HWP Price Continued to Trend Down Due to Insufficient Demand Drive

Intro: In March, the downtrend in the imported HWP spot market continued due to insufficient market confidence, falling paper prices, stable market supply and price drops at domestic pulp mills as well as the futures market. The HWP spot market still deviated from the traditional seasonality. In April, as the industry enters a traditional slack season, market demand will become the key driver of the pulp market, and the HWP price may continue to trend down.

HWP Prices Maintained a Clear Downtrend

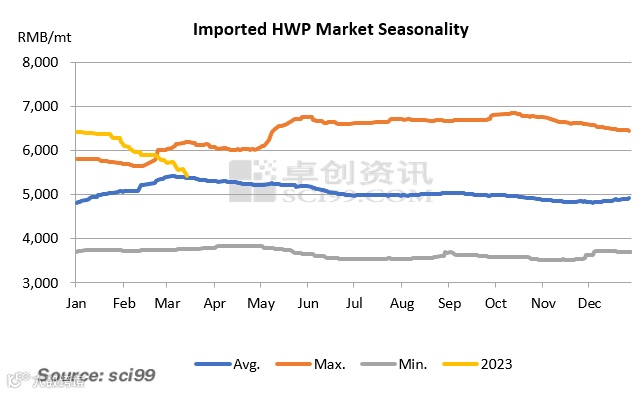

In the past five years, the HWP price trend showed clear and constant seasonal patterns. However, the market trend in 2023 deviated from the traditional seasonality and fell constantly.

Major drivers behind the HWP spot market downtrend include the following:

First, the HWP supply prospect is stable, and constant price drops have affected market sentiment. According to Brazilian customs, the HWP export volume from Brazil to China reached 686kt, up 13.76% M-O-M and 62.56% Y-O-Y. Also, the inventory accumulation in Europe and China also testified that the supply did not turn tight. As for domestic production, although the February HWP output dropped by 7.54% M-O-M due to fewer calendar days, the operating rate remained high at 88%, and the output was also 1.02% higher Y-O-Y. Thus, the supply of both imported and Chinese-made HWP is expected to remain stable.

Besides, local HWP producers in China have constantly lowered prices since February, and spot sellers of imported HWP also sold based on their own situations. The falling prices had a major impact on the market sentiment and the price stability of HWP.

Second, paper prices started to soften, affecting pulp purchases. According to SCI, as of March 15, average market prices of downstream tissue and ivory board dropped by RMB 133/mt and RMB 200/mt, and the falling paper prices had a negative influence on the pulp market trend.

Third, the dominant SP contract price at SHFE saw major declines, weighing on the HWP market price. As of March 15, the SP 2305 contract closed at RMB 6,126/mt, but the lowest price was recorded at RMB 6,028/mt.

Market Trend May Hardly Pick Up During the Upcoming Traditional Low Season

On the demand side, the market demand is expected to turn down, and the recovery in end demand is slow. But as paper mills are holding relatively high operating rates, the supply pressure may continue to mount. In addition to the bearish expectations brought by falling pulp prices, the paper industry is facing pressure from two sides. But the demand for textbook printing is relatively inelastic, so the market performance of P & W paper is better than the others, which may somewhat cushion the pulp decline.

As for market sentiment, most players held bearish expectations as reflected by the BSK futures trend, and the HWP price is also under pressure.

On the supply side, as additional volumes arrive at ports from the newly added capacity, the imported HWP is expected to grow. Also, domestic production may remain solid, so the supply factor may continue to pressure the HWP price.

In terms of cost, considering the two-month shipping time, the cost of spot resources in April is determined by the import offer for February volumes. Taking Arauco BHK as an example, the import cost dropped narrowly by 1.65% M-O-M, but was still 22.06% higher Y-O-Y. The high import cost may somewhat buffer the price drops in the spot market.

In conclusion, the HWP market will enter a traditional slack season in April, and the market demand is expected to cool down. But as supply remains firm, SCI reckons that the HWP price may continue to trend under pressure.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.