Refineries Keep Enthusiastic about Unconventional Gas Production

Intro: The LNG market prices rebounded this year and China’s LNG producers raised their operating rates. Capital focused more on the coke-oven gas-LNG producers. The industrial gas market boomed in 2017, and the demand for LNG based on coke-oven gas increased due to its high gasification rate and low price than piped gas.

Cost:

According to the estimate, the ex-works cost of coke-oven gas-LNG was RMB 2,850/mt or RMB 2.03/cbm, and the coke-oven gas price was RMB 0.5/stere. But in some areas the coke-oven gas is supplied to the market as the urban gas. For example, the coke-oven gas price in Tangshan, Hebei Province is set by the Tangshan Gas REFCO Group at RMB 0.58/stere.

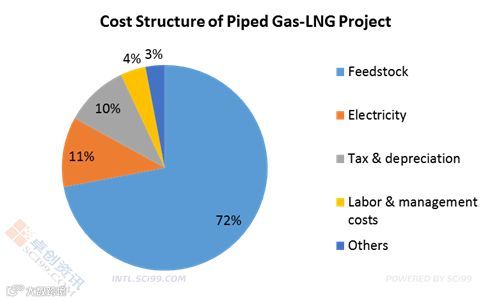

Different from the coke-oven gas-LNG producers, most LNG producers use piped gas as the feedstock, so their cost depends on the price of the feedstock gas. In 2016, the feedstock price of LNG producers in Northwest China was RMB 1.34/stere, and with the production cost of RMB 0.6/stere, the ex-works cost was RMB 2,813/mt. In 2017, the feedstock price of LNG producers in Northwest China was RMB 1.88/stere, and with the production cost of RMB 0.6/stere, the ex-works cost was RMB 3,596/mt. Since 8am, August 10, 2018, for the volume within the plan, CNPC raised the feedstock price of LNG producers in Northwest China by RMB 0.2 to RMB 2.08/stere; and for the volume exceeding the plan, the price was RMB 3/stere. The cost of LNG producers increased by RMB 290/mt. The price of coal-bed gas is usually RMB 1.6/stere, and with the production cost of RMB 0.5/stere, the ex-works cost was RMB 3,120/mt.

Profit:

The feedstock price of piped gas-LNG producers was high so their profits were low. The LNG prices were constantly at historical lows, and several piped gas-LNG producers shut down for long term due to the negative profits. By contrast, the profits at coke-oven gas-LNG producers were favorable.

Operating Rates:

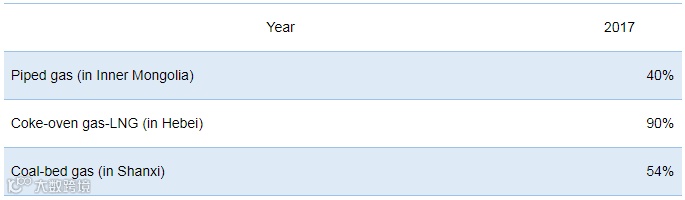

The terminal price of natural gas increased constantly in China, pushing up the feedstock price of piped gas-LNG producers greatly because their feedstock price refers to terminal price. However, the LNG market prices decreased constantly at the same time. So piped gas-LNG producers cut down their operating rates due to the negative profits.

Besides, the industrial LNG market boomed in 2017, and the demand for LNG based on coke-oven gas increased due to its high gasification rate and low price than piped gas. The feedstock supply of coke-oven gas-LNG producers in Hebei was stable, so the output and operating rates of those producers were high.

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499