China C4R2 Prices to Move Downward in December 2022

According to SCI’s data, China’s C4R2 prices declined rapidly in early December, especially in Shandong. In the short term, the notable decline in C4R2 prices will probably stimulate the downstream replenishment enthusiasm, supporting the overall C4R2 prices. In the long term, it is predicted that operating rates of downstream deep-processing units will see minor increments. Accordingly, China’s C4R2 prices may move downward.

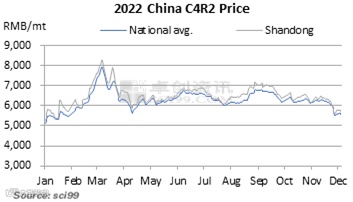

As seen from the chart above, C4R2 prices in Shandong fluctuated within a narrow range and hovered at RMB 6,150-6,400/mt from Q3, 2022. However, C4R2 prices in Shandong dropped by RMB 600/mt to around RMB 5,625/mt in early December.

Recently, the international crude oil prices kept dipping. Therein, the WTI crude oil prices dropped below $80/bbl, weighing on China’s refined oil market. Moreover, the overall gasoline demand was mediocre, so China’s refined oil prices went down, exerting bearish impacts on oil-blending feedstock market. According to SCI’s data, China’s alkylate prices declined by RMB 600-700/mt within four days in early December. Influenced by the decline in feedstock cost and downstream product prices, the overall production profit underperformed, and more market participants adopted bearish attitudes to the future market. Therefore, some downstream deep-processing enterprises cut unit operating rates to alleviate risks.

According to SCI’s data, operating rates of alkylation units in Shandong averaged 46.61% in November, down 2.26 percentage points M-O-M. Moreover, profits from alkylate production in Shandong averaged RMB 155/mt in November, down RMB 60/mt M-O-M. The decline in alkylation unit operating rate resulted in the C4R2 demand curtailment, and the profit loss further weighed on the production enthusiasm. Influenced by the demand curtailment, C4R2 prices in Shandong dropped notably.

With C4R2 prices declining, sales of C4R2 and alkylate improved somewhat, alleviating the inventory pressure on producers. Accordingly, it is estimated that China’s C4R2 prices will fluctuate within a narrow range in the short term.

In the long term, the demand from the oil product market may see minor improvements, so operating rates of deep-processing units will probably hover at lows. Meanwhile, the overall C4R2 supply is likely to inch up. Therefore, SCI reckons that China’s C4R2 market will probably move sideways in December 2022.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.