Jun China’s PP Imports to Improve on Workable Arbitrage

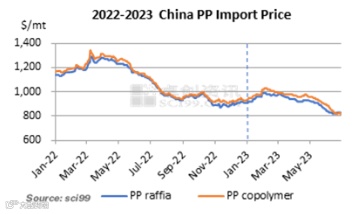

Highlights: China’s PP import prices moved downwards, as overseas PP units resumed production and the downstream demand stayed weak. The import arbitrage window opened gradually. Recently, there were more quotations for low-priced imported goods, and deals perked up.

China’s PP import prices rose at first but then showed a downswing in the first half of 2023, which recorded low in June. Therein, CFR China offers for PP raffia declined from $920-940/mt in early April to $810-830/mt in mid-June, with an average price shedding $110/mt or 11.83%. And CFR China offers for PP copolymer decreased from $960-980/mt in April to $810-850/mt in June, with average price falling by $140/mt or 14.43%. After PP import prices dropped, the import arbitrage economics turned workable, and deals of imported cargoes improved. Low-priced imports impacted the Chinese PP market.

The reason why PP USD prices declined was mainly a supply glut in the overseas market. Overseas PP supply became plentiful after PP units resumed operations in Southeast Asia and the Middle East, so holders whittled down offers amid high inventory pressure to promote deals. Nonetheless, the buyer appetite was encumbered by slack orders and relatively low operating rates, which led to muted deals. That prompted overseas suppliers to sell more goods to China and provide more low-end offers.

PP supply in Southeast Asia was ample with units restarted.

Overseas PP units have begun to resume operations since April, and short-sea shipping cargoes became sufficient gradually. Although some units in the Philippines and Malaysia remained in downtime, PP supply in Southeast Asia mounted up as the 770kt/a units at IRPC Public, 300kt/a at Hyosung Vietnam and 400kt/a units in Nghi Son resumed production in succession between March and April. Furthermore, more goods flowed from the Middle East to Southeast Asia after the former finished maintenance peak.

Foreign PP Unit Maintenance

Remarks: 1. RS = restart, SD = shutdown

2. The output loss above refers to the affected output due to maintenance at producers during the month.

3. In June 2023, a lot of PP units in Europe, the U.S., and Asia began to undergo maintenance, and some of them remain in downtime now. PP supply in Europe, the U.S., and Northeast Asia decreased, while that in Southeast Asia was relatively sufficient. SCI predicts that overseas PP supply will be further ample in July.

Buyer appetite was tepid in Southeast Asia and South Asia, and deals were mainly done to cover rigid demand.

Even if local prices continue to fall in Southeast Asia and South Asia, downstream processors had insufficient orders amid the demand dull season. Downstream users were inclined to maintain basic purchases and kept low feedstock inventories. Additionally, crude oil values depreciated in June, and China faced sluggish demand and more low-priced imported cargoes, so the bearish sentiment of market players became heavier. Buyers were also wary about operating before the end demand revived effectively.

The price spread between China-origin PP and imported PP shrank, while China’s PP imports grew.

In April, overseas PP prices inched lower from highs, mainly due to the concentrated maintenance in Northeast Asia and Southeast Asia and the operating rate reduction of some producers due to cost pressure. The supply has not been restored, so overseas holders of resources provided sporadic quotations to China and kept firm offers. According to the GACC, PP import volume from South Korea and Singapore registered a Y-O-Y decline, while that from Russia, the Americas and India achieved a Y-O-Y surge. In May, PP USD prices kept falling, and China’s buyers received a lot of quotations from overseas suppliers. But the import arbitrage window kept closed, as overseas PP prices were higher than China’s domestic prices. Traders were wary about operating, and deals didn’t improve noticeably.

China’s PP import volume grew by 17.3% M-O-M to 308kt in May, but that from January to May declined by 3% Y-O-Y. In H1 June, overseas market players worried about the economy, dampening the market stance. The downstream demand didn’t change a lot. Overseas suppliers continued to whittle down offers to stimulate the buyer appetite, and the import arbitrage window opened. The price spread between China-origin PP and overseas PP diminished gradually with the exchange rate of RMB against USD continuing to soften, but some arbitrage economics stayed workable. In June, deals of imported cargoes were favorable, and PP import volume is supposed to rise by 8.77% to 335kt in June.

Remarks: The above PP import volume involves PP in primary forms (HS: 39021000), ethylene-propylene copolymer (HS: 39023010) and propylene copolymer in other primary forms (HS: 39023090).

Remarks: The above import data is for PP in primary forms (HS: 39021000), which comes from the General Administration of Customs of the People’s Republic of China (GACC).

The USD’s exchange rate against the RMB may remain at a high level in the short run, which to some extent supports the price of overseas resources. The overall sales pressure is still obvious in the case of limited improvement in downstream and end demand. The stimulation of domestic policy on macro market sentiment and the expected fulfillment remain to be verified. In the short term, China’s PP imports may further increase, while its exports may hardly improve in the short term. PP USD prices will probably fluctuate in a certain corridor, and market players are recommended to operate cautiously.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.