The Propylene Supply will continue to Increase in 2019

Highlights

The continuous increase in propylene supply was still the general trend. In recent years, one new increase feature was that the traditional production technologies and emerging production technologies developed synchronously, which jointly promoted the output and capacity of propylene to grow rapidly in China. The imported propylene was impacted by the increase in China’s domestic propylene volume to some extent, but the propylene supply was relatively stable due to the constant rigid demand. Looking forward to 2019, China's propylene supply will once again enter into the expansion period, and will also show new features.

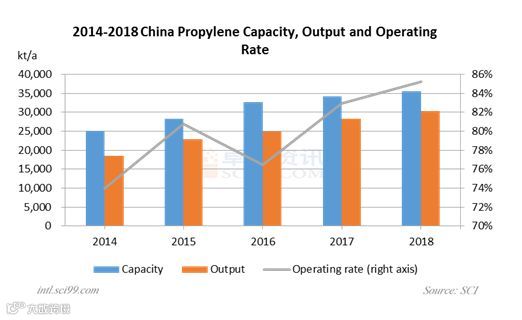

In recent years, the propylene supply continuously increased, especially the output and capacity of China’s propylene. In 2018, the propylene capacity rose to 35,600kt/a in China, up 42.34% from 2014, and the propylene output rose to 30,350kt in China, up 64.05% from 2014.

One important reason why China’s propylene supply increased was that new production technologies developed rapidly. In terms of coal to olefin (CTO), in 2013, the units at Datang Duolun Coal Chemical, Wison (Nanjing) Clean Energy and Ningbo Fund Energy etc. were put into operation. In 2014, the units at Shenhua Ningxia Coal Industry, China National Coal Group Yulin Energy, Ningxia Baofeng Energy Group and Pucheng Clean Energy Chemical etc. were put into operation. In 2015, the units at Zhejiang Xingxing New Energy Chemical, Shandong Yangmei Hengtong Chemical, Shenhua Yulin Energy and lots of MTP producers were put into operation. In 2016, the units at Inner Mongolia China Coal Mengda New Energy and Chemical, Shenhua (Xinjiang) Group, Zhongtian Hechuang Energy, Jiangsu Sailboat Petrochemical and Full-Tech (Changzhou) Energy & Chemistry Development were put into operation. In 2017, the CTO unit (phase II) at Zhongtian Hechuang Energy and the coal conversion to oil project at Shenhua Ningxia Coal Industry were put into operation. In 2018, the DMTO unit at Shaanxi Yanchang Petroleum Group Yan'an Energy and Chemical was put into operation. In general, the propylene capacity from CTO technology was continuously improving.

In terms of PDH, in October, 2013, the first unit at Tianjin Bohai Chemical Group was put into operation. In 2014, the units at Zhejiang Satellite Petrochemical, Ningbo Haiyue New Material and Shaoxing Sanyuan Petrochemical were successively put into operation. In 2015, the units at Zhangjiagang Yangzi River Petrochemical and Wanhua Chemical Group were put into operation. In 2016, the units at Haiwei Group and Oriental Energy New Material (Ningbo) were put into operation. However, in 2017, there was no PDH unit being in commissioning, and just one set of ADH unit at Shandong Dongming Petrochemical Group was put into operation. In 2018, there was still no PDH and ADH units being in commissioning. Thus, the increase in propylene capacity from PDH technology slowed down.

In addition, another new feature for the increase in China’s propylene supply was that the capacity from traditional production technologies restarted to expand. In 2016, the catalytic cracking unit at CNOOC Ningbo Daxie Petrochemical was put into operation. In 2017, PetroChina Yunnan Petrochemical and the refining project (phase II) in Huizhou Refining & Petrochemicals planned to build catalytic cracking units. In 2018, the cracker (phase II) at CNOOC and Shell Petrochemicals Company Limited (CSPC) and the third set of gas separation unit at Shandong Chambroad Petrochemicals were put into operation. In a word, the propylene capacity from traditional production technologies restarted to expand, accelerating the growth pace of propylene supply.

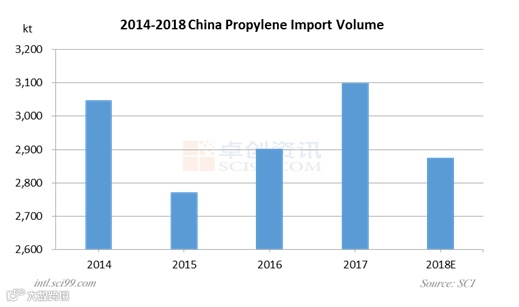

The imported propylene has always been an important supplement to China’s propylene market. In recent years, the annual import volume of propylene was relatively stable. In 2014, China's propylene import volume reached a new high of 3047.8kt. In 2017, China's propylene import volume was 3098.3kt, which hit a new high. From January to November 2018, China's propylene import volume was 2581.2kt, downs 6.85% from 2017. SCI predicts that China's propylene import volume for the whole year of 2018 will be about 2875kt.

The annual propylene import volume was stable because of the supply gap in China, especially in East China. However, as China’s domestic propylene supply increased in succession, the imported propylene may gradually decrease. Of course, this was only a hypothesis, and even if the amount of imported propylene fell, the decrease will be relatively limited. East China will still need a large number of imported propylene sources, this situation will not be able to change substantially in the short term.

Forecast

……

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499