Ivory Board Market May See Downward Pressure in Q4 After Capacity Expansion

Preview: In Q3, the ivory board market first rose then declined. The market was oversupplied in general due to limited seasonal demand recovery, and the ivory board price started to fall after a slight rebound. In Q4, with the release of new capacity, the market supply increased overall, but the demand recovery was hardly optimistic. It is estimated that the ivory board market may continue to go down.

Ivory board market hovered at a 5-year low level

In Q3, the ivory board market showed a brief rising phase but then it started to drop. According to SCI, the average ivory board market price in Q3 was RMB 4,393/mt, down 0.54% QoQ and 0.29% YoY. The highest price appeared in late July and early August at RMB 4,450/mt, while the lowest prices appeared in late September at RMB 4,260/mt. The price trend can be split into two phases.

Phase I: the ivory board price bottomed out in July. After the continuous downtrend in H1, the ivory board price dropped to a low level, and participants struggled to make profits. Ivory board mills lowered production continuously from May to June, and the enterprise inventory fell constantly. In addition to the anticipated Mid-Autumn Festival-related orders, the market expected demand improvements. Therefore, large-sized ivory board mills raised prices by RMB 200/mt, leading to a price hike in the market.

Phase II: From August to September, the ivory board market fell constantly. As previous shutdown units resumed normal production, the ivory board production increased overall but was below expectations. The inventory rose constantly at paper mills, and some started to lower order-taking prices under sales pressure. Downstream distributors also lowered paper prices accordingly to destock.

The ivory board market was at a five-year low level. Due to market oversupply, the ivory board price hardly increased under pressure.

The market supply and demand increased simultaneously, but the market was still oversupplied. In addition to the launch of new capacity, the market sentiment was also bearish. Thus, the market maintained a downtrend in Q3.

Supply: In Q3, the ivory board production first rose and then declined. The ivory board output in August reached 1,013.2kt, which was the highest in Q3. The overall output was 2,808.8kt in Q3, up 2.51% QoQ. Some ivory board lines at large-sized players in East and South China were restarted in July, producing more cup stock and food-grade ivory board, but the output of commodity-grade ivory board also increased in August. Some players went under maintenance briefly in September. Medium and small-sized players produced differentiated products with low basis weight, but as the market turned weak, some started to shut down in September. The swing line in Southwest China did not produce ivory board from July to September, but its 1-1.2 million ton/a new capacity in South China was put in trial production on September 10. The market sentiment turned more bearish due to anticipated capacity expansion.

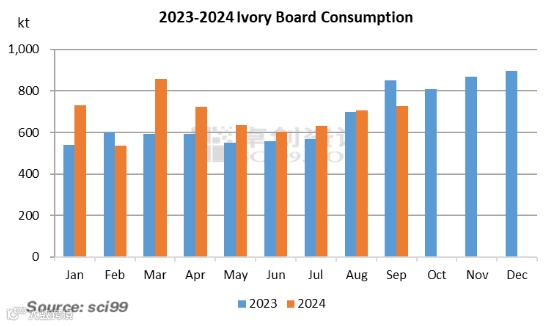

Demand: The ivory board market demand increased in Q3, but the peak season demand was below expectations. In Q3, the ivory board consumption was 2,068.3kt, which was smaller than production but still increased by 5.19% QoQ. The order release was limited before the Mid-Autmn Festival, and those for pharmaceutical packaging were delayed. The orders from the food and beverages industries were unideal. Thus, the sales pressure became prominent after entering August, and by the end of the month, the inventory at some ivory board mills and distributors climbed to a high level. Therefore, some sellers started to lower prices to destock in September.

The cost factor failed to lend support to the ivory board marke

In Q3, the wood pulp prices diverged but went down in general. Therein, the HWP price was affected by the continuous release of new capacity in China and Brazil, so the supply pressure increased notably. As of September 29, the HWP average price went down by 12.54% QoQ, and those of SWP and CMP fell by 3.44% and 7.68% respectively. As the pulp prices decreased, the theoretical production cost of ivory board dropped by 7.21% QoQ.

The market supply-demand imbalance may hardly ease in Q4

On the supply side, with the release of new capacity, the market supply pressure continued to mount. The 1.2 million ton/a new capacity in South China is expected to start normal production in mid-October, and with capacity ramp-up, the ivory board supply may step up continuously from November to December. With no apparent maintenance schedules, the market supply pressure will likely increase constantly, and some medium and small-sized players may switch to produce other products. In general, the ivory board output is likely to increase by 2.35% QoQ.

On the demand side, order status is still expected to recover, but the overall demand increase may be limited. Boosted by the Double 11, New Year’s Day and Spring Festival holiday, new orders may pick up in Q4. Downstream players tend to stock up 2 months in advance, so extensive order placement is expected from late October to November. However, due to softened end consumption, the seasonal demand recovery may still bear uncertainties. Thus, the ivory board consumption may increase, but the increment may be less than 1%.

In terms of cost, the feedstock wood pulp price may first remain stable and then drop, but the cost support is likely to head down. The maintenance at some overseas pulp mills lends some support to the market sentiment, which may stabilize the pulp price at the start of Q4. However, the capacity ramp-up at domestic and overseas new pulp capacity is still ongoing, and the pulp market still suffers downward pressure in Q4. Thus, the cost factor may be bearish for the ivory board market.

In general, the ivory board market may be affected by the release of new capacity. The market supply is to increase, but the support from demand recovery may still be questionable. Due to overcapacity and intensified competition, the ivory board price may continue to search for a bottom. In November, with the concentrated release of demand, the ivory board price is likely to rise slightly as sellers attempt to raise prices. In December, sellers are likely to lower prices to recoup cash, so the ivory board price may start to drop.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.