Southeast Asia Methanol Price Rise Accelerates in Sep

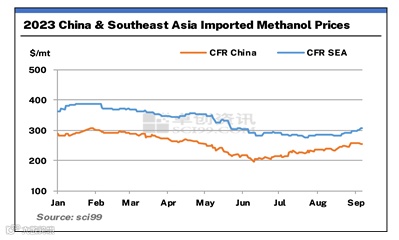

Southeast Asian methanol market was stable-to-rising from August to September. Entering September, the methanol price growth accelerated notably, following the maintenance of local two methanol units. Up to September 12, the methanol price in Southeast China closed at $305-310/mt, up $10/mt or 3.36% from the average price last week.

At the beginning of September, two major methanol units in Brunei and Southeast Asia began maintenance successively. The capacity of these two units takes up about 56% of the total in Southeast Asia, and their products account for 70%-80% of local supply. Thus, the running status of these two units plays an important role in influencing the local methanol market trend. Up to September 7, the overall operating rate of the methanol units in Southeast Asia was 66.43%, down 23.57 percentage points from last week.

Facing more-than-expected supply reduction, downstream users with rigid demand had to purchase at higher prices. Meanwhile, the demand for traditional downstream products such as formaldehyde improved, further supporting the methanol price rise. In India, downstream plants also began to purchase feedstock again with the end of the rainy season when the production of some products like formaldehyde and plywood was heavily affected. Up to September 12, the methanol price in India closed at $280-285/mt, up $15/mt or 5.61% from the average price last week, the largest price rise in Asia.

Methanol producers typically sell methanol via both term contracts and spot goods. Basically, term contracts have fixed premiums and volumes, while spot trading is more flexible. July and August are the traditional demand slack season, so some methanol producers, especially those in the Middle East, sell forward-month shipment cargoes in advance to avoid risks from price declines and inventory buildup. A few producers said they sold out September shipment cargoes in August. As a result, merchantable resources were few when the price rose.

On the whole, supply reduction, short-covering demand and pre-sale together pushed up the methanol prices in Southeast Asia. With the price spread between Southeast Asia and China expanding, China’s methanol export volume may increase somewhat. However, the methanol consumption volume in Southeast Asia is expected to decrease due to the recent intensive maintenance of downstream acetic acid units, and the resources from the Middle East, Europe and the U.S. will also gradually supplement the supply gap in Southeast Asia. Therefore, it is predicted that the methanol prices in Southeast Asia may correct downwards later.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.