Will Duplex Board Market Trend Reverse in H2, 2022?

Introduction

In H1, 2022, the market price of duplex board decreased After trending sideways at low, and the downstream demand continued to be tepid. The bullish factors may constantly increase in H2, 2022, so it is predicted that the transaction price of duplex board may fluctuate upwards by RMB 200-300/mt in H2.

In H1, 2022, the market price of duplex board decreased after temporary stabilization.

In H1, 2022, the market price of duplex board dropped after stabilization. The market price of duplex board was stable in Q1, while it showed downward trend in Q2. According to SCI, in H1, the average price of A-grade 250g duplex board was RMB 4,716.75/mt, down 8.21% M-O-M and 14.92% Y-O-Y. The highest price of H1, 2022 was RMB 4,931.25/mt in late March, while the lowest one was RMB 4,312.50/mt in late June.

Specifically, the activity of market transaction was tepid in January and February due to the Spring Festival holiday. At the beginning of March, large-sized paper mills players increased the market price of duplex board and then announced maintenance scheduled in April. However, some players shutdown due to logistics issue, resulting in low market transactions. In Q2, the price of duplex board dropped. The inventory in large-sized paper mills was at a high level due to the traditional off-season and slow logistics recovery, thus, players constantly offer discounts to stimulate purchases, and the paper prices continued to decline. However, the downstream end-demand was constantly tepid, and distributors were cautious to restock. Therefore, the contradiction between market supply and demand was obvious in H1, 2022.

The contradiction between supply and demand was obvious.

Remarks: In order to better reflect the import & export data of duplex board and ivory board paper, and make it easier for market participants to reference, SCI has adjusted the tariff codes of import & export data. Also, import & export data of duplex board and ivory board paper are merged. Sorry for the inconvenience.

In H1, 2022, the output of duplex board declined by 8.01% Y-O-Y, and the operating rate dropped by 12.74% Y-O-Y. However, the enterprises’ inventory increased 39.28% Y-O-Y. The market transactions atmosphere was tepid in H1 due to the demand off-season and the limited logistics transport, and the operating rate in some regions obviously decreased. Besides, the inventory pressure on large-sized paper mills constantly increased, resulting in maintenance in some mils. In terms of gross profit, paper mills’ profit constantly decreased due to the selling of low-end products. The gross profit of duplex board dropped by 11.01% Y-O-Y. In regards to export volume, the export volume of duplex board and ivory board paper rose by 105.98% Y-O-Y, mainly relying on the ivory board paper export volume. From the perspective of consumption, the consumption of duplex board decreased by 5.86% Y-O-Y. On the one hand, sales at paper mills was limited due to the slow logistics recovery in some regions, and the enthusiasm of market transaction was low. On the other hand, distributors were cautious about restocking, and the market transaction was on a need-to basis due to the effects of clients’ attitudes and traditional off-season.

Both cost and demand are bullish, and transactions in H2 may fluctuate upwards.

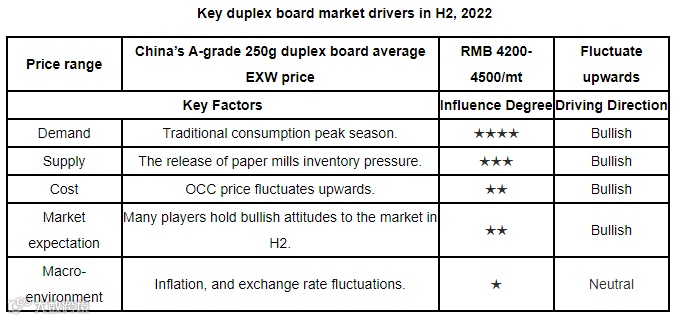

In H2, 2022, it is predicted that the market transaction of duplex board will slightly increase, and the main influencing factors are as follows.

First of all, from the perspective of fundamentals, the contradiction between market supply and demand is still obvious. In terms of supply, paper mills’ inventory is still at a high level, and many paper mills have the pressure on destocking. There is no scheduled turnaround in H2, 2022, but the release of newly added capacity may be delayed. In regards to demand, H2 was the industry traditional peak season, distributors may start to restock one month before the Mid-Autumn Festival to prepare for the upcoming Mid-Autumn Festival, National Day and Spring Festival holidays.

Secondly, in terms of cost, the OCC price may fluctuate upwards, which means the cost support can increase. The demand for paper products is usually concentrated in H2 of the year, the OCC supply tightness is more likely to lead paper price hikes.

Finally, in regards to attitudes, July is still the traditional off-season, and the enthusiasm for distributors to restock was low, so paper prices are still at risk of falling. From August, the downstream buying interests may gradually increase, and paper prices start to obviously rise. In December, paper prices may fluctuate within a narrow range due to the finish of demand peak season.

Overall, according to SCI, it is predicted that the market price of duplex board will fluctuate upwards in H2, 2022, and the ex-works price of A-grade 250g duplex board may fluctuate within the range of RMB 4,200-4,500/mt. Also, the average price of duplex board is expected at RMB 4,325/mt, down 8.31% M-O-M or 15.84% Y-O-Y in H2.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.