How Will the NBR Market Develop After the Price Rebound?

The NBR market price headed downwards from H2 of April, and the 4-month downward trend ended in H2 of August. What is the reason behind this round of rising prices?

By Sep 14, offers for 3305E produced by PetroChina Lanzhou Petrochemical were about RMB 16,500-17,000/mt, which increased by 17.54% from the lowest point in H2 of August but decreased by 32.73% from the highest point in the middle of the April.

The main reason for the recent rise in the price of NBR in China was the tight supply of spot goods in the market. In the early stage, some NBR holders had bearish sentiments about the NBR market in August and September, so they kept cutting prices for pre-sale. However, due to the low availability of spot inventory at some middleman and downstream producers, they replenished inventory when prices of NBR were falling. Starting from late August, new resources entering the market were delivered to meet early orders first. Besides, some NBR units in East China reduced the operating rate and production in August, so the tightening of the spot goods available for sale made the market price of NBR stop falling and rebound. In August, China’s domestic NBR output in August fell by about 4% M-O-M.

There are still some pre-orders that have not been delivered in H1 of September, so the supply side supports the high market price. However, the improvement in downstream demand is limited. Although the operating rate of some downstream producers has increased compared with the previous period, there is still a certain gap compared with the same period of previous years. In addition, some downstream producers stocked feedstock at relatively low prices in the early stage, and the stocking time was expected to be long. Most downstream producers are waiting for the delivery of early orders, and only some producers in urgent need of feedstock conduct a small amount of procurement based on rigid demand, and the high negotiation prices in the market fall under pressure.

SCI holds that there is limited room for further increase in the NBR market from late September to October, and there is no lack of possibility of price decline. On the one hand, the substantive structure of the fundamentals may hardly be improved. With the successive delivery of previous orders and the increase in the operating rate of some units in East China, the tight market supply may be alleviated gradually. Although some units in East China are scheduled to be overhauled by the end of October, the reduction in supply may not offset the impact of weak demand on the market. The National Day holiday is expected to result in a demand reduction. Although the recent growth rate of export volume is favorable, due to the small volume, its impact on the overall market may be limited. SCI estimates that China’s NBR export dependence is about 10%.

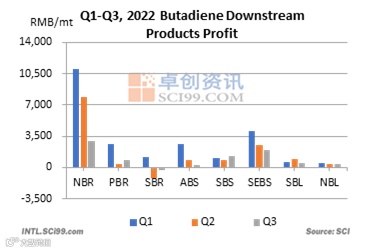

On the other hand, the feedstock price may hardly support the NBR market. The main feedstock of NBR is butadiene and acrylonitrile, of which the unit consumption of butadiene accounts for about 70%. In terms of butadiene, supported by the planned maintenance of some plants in the North and the low inventory in East China, the price of butadiene is relatively firm. However, in October, it is highly possible that the butadiene price may move downwards. In October, some units under maintenance in North and East China are expected to restart, and some new units are expected to release some of their output. The increase in supply may result in the downward trend of butadiene prices, which may barely support the NBR price from the cost side. At the same time, NBR is still the most profitable product among downstream products of butadiene, and the relatively considerable profit may reduce the impact of cost on the NBR market price.

On the whole, the market price of NBR may remain firm under the support of tight supply in the short term. However, in the medium term, affected by the successive release of supply, limited improvement in demand, and insufficient cost support, the high price of NBR may weaken. In the medium and long term, we need to pay attention to the variables on the demand side.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.