Q4 NBR Prices to Fluctuate Downward After Moving Sideways in Q3

Introduction: In Q3, China’s NBR market prices moved sideways for a long period. In Q4, domestic supply is expected to remain stable, while demand growth may not keep pace with supply. Consequently, the NBR market price is projected to fluctuate downward in Q4.

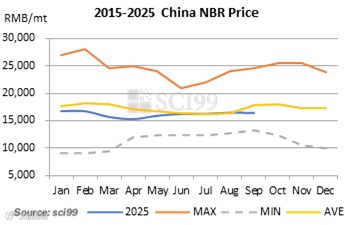

In Q3, China’s NBR market price entered a sideways trend. The market showed clear characteristics of competition between negative and positive factors. Taking 3305E produced by PetroChina Lanzhou Petrochemical as an example, the fluctuation range of prices within the third quarter was only around RMB 300/mt. By September 30, the closing price was RMB 16,100-16,400/mt, flat from the beginning of the quarter. The average price in Q3 was RMB 16,319/mt, up 3.67% QoQ and up 5.72% YoY.

During the third quarter, price support mainly came from the supply side, as unit maintenance reduced supply and bolstered the bottom of NBR prices. Factors that prevented prices from rising were on the demand side and the cost side. The demand side experienced a seasonal off-season in July and August, and the recovery in September was lower than expected. Meanwhile, feedstock prices remained at a low level. Both of these factors dragged down the NBR market.

(1) Supply: Concentrated unit maintenance reduced supply and supported NBR prices. In Q3, the production line at PetroChina Lanzhou Petrochemical underwent maintenance in July and August, and that at Ningbo Shunze Rubber took turnarounds from mid-July to mid-September. SCI estimates China’s NBR output in Q3 decreased by 17.7% compared to Q2. This supply reduction supported NBR market prices.

(2) Demand: Mediocre downstream demand pressured the NBR price increase. The market first experienced a seasonal demand slack period in July-August. High temperatures, production and sales pressure, as well as inventory pressure of finished products, all constrained operating rates in downstream industries. SCI monitored that operating rates of the downstream hose and sealing industries fluctuated around 50-60% in July-August. Entering September, the market demand recovery fell short of expectations, leading to poor downstream demand for NBR and capping price gains.

(3) Cost: Low feedstock prices failed to provide cost support. Butadiene, a key feedstock for NBR, directly determines its production cost. In Q3, butadiene prices fluctuated within a noticeably narrower range compared to the past, with a high-low spread of only RMB 1,050/mt for the quarter, and prices persistently hovered below RMB 10,000/mt. Low feedstock prices meant the cost side lacked support for NBR.

In Q4, the growth rate of supply may be higher than that of demand, so NBR prices will likely fluctuate downward.

The NBR market price will likely fluctuate downward in Q4. Fundamentally, China’s supply is predicted to be generally stable in Q4. Only Zhenjiang Nantex Chemical’s production line is scheduled to experience maintenance from late October to early November. Domestic NBR output in Q4 is projected to increase by about 20% compared to Q3. Regarding demand, although some downstream operating rates are estimated to gradually increase in October, overall performance may remain divergent, with small and medium-sized enterprises underperforming. Furthermore, downstream demand is forecasted to see a seasonal decline in November-December. China’s NBR consumption in Q4 is anticipated to grow by 7% compared to Q3. This fundamental pattern of supply growth outpacing demand will probably pressure the NBR market. Additionally, butadiene prices may decrease notably amid expected supply growth, so the cost side will possibly be bearish for NBR prices. Therefore, the NBR market price will likely fluctuate downward in Q4.

Risk warning: Trade frictions may exceed expectations.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.