PP Price Changes amid Global Capacity Expansion

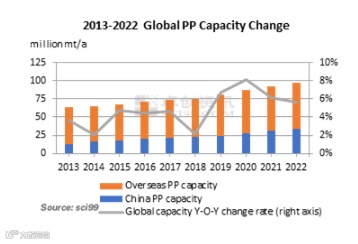

Preface: Global PP capacity changed remarkably over the past few years. Therein, capacity expansion was notable in Asia. The spread between China-origin PP prices and overseas PP prices undulated with changes in supply-demand fundamentals.

Global PP capacity is expanding and the Asian PP capacity ranks first.

Global PP capacity kept expanding over the past few years. In terms of capacity distribution, the capacity expansion was intensive in Northeast Asia and Southeast Asia, while it was sporadic in the Middle East, North America and other locations. In 2022, global PP capacity increased by 5,160kt/a to 97,396kt/a. Therein, China’s PP newly added capacity was 2,630kt/a, and global newly added capacity (except for China) was 2,530kt/a. PP capacity was concentrated in Northeast Asia, Western Europe, the Middle East and North America, where the capacity took up nearly 80% of the global PP capacity. In terms of global trade, there was a close trading relationship among Northeast Asia, Southeast Asia and the Middle East. The North and South American regions were relatively independent in their trade, mainly exporting goods to each other, while Europe mainly received goods from North America and the Middle East. China is a leading PP supplier and consumer in the world, with the largest share of capacity and a large number of consumers. PP goods produced in China mainly meet domestic demand.

Northeast Asia, represented by China and South Korea, is subject to huge demand and strong energy support, where PP capacity release will continue to maintain a leading position in the world. Northeast Asia increasingly becomes an important PP market to be reckoned with, and the price of PP in the Northeast Asian market will be more representative of the world. At the same time, under the background of continued global capacity expansion, product upgrades and price competition will lead the future PP trade trend.

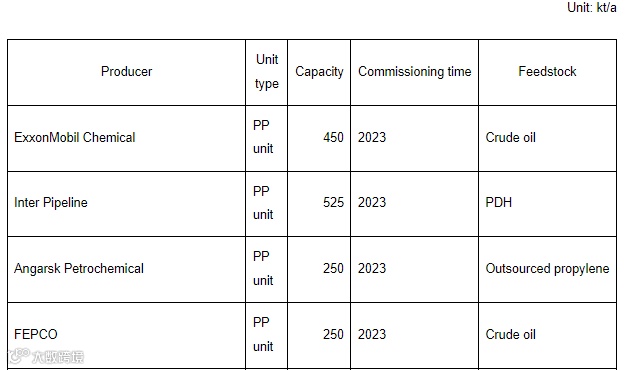

2023-2027 Global PP Capacity Expansion Plans

Changes in supply-demand fundamentals arouse fluctuations in China’s domestic PP and imported PP prices.

China’s domestic PP prices and imported PP prices shared a similar trend from 2018 to 2022, but the changes in imported PP prices somewhat lagged behind those in China’s domestic PP prices. The spread between China’s domestic PP prices and imported PP prices was still mainly influenced by the changes in the supply-demand fundamentals in China and the overseas market. For instance, global PP capacity expanded continuously in recent years, but the market demand became stagnated because of external factors. The correlation between the futures market and spot market strengthened with the financial feature of PP rising constantly.

In 2022, influenced by international situations, crude oil prices kept rising from the beginning of the year. Imported PP prices went up amid strong cost support and intensive maintenance of overseas units, and the spread between China’s domestic PP prices and imported PP prices was enlarged in Q1. With the export arbitrage window open, Chinese-made PP resources flowed into the overseas market, also pushing up China’s domestic PP prices. However, with the influence of cost becoming normal and the overseas market demand keeping weak, overseas PP suppliers cut offers sharply to ease inventory pressure in end-Q2, and China’s PP market gradually returned to the dominance of supply-demand fundamentals. In Q3, PP USD prices were lower than China’s domestic prices, closing the export arbitrage window gradually. The total export volume of PP exerted a substantial impact on China’s PP supply-demand fundamentals. The export arbitrage window hardly improved in Q4 because the overseas demand remained insipid. In 2022, against the background of complex international situations and China’s domestic capacity expansion, PP market prices lacked enough upward momentum, but the soft demand in the overseas market also curbed the imported PP prices. Thus, the overall price spread fluctuations were large in 2022.

In December 2022, China mainly exported PP to Southeast Asia and South America, while the top ten destinations of China’s PP cargoes varied a lot. China’s PP export volume to Vietnam was 8.1kt, ranking first and taking up 18% of the total exports. That to Malaysia and Russia was 3kt and 2.7kt each, raking second and third respectively. In Southeast Asia, China’s PP exports were concentrated in Vietnam, the Philippines and Indonesia. In South America, Brazil was the major importer of China’s PP goods. China’s PP exports have improved slightly compared with November 2022. From the flow point of view, PP exports mainly flowed to Southeast Asia and South America.

At the beginning of 2023, PP supply in Northeast Asia and the Middle East tightened because of more unit turnarounds. Meanwhile, overseas demand for PP warmed up, which propelled the growth in Southeast Asian and South Asian PP prices. Thus, overseas PP prices were higher than China’s domestic PP prices, and their price spread widened gradually. At the end of February, the 500kt/a phase II units at Sinopec Hainan Refining & Chemical and 500kt/a unit at PetroChina Guangdong Petrochemical came on stream officially, which contributed to PP supply, especially homo PP supply. China’s domestic PP prices stood at a global low, so overseas suppliers showed weakened enthusiasm for providing quotations to China’s buyers. Therefore, China’s PP import volume is likely to dip. Participants are recommended to focus on the overseas market demand and the current economic stagflation, which may influence China’s PP export market.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.