Apr China Butadiene Import & Export Volume Advanced

Snapshot: In April, China’s butadiene import and export volume remained in an upswing. The import volume of butadiene was around 10.2kt, up M-O-M but down Y-O-Y. The export volume of butadiene reached 6kt roughly, up M-O-M and Y-O-Y.

Since 2022, China’s butadiene import volume has been relatively low, due to a lower import dependence degree along with improving the self-sufficiency of domestic supply. As for the export, recently, the price spread between domestic and Asian butadiene prices is relatively notable. Asian butadiene market price is high, so the export volume of Chinese-made butadiene heads up.

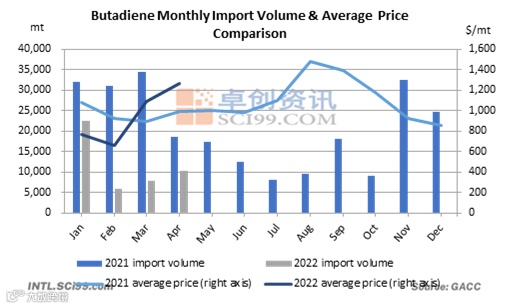

In April, the import volume of butadiene in China ramped up M-O-M.

In April 2022, the import volume of butadiene was around 10.2kt, up 28.8% M-O-M but down 44.8% Y-O-Y. From January to April, the total import volume of butadiene reached 46.5kt, down 59.95% Y-O-Y. In April, China mainly imported butadiene from the Middle East, South Korea and the Philippines. As seen from the receipt and delivery places, imported butadiene resources mainly flowed to Zhejiang and Jiangsu. Other regions mainly consumed Chinese-made butadiene, and the demand for imported butadiene was not high.

In April, China’s and Asian butadiene prices both trended down, but the latter was still higher than the former. Affected by that, China’s players showed thin purchasing appetites for Asian butadiene resources. Besides, as the crude oil price was high, the operating rate of crackers in Japan and South Korea was low and there was a certain demand gap in the two countries. Thus, no ample butadiene resources were exported to China in foreign countries. In April, the import volume of butadiene in China inched up, but it was still at a low level.

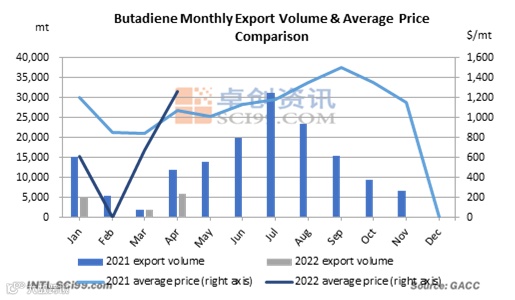

In April, the export volume of butadiene in China leveled up M-O-M.

In April 2022, the export volume of butadiene in China was around 6kt, up 203% M-O-M but down 49.46% Y-O-Y. From January to April, the total export volume of butadiene reached 13kt, down 62.43% Y-O-Y. In April, Chinese-made butadiene was exported to South Korea, and there were no other export destinations.

As Asian butadiene price was still higher than China’s butadiene price in April, some of the Chinese-made butadiene was exported for arbitrage. Besides, the operating rate of crackers in South Korea and Japan declined, so there was a certain demand gap. In April, domestic demand for butadiene trended down from March, and the available export volume of butadiene in China moved up. Yet, most of the Chinese-made butadiene was still consumed by domestic downstream users.

In May, as the Asian butadiene price is higher than China’s butadiene price, the import volume of butadiene may still be at a relatively low level, hardly replenishing the domestic market. As seen from the export market, due to rising arbitrage space in the export market, the export volume of butadiene in China is likely to warm up in May. Chinese-made butadiene will be mainly exported to South Korea. China’s butadiene supply pressure will be eased, which will bolster domestic butadiene prices.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.