operating rates. However, there were instances of shutdowns for maintenance, so the overall output changed limitedly compared with last year. Regarding foreign EPDM units, South Korea’s LVE maintained stable production, while Kumho shut two lines down for maintenance at the end of May. In Saudi Arabia, SABIC stopped production for maintenance from January to March, while the Kemya elastomer plant mainly produced POE, and the operation was largely stable from April to May. However, the overall output did not reach the same level as last year. In June, producers in Saudi Arabia resume regular production, while there are still maintenance shutdowns at China’s domestic producers. Therefore, the output is expected to remain low.

In terms of imports, from January to April 2024, China imported 52,682.71mt of EPDM in total, up 9.33% Y-O-Y, while the average price in US dollars for imports generally decreased. Specifically, in April, the total import volume was 11,437.86mt, down 2.66% Y-O-Y, and the average price was $2,249.07/mt, down 1.96% Y-O-Y. Given China’s market demand and unstable shipments of imports from Saudi Arabia, the import volume in May was estimated to remain at the same level as that in April.

As a result, the total supply of EPDM, including Chinese-made and imported resources, was estimated at 195kt from January to May, approximately a 3% increase Y-O-Y. As for Chinese-made goods, even with the maintenance shutdowns at domestic producers from January to May, the monthly output did not differ significantly from last year. As for the imported supply, it was boosted by the resources from South Korea mainly.

China EPDM Units Running Status in May

Remarks: SD* = shut down; RS* = restart; NO* = Normal operation; OR* = operating rate

The output of Chinese-made EPDM in June is expected to decrease M-O-M. The 75kt/a unit at Shanghai Sinopec Mitsui Elastomers and the 50kt/a unit at Ningbo SK Performance are scheduled for maintenance shutdowns. Meanwhile, imported supplies from South Korea are expected to remain stable, while the import volume from Saudi Arabia is expected to increase, but the increase may not be substantial due to ongoing shipping issues. Overall, the supply is anticipated to remain relatively tight in June, playing a role in stabilizing product prices.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.