Traditional Refineries Confronting Severe Overcapacity

Large refining and chemical projects to be put into operation

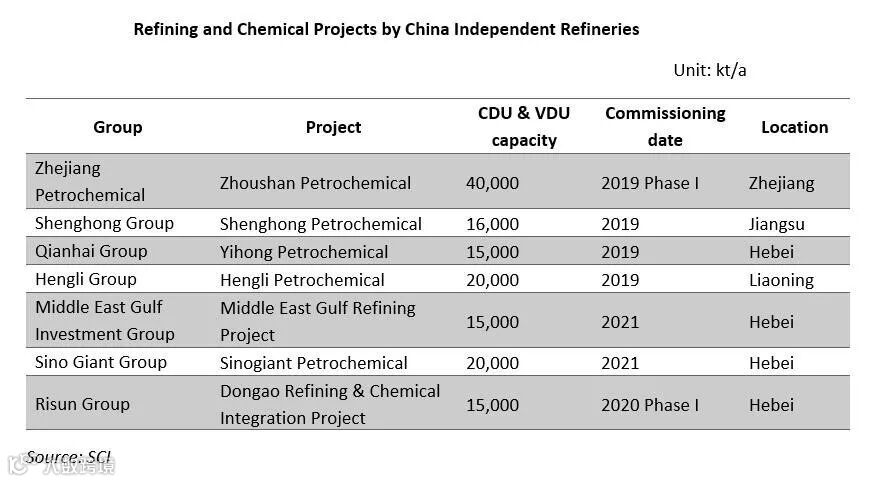

In October 2017, Sinochem Group and Risun Group jointly built a 15,000kt/a refining and chemical integration project in Caofeidian, Hebei Province. As of October 23, over ten refining and chemical projects with capacity of over 10,000kt/a are being built and projected. The growth of China’s oil refining capacity is far beyond expectations.

China’s oil refining capacity reached 780 million mt in 2016. PetroChina Yunnan Petrochemical and the second phase of CNOOC Huizhou Refining and Chemical Project were put into operation in the third quarter of 2017. It is expected that China oil refining capacity will reach 900 million mt in 2020.

China’s refined oil demand growth slowing down

From the above two charts, we can see that China’s gasoline demand growth rate is dropping, and the secondary industry’s proportion in China’s economy is slipping. In the meantime, China is encouraging customers to use non-fossil fuels, such as ethanol gasoline. The demand growth of gasoline and diesel may drop to below zero in the future.

Industry reform coming soon

China’s refined oil demand growth is slowing down, while the supply is increasing. Accordingly, China is building seven petrochemical bases in eastern coastal region, including Dalian (Liaoning Province), Shanghai, Huizhou (Guangdong Province), Gulei (Fujian Province), Caifeidian (Hebei Province), Lianyungang (Jiangsu Province) and Ningbo (Zhejiang Province). Through macro-control and market competition, China’s oil refining industry is reforming towards large-scale, integration and standard.

For more information please contact us at

overseas.sales@sci99.com

+86-533-6296499