PP Downstream Demand to Brighten in Small Peak Season

Introduction: During the Spring Festival holiday, operating rates across downstream industries declined. Downstream operating rates rebounded from lows after the holiday. However, downstream purchases of PP were softer than expected. The operations in major PP downstream industries were as follows:

As of the end of February, the monthly average operating rate at plastic woven enterprises climbed by 5.25 percentage points MOM and rose by 11 percentage points YOY to 42% in February because the same period of last year encountered the Spring Festival holiday in the middle of February. After the holiday, PP prices changed marginally, and some downstream enterprises still had certain feedstock inventory, so their enthusiasm for stockpiling was low. At the end of February, the PP futures and spot prices both fell, so some downstream enterprises purchased cheap PP resources somewhat, reflecting improving consumption of PP.

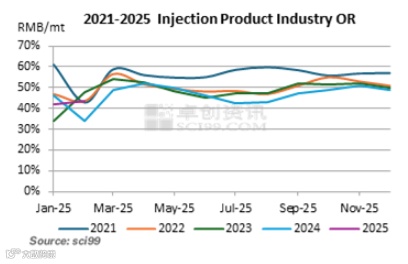

The monthly average operating rate at injection product enterprises stood at a historical normal level in February 2025, which climbed by 0.25 percentage points MOM and 5.75 percentage points YOY to 42%. It rebounded slowly because orders from end users improved narrowly. Operating rates at the plastic tray and modified product plants were lower than those in the period before the holiday.

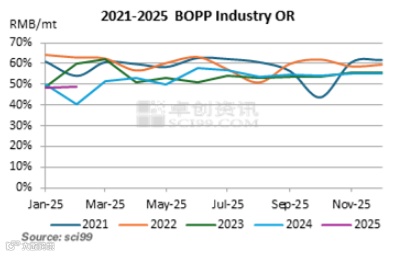

The monthly average operating rate at BOPP enterprises rose by 0.6 percentage points MOM but grew by 8 percentage points YOY to 48.88%. Most of the BOPP enterprises shut units down during the Spring Festival holiday, but they almost restarted business around the Lantern Festival. The industry operating rate rebounded to the pre-holiday level, reflecting stable purchases of PP.

After the Spring Festival holiday, downstream enterprises uplifted operating rates gradually, but they stayed cautious about stockpiling given inadequate orders and high inventory pressure. Later, their inventory may be consumed step by step. The PP industry will usher in the traditional small demand peak season in March when plastic woven and film plants may witness bettered orders. Downstream operating rates may trend flat-to-up. Thus, the downstream demand for PP is supposed to warm up in mid-to-late March. However, the procurement for PP may be constrained somewhat in March because of low-priced stockpiles at the end of February.

For PP supply, it was not ample in February with newly added capacity and unit maintenance mixed. In March, the overall maintenance intensity may soften slightly as closed units may resume production gradually, even if there will be newly added arrangements for maintenance. However, the maintenance may lead to a supply crunch of some grades, which may underpin the PP market price.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.