Weak IIR Demand in H1, 2022

In H1 of 2022, the IIR market was supported by feedstock cost and exchange rate, while the weak demand restricted the market price to some extent. Overall, the IIR price trended sideways after the stable-to-rising trend. In H2 of 2022, considering the influence of time and extent of demand recovery, the IIR price is estimated to rally after decreasing.

From January to June 2022, the overall IIR price trended sideways after the stable-to-rising trend. The average price of regular IIR 532 was RMB 16,633.6/mt in Jiangsu market, which increased by 8.9% from H1 of 2021 and 15.7% from H2 of 2021. The average price of BIIR 2030 was RMB 23,827/mt in Jiangsu market, which increased by 15.8% from H1 of 2021 and 13% from H2 of 2021. The average price of BIIR 2222 was RMB 22,338/mt in Jiangsu market, which increase by 11% from H1 of 2021 and 13.6% from H2 of 2021. The average price of regular IIR 1675N was RMB 15,964/mt, which increased by 5.1% from H1 of 2021 and 10% from H2 of 2021.

China’s IIR market price changes in H1 of 2022 were mostly ascribed to a few causes. First, the rising costs pushed up IIR market prices. Second, changes in exchange rates increased the market prices of imported IIR cargoes. Third, certain imported IIR had a low trading volume in the market due to variables including the international environment, and market participants primarily consumed part of the inventory.

Industry profit continued to be compressed by high cost and low demand

From January to June, the average profit of regular IIR was about RMB 51/mt in theory, which decreased by RMB 1,270/mt from H1 of 2021 and RMB 270/mt from H2 of 2021. The main reason was that in H1 of 2022, the international crude oil price increased by a large margin, which boosted China’s domestic MTBE price uptrend. As costs remained high, the profit of the regular IIR industry continued to be compressed, so the IIR market price was forced to increase from the same period of 2021. (Remarks: The profit is the theoretical calculation value, for reference only.)

Output saw limited changes while imports had significant increase

From January to June 2022, the total output of IIR in China was 136kt, which remained largely unchanged compared with the same period of 2021. At the same time, the overall import volume of IIR was 144.5kt, up 21% Y-O-Y. This year, the import volume of IIR achieved Y-O-Y growth, especially in April and May, the growth rate exceeded 32% and 57% respectively, which was induced by the considerable increase in the import volume of Russia-origin resources.

Hard to improve weak demand

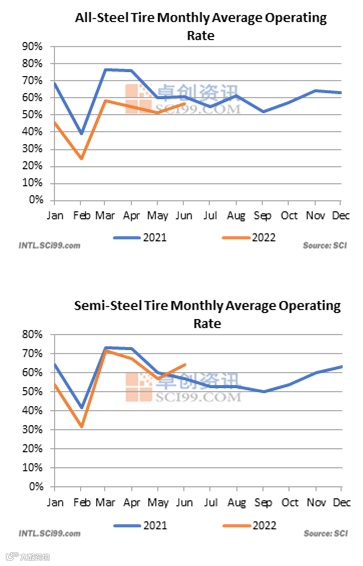

In H1 of 2022, the operating rate of the all-steel tire industry in Shandong was significantly weaker than that of the same period in 2021, and the operating rate of semi-steel tires also showed a downward trend, but the Y-O-Y decline in the operating rate of semi-steel tires was lower than that of all-steel tires. From January to June 2022, the total output of all-steel tires in China was 58.3545 million pieces, down 14% Y-O-Y. At the same time, the total output of semi-steel tires was 236.3846 million pieces, down 4.5% Y-O-Y. As the operating rate of the downstream tire industry failed to meet the level of last year, the demand restricted IIR price increases.

H2 IIR market outlook

China’s IIR market demand is anticipated to improve in H2 of 2022 after having a subpar performance in H1 of this year. Although the operating rate of the downstream tire industry has partially recovered, it is not anticipated that the overall demand for IIR would rise much in the near future. It is expected that the overall IIR demand may still be in the process of slow recovery from July to August. SCI predicts that from July to August, the IIR market price may be reduced slightly affected by sales and inventory, but it is predicted to rise from September to December as downstream demand is anticipated to strengthen.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.