2022 China PVC Capacity Expected to Register an Uptick

Preface: In 2021, newly added PVC capacity was released limitedly in China, and operating rates were notably low in second half of the year. That underpinned PVC market prices strongly from the supply side. In 2022, it is expected that there will be more newly added capacity, but operating rates will continue to get restricted.

China’s PVC prices were bolstered by insufficient supply in 2021. Newly added PVC capacity was released limitedly, and operating rates were notably low in second half of the year, leading to lower growth rate of output than expected. Details about PVC supply were shown as follows:

Limited Capacity Increase in 2021

As of the end of 2021, the newly added capacity was 520kt/a in 2021, and 50kt/a capacity was eliminated, so the actual capacity change was only 470kt/a. The commissioning of other units was delayed until 2022. China’s PVC powder capacity reached 26,170kt/a in 2021, up 1.83% Y-O-Y. Therein, calcium carbide-based PVC powder capacity was 20,600kt/a, taking up 78.7% of the total, and the proportion declined. Ethylene-based PVC powder capacity was 5,570kt/a, occupying 21.3% of the total, and the proportion rallied.

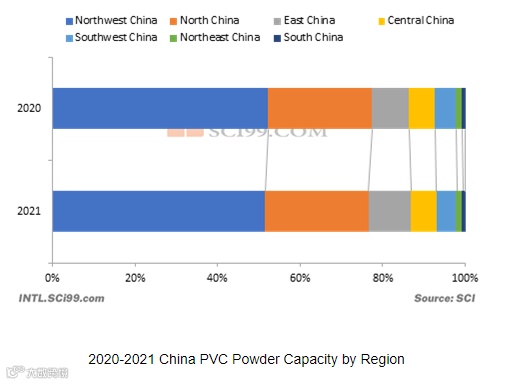

In 2021, the regional concentration and integration of China’s PVC powder industry remained at a high level, and the capacity was still in the three major producing areas of Northwest China, North China and East China. The total capacity of the three producing areas was 22,720kt/a, accounting for 86.82% of China’s total. Among them, the PVC powder producers in Inner Mongolia and Xinjiang still had obvious scale advantages. The total capacity in Inner Mongolia and Xinjiang was 8,930kt/a, accounting for 17.5% and 16.6% respectively of the total, and there were many leading companies. In addition to the advantages of scale, Northwest China was also the main producing area of the feedstock calcium carbide. Most enterprises there have supporting feedstock calcium carbide plants and have obvious advantages in cost and feedstock supply stability.

Shandong was the main producing area in North China, and its capacity took up 13.7% of China’s total. Thus, Shandong was the thirdly largest province in PVC powder capacity. In East China, ethylene-based PVC powder capacity took the majority.

Relatively Low Operating Rates in H2, 2021

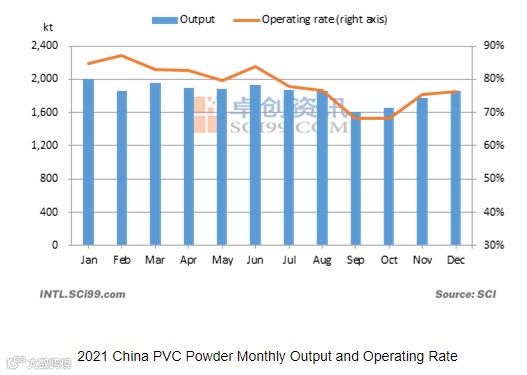

In 2020, the capacity growth rate increased, and some units resumed production, so the output growth rate increased again. In 2021, the growth of PVC powder capacity slowed down, but the operating rate increased from 2020, so the output of PVC powder went up. In addition, there was 1,000kt/a new capacity that should have been added in Q4 of 2020 to be released in 2021, which further pushed PVC powder output up. In January 2021, China’s PVC powder monthly output exceeded 2,000kt/a, climbing by 12.16% Y-O-Y and recording high. However, the monthly output declined later, especially in Q3, affected by feedstock supply, production cost, regulation, etc. The monthly output recorded low in September, which decreased by 6.45% Y-O-Y to 1,608.35kt. That from September to December all suggested a Y-O-Y decrease. China’s PVC powder output in 2021 was 22,166kt, up 6.52% from 2020.

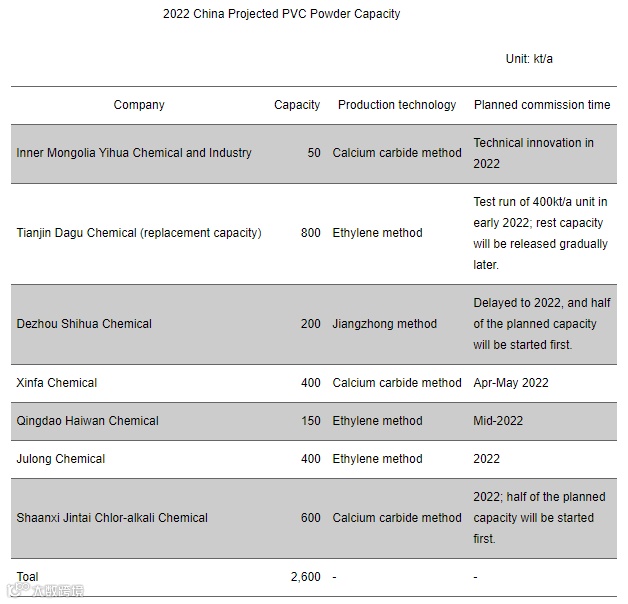

In 2022, a total of 2,600kt/a PVC powder capacity is expected to become operational. Therein, the capacity at Qingdao Haiwan, 100kt/a of the capacity at Dezhou Shihua Chemical, the capacity at Xinfa Chemical and 300kt/a of the capacity at Shaanxi Jintai Chlor-alkali Chemical are likely to be put into production as scheduled. The replacement capacity at Tianjin Dagu Chemical needs to be excluded. The actual newly added capacity is expected to be 1,000kt/a, up 3.8% Y-O-Y. SCI predicts that half of the capacity will be released in H1 of 2022, and the rest will be released in H2 of 2022. PVC powder units’ operating rates are expected to still be impacted by feedstock supply in 2022.

All information provided by SCI is for reference only,which shall not be reproduced without permission.

Please click "Read more" for the full article.