H1, 2019 China MTBE Market Review

MTBE Price Review

In H1, 2019, China’s overall MTBE prices fluctuated downward, and the profits of iso-butane dehydrogenation units greatly declined. Accordingly, the operating rates of iso-butane dehydrogenation units further dropped, and the MTBE producers suffered heavier pressure.

China’s overall MTBE prices fluctuated downward in H1, 2019 but rebounded from H2 June 2019. In H1, 2019, China’s MTBE prices averaged RMB 5,360/mt, down RMB 651/mt or 10.83% Y-O-Y. In early January, most downstream users replenished stocks after the New Year’s Day holiday, and the sales at MTBE producers performed well. Accordingly, the MTBE market supply became tight. Meanwhile, the international crude oil prices went up, giving support to the market sentiment. Therefore, the MTBE producers raised the market prices. With the downstream replenishment coming to an end, the downstream demand for MTBE weakened. At the same time, the decline in the international crude oil prices weighed on the market sentiment. Therefore, China’s MTBE prices crashed and then fluctuated downward. In mid-February, the international crude oil prices kept rising, so most MTBE producers raised the MTBE prices. Entering March, the demand for MTBE from the gasoline market remained tepid, and refineries showed resistance to the high-priced feedstock due to the profit losses. Accordingly, the demand for MTBE further weakened, and the MTBE prices kept dipping. In H2 May, the demand for MTBE from independent refineries became tepid, and the decline in the gasoline purchasing prices at Sinopec weighed on the market sentiment. Moreover, some MTBE units were restarted, and the MTBE unit at Dalian Hengli Petrochemical was put into operation. Therefore, the increment in the MTBE supply aggravated the bearish sentiment. The MTBE prices further dropped, and the MTBE producers suffered severer profit losses. Meanwhile, more and more MTBE producers chose to shut down the unit or cut the unit operating rate. With the approach of end-May, there were export cargos at Dalian Hengli Petrochemical, Wanhua Chemical Group, Huizhou Yussen Chemical, etc., so the MTBE market supply declined to some extent. Meanwhile, the international crude oil prices went up due to the tension in Iran, and the downstream demand for MTBE performed well. Thus, China’s MTBE prices rose.

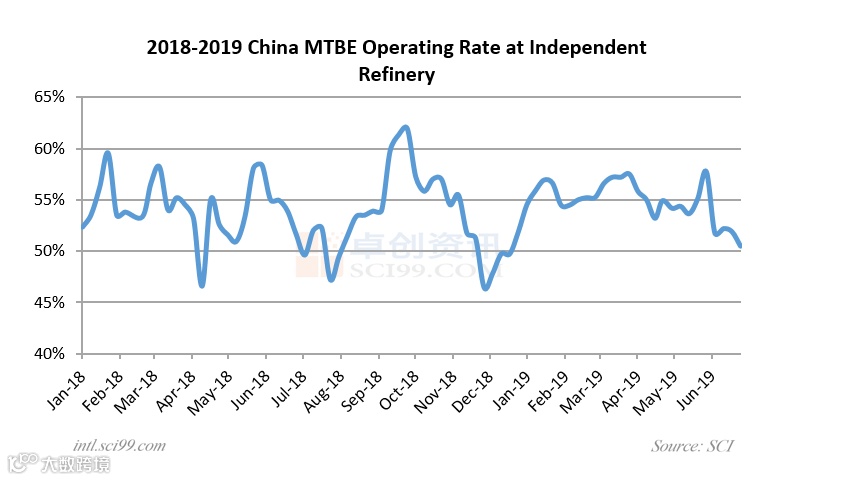

According to SCI’s statistics, the operating rates at independent refineries averaged 54.89% in H1, 2019, up 0.53% Y-O-Y. As seen from the chart, the overall MTBE units at independent refineries ran steadily but kept dipping from March. In H2 May, the operating rates further dropped. With the unit profit losses become severer, more and more MTBE producers shut down the units or cut the unit operating rate. Therefore, at the end of May, the overall operating rate of MTBE units at independent refineries greatly decreased.

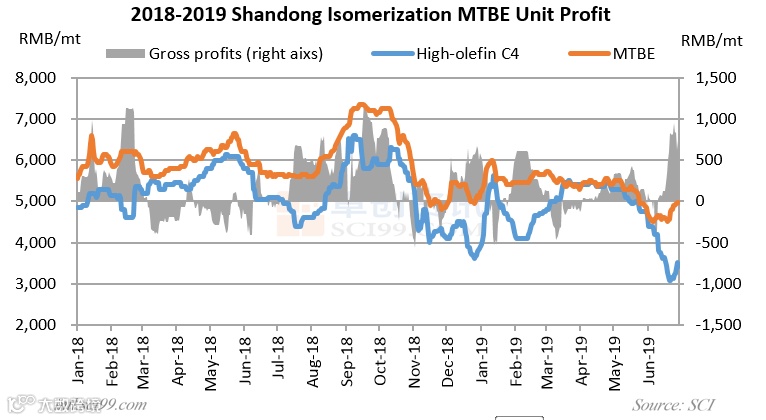

In H1, 2019, the average profit of isomerization MTBE units in Shandong was RMB 148/mt, up RMB 58/mt or 64% Y-O-Y. On the whole, the profits of the isomerization MTBE units in Shandong were fairish. In H2 May, the isomerization MTBE units suffered heavy profit losses in response to the great decline in the MTBE prices. However, many isomerization MTBE units were shut down, and the high-olefin C4 prices in Northwest China quickly declined due to the lukewarm demand. With the cost decline, the profits of isomerization MTBE units greatly improved.

In H1, 2019, the profits of iso-butane dehydrogenation MTBE units averaged RMB 3/mt, down RMB 191/mt or 98% Y-O-Y. On the one hand, China’s MTBE prices went down. On the other hand, the prices of China-origin iso-butane remained firm due to the tight supply. Therefore, the profits of iso-butane dehydrogenation MTBE units were negative from March.

MTBE Supply & Demand Review

In H1, 2019, there were new MTBE units put into operation in China, so China’s MTBE capacity kept rising. In terms of the demand for MTBE, although the promotion of ethanol gasoline continued, the demand for MTBE remained in an uptrend due to the gasoline quality upgrade.

In H1, 2019, China’s MTBE supply and demand went up, so the industry competition became severer. Therefore, it was tougher for MTBE producers to survive.

According to SCI’s statistics, up to the end of June 2019, China’s MTBE capacity totaled 22,340kt/a, up 7.3% Y-O-Y. Therein, the capacity of MTBE units with no operation was 1,585kt/a, and the total MTBE capacity at PetroChina, Sinopec and CNOOC was 5,100kt/a. Furthermore, the MTBE capacity at independent refineries and deep-processing enterprises totaled 17,240kt/a. In H1, 2019, the major newly added MTBE unit was the mixed alkane dehydrogenation one at Dalian Hengli Petrochemical with the total capacity of 820kt/a.

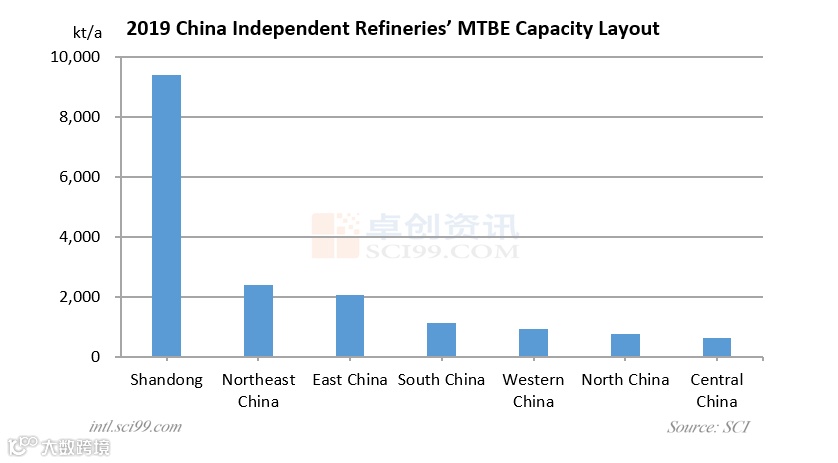

As for the layout of MTBE capacity at independent refineries, most MTBE units were concentrated in Shandong with the total capacity of 9,390kt/a, taking up about 54% of the total. The MTBE capacity in Northeast China and East China took the second and the third places, with the proportion of 14% and 11% respectively.

According to SCI’s statistics, China’s total MTBE output in H1, 2019 reached 6,346.6kt, up 8.29% Y-O-Y, as the MTBE capacity went up.

According to China Customs, China imported 126.1kt of MTBE from January to May, at the same time, China’s MTBE export volume was 38kt. Accordingly, China’s MTBE apparent consumption volume was about 5,376.5kt, up 10.08% Y-O-Y. According to the NBS, China’s gasoline output was 59,187kt from January to May 2019, up 4.0% Y-O-Y. Meanwhile, the average adding proportion of MTBE was about 9%. In June, China’s MTBE output was about 1,058.2kt. Therefore, SCI estimates that China’s MTBE apparent consumption volume in H1, 2019 will reach 6,400kt, up 8.79% Y-O-Y.

On the whole, China’s MTBE capacity expanded in H1, 2019, and the newly added unit became the downstream-matched one, lengthening the industrial chain. Moreover, influenced by the severer market competition, more and more MTBE units were shut down. In order to alleviate the domestic competition pressure, China’s MTBE producers raised the MTBE export volume. However, the export market was tough due to the relatively low export arbitrage.

MTBE Market Forecast

In H2, 2019, SCI estimates that China’s MTBE prices will rise at first and then go down. On the one hand, China’s MTBE capacity will further expand. On the other hand, the promotion of ethanol gasoline will accelerate. Therefore, it will remain tough for MTBE producers to survive.

In terms of the international crude oil market, most market participants adopt wait-and-see attitudes to it. In Q3, 2019, the international crude oil prices may fluctuate upward, as the crude oil stocks in the U.S. will decline and most market participants hold bullish sentiment toward the Sino-U.S. trade negotiation. In Q4, 2019, the crude oil output in the U.S. will greatly rise, offsetting the bullish impacts of crude oil output reduction. Moreover, the demand will gradually weaken. Therefore, it is predicted that the international crude oil prices will keep dipping from the high level.

In H2, 2019, China’s MTBE capacity will continue to rise, including the 190kt/a one at Zhejiang Petrochemical and the 250kt/a one at Shaanxi Yanchang Petroleum (Group). On the one hand, China’s MTBE capacity has become surplus, and the unit profits underperform. On the other hand, with the promotion of ethanol gasoline, the growth of MTBE capacity expansion greatly slows down. More and more MTBE units are the downstream-matched ones.

From August to September, the demand for gasoline will become strong. Moreover, with the approach of the National Day holiday, the downstream consumption of gasoline will greatly rise. Thus, SCI reckons that China’s MTBE prices in H2, 2019 will be higher than those of H1, 2019. After October, the gasoline consumption volume will go down, weighing down the MTBE prices. Furthermore, China plans to promote ethanol gasoline nationwide by 2020. At this point, ethanol gasoline has run under mandate all-roundly in Henan, Heilongjiang, Jilin, Liaoning, Anhui, Guangxi and Tianjin. In Shandong, Hebei, Hubei, Jiangsu, Inner Mongolia, Shanxi and Guangdong, these areas also have started to promote ethanol gasoline. Given the promotion deadline, SCI estimates that the ethanol gasoline promotion may accelerate in H2, 2019, hitting the MTBE market.

......

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6090596