Tissue Market May Remain Bearish in Oct

Preview: Due to bearish sentiment in the market during H1 of October, the tissue market sales slowed down, and the tissue price edged down. The market supply may recover slightly, which projects a bearish influence on the market. The cost factor may also lend little support, while the demand boost may be limited. Thus, the tissue market may continue to decline.

As of October 21, the tissue daily average price fell to RMB 6,138/mt, down 0.41% MoM. During the National Day holiday, some medium and small-sized tissue mills had brief maintenance, and the market supply dropped slightly, so the tissue price remained stable. The tissue sales in southern China were passable, and the local tissue price was stable-to-increasing. In northern China, due to capacity expansion, some low-priced tissue resources were available in the market. In addition to the generally bearish expectations towards end-year consumption, the tissue price has started to drop in northern China since mid-October. The tissue sales also slowed down in southern regions, but the price remained stable with limited inventory pressure. As of October 21, the tissue average price was RMB 6,156/mt, down 0.11% from that in September.

Cost fluctuated downwards, which projected bearish influence on tissue prices

In H1 of October, the imported pulp spot prices fluctuated downwards. According to SCI, as of October 21, the imported SWP price fell to RMB 6,233/mt, down 0.13% compared to that in late September. The HWP price fell to RMB 4,705/mt, down 1.16% MoM. The falling pulp prices had a bearish influence on the price of tissue. As pulp prices dropped, tissue mills lowered prices further, but their profit levels failed to improve notably. In addition, downstream players also showed limited purchasing interest in view of bearish market trends in the future.

The tissue market lacks sufficient support with weaker supply and demand

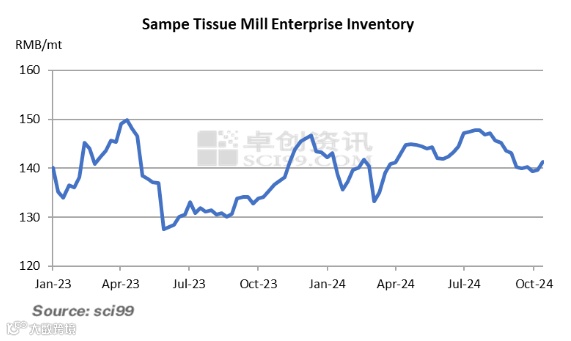

The market supply dropped slightly as of October 17 to 63.84%, down 4.75pp from that in late September. During the National Day holiday, tissue mills and downstream converters had brief maintenance schedules, which led to a decline in both market supply and demand. After the holiday, some tissue mills maintained production cuts, so the total market supply is expected to drop from that in September.

The demand recovery was relatively slow. Due to the National Day holiday, downstream converters had brief maintenance, which led to lower market demand. The sales of tissue were mediocre after the holiday, and the sales of tissue jumbo rolls also decreased. Besides, some players held pessimistic sentiments towards the upcoming shopping fest, which further restricted the purchase appetite of downstream converters. In general, as of mid-October, the tissue market supply and demand have both dropped from those in September, while the restocking of downstream converters in late October will require further observation.

The tissue market may continue to edge down with limited changes in supply and demand

On the supply side, the operating rates of some regions may recover slightly after local players complete maintenance, but tissue production will still be suppressed by poor profit in tissue production.

On the demand side, in late October, some converters may still stock up adequately, lending a slight boost to the market price.

In terms of cost, in late October, with the anticipated launch of new pulp capacity in China, the market pulp price is still expected to edge down, which may lend limited support to the tissue price.

In conclusion, due to bearish supply-demand and cost factors, the tissue price is still expected to edge down in the upcoming weeks.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.