Increase in Downstream Demand for Propylene Will Speed Up

Highlights

In recent years, the downstream demand for propylene continuously increased, but the growth rate declined, indicating that the downstream demand expansion entered into a gap period. However, the downstream demand remained extensive, and the PP was still the most important downstream product. In 2019, the downstream demand will enter the expansion period again, and the growth rate will also significantly improved. Therefore, players should focus on the commissioning of new capacity in the downstream industries.

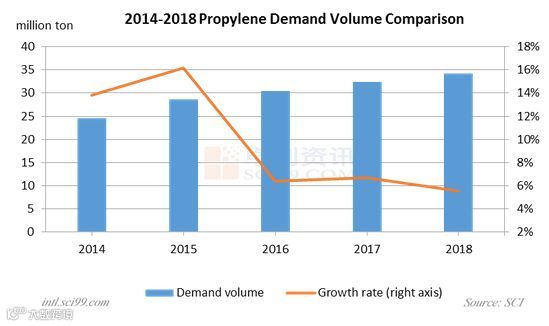

In recent years, the downstream demand for propylene increased in succession. By the end of 2018, the total downstream demand volume in China was 34.22 million tons, up about 5.52% from 2017. In the last five years, the compound annual growth rate of the demand for propylene in China was about 8.61%. However, since 2016, the downstream demand expansion slowed down significantly, and the increase in the demand entered into a gap period.

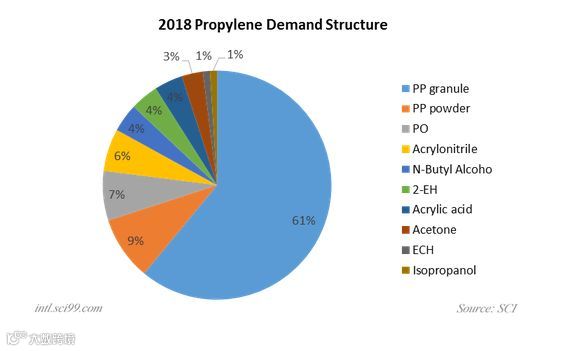

From the perspective of specific downstream products, in 2018, there was no obvious changes in the demand structure of propylene from previous years, and the PP was still the most important downstream product. Hereinto, the PP granules took up 61% of the total demand volume, unchanged from 2017. The PP powder ranked second, taking up 9% of the total demand volume, down 1% from 2017. In addition, the chemical downstream products were in a wide range of varieties, but the proportion of PO, acrylonitrile, NBA, acrylic acid, acetone and other downstream products was limited. As a whole, the demand structure was relatively stable.

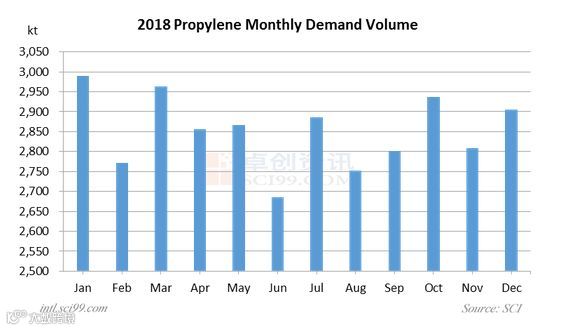

From the perspective of specific month, there was no obvious regularity in the change of propylene downstream monthly demand. In 2018, the demand volume was highest in January and lowest in June. The most important influencing factor for the propylene demand is the operating rate of PP. The propylene demand from PP accounted for a largest proportion of total demand volume, so the change in the operating rate had the most obvious impact on the demand. Although the rest downstream products were in a wide range of varieties, the demand volume was relatively limited. Therefore, changes in the operating rate of one or several products had no obvious impact on the demand.

Forecast

From 2019, the propylene supply will enter a new expansion period. Similarly, the downstream demand will also expand synchronously, so the expansion in the supply and demand shows an integrated trend. Whether the CTO/MTO units or the PDH units or the refining-chemical integration units, there are the matched downstream units for most of them. SCI predicts that the downstream demand for propylene will exceed 37 million tons in 2019, up about 8.12% from 2017. However, there is the stronger uncertainty in the downstream capacity expansion. Players should focus on the commissioning of new capacity in the downstream industries.

.……

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499