PE Price Fluctuations from Supply Perspective

China’s PE market prices witnessed fluctuations from January to November 2024. After New Year’s Day, PE prices moved downwards amidst fluctuations. When the supply of some resources became tight, prices of most varieties showed increasing trends. July, being the traditional slack season for demand, saw limited market gains. From the end of July to September, prices were dragged down by increased supply with fewer units being involved in maintenance. However, positive macroeconomic policies led to a noticeable rise in early October, but it cooled off by mid-October as these benefits dissipated, leading to a downward trend in prices in response to fundamental factors. Some varieties experienced tight supply in November, pushing prices up. It is anticipated that with the commissioning of new units, prices may fall and then rise between late November and January 2025.

Taking LLDPE as an example, as of November 18, 2024, the price averaged RMB 8,369.13/mt, up 1.84% YoY.

In Q1 2024, downstream producers took the Spring Festival holiday, diminishing purchasing enthusiasm. After the holiday, demand from these producers recovered slowly, creating significant market sales pressure. The PE market showed a weak trend in Q1, with prices for most varieties reaching the lowest levels of the year. In April and May, rising trends pervaded PE market prices influenced by positive macroeconomic news that buoyed the commodity market and led to higher plastic futures, driving up market prices. Moreover, maintenance for several units was scheduled earlier than in previous years. Therefore, the price showed an increasing trend due to tight supply. In June, the traditional slack season, downstream producers showed a weak willingness to purchase feedstock, so the social inventory of some resources piled up in early June, which dented the price increases for most varieties, and some resources even saw price decreases. What’s more, some downstream producers stopped production for maintenance or reduced operating rates, chipping away at the consumption of feedstock and resulting in weaker demand. From July to September, the price was on a downward trajectory. Following multiple policy announcements regarding interest rate cuts by the Federal Reserve, China’s reserve requirement and interest rate reductions, and mortgage interest rate decreases in late September and early October. Besides, crude oil prices showed a strong trend during the National Day holiday, which boosted the sentiment in the bulk commodity market. After the holiday, market prices climbed. However, due to the lack of end-user demand improvement, the inventory of finished products piled up in some industries, weighing on buyers’ interest in feedstock procurement and leading to a shift from rising to falling prices in late October.

Into November, some varieties of goods were in tight supply, and the futures market showed an increasing trend driven by the macroeconomic tailwind. Therefore, the spot market price went up. Heading into late November, as macroeconomic policy benefits began to wane and with the commissioning of Sinopec Tianjin Company Phase II Nangang Project and Inner Mongolia Baofeng Coal-Based New Materials Project, prices are expected to see a downturn.

Supply: Output Loss Increasing, Easing Domestic Supply Pressure

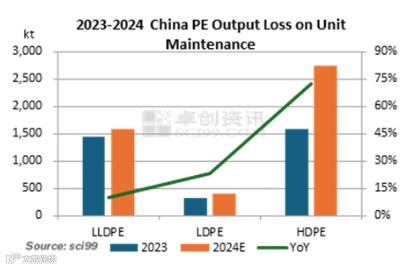

1. The output loss caused by unit maintenance increased.

At the beginning of 2024, some producers continued overhaul, while the overhaul of some units at PetroChina Lanzhou Petrochemical, Sinopec-SK (Wuhan) Petrochemical Company and PetroChina Daqing Petrochemical ended. There were more unexpected maintenance shutdowns, leading to higher output loss. Compared to 2023, the maintenance season began earlier this year, in Q2 and Q3, and the output loss peaked in July.

The output loss due to maintenance in 2024 was higher than that in 2023, especially for HDPE, which increased by 73% YoY. During the slack season from April to July, sales were underwhelming. To reduce costs, most producers opted for shutdowns. After the peak season in October, producers entered another round of maintenance, keeping the output loss at a relatively high level in October and November. SCI estimated that the LDPE output loss may be 396kt in 2024, up 75kt or 23% YoY. The output loss of LLDPE may be 1,595kt, up 146kt or 10% YoY, and that of HDPE may be 2,743kt, up 1,154kt or 73% YoY.

2. The output increased YoY on new capacity commissioning.

As for LDPE, an unplanned outage of Sinopec Qilu Petrochemical’s LDPE unit and frequent maintenance at Sinopec Maoming Petrochemical, Zhejiang Petroleum & Chemical and Shenhua Xinjiang Energy were seen. However, in 2023, crude oil prices were high, so most producers reduced their operating rates due to profit considerations. Although maintenance increased in 2024, the operating rate was higher than that in 2023. Moreover, Ningxia Baofeng Energy changed the production of its newly added unit from EVA to LDPE in November. As a result, the output of Chinese-made LDPE increased by 1.4% YoY.

For LLDPE, the output in Q1 2024 was higher than that in the same period last year with the release of newly added capacity in 2023. However, starting in Q2, several LLDPE units ushered in the heavy maintenance season, increasing the output loss, particularly in May and June when output significantly declined. The output hit the lowest point of H1 at 798.5kt in June. During the peak season in September and October, most producers raised their operating rates, leading to a yearly peak output of 968.6kt in October. In November, the Sinopec Tianjin Company Phase II Nangang Project came online, and operating rates at some producers increased. The overall LLDPE output in 2024 saw a 2.8% increase over 2023.

For HDPE, output in Q1 2024 exceeded that of the previous year. Baofeng Energy’s Phase III Project, adding a 400kt/a HDPE unit in September 2023, meant that despite no new capacity launches and monthly output loss exceeding the previous year, Q1 2024 still saw a YoY output increase. However in Q2, the output loss due to maintenance hit a historical high, so the output was lower than that in the same period last year, but it increased from last quarter with increased operating rates. In Q3 and Q4, HDPE sales met obstacles, with increased social inventory pressure. Meanwhile, the output fell as there were more maintenance shutdowns. The overall HDPE output in 2024 dropped by 2.2% compared to 2023.

Forecast: Prices to Be at A High Level in November

China’s PE market price may remain high, with promising macroeconomic expectations. Despite the increase in the supply of Chinese-made goods, the supply of some grades may be tight with the high output loss stemming from maintenance, indicating a strong likelihood of sustained high prices into November.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.