H2 Oct PP Prices Fall amid Supply-Demand Imbalance

China’s PP capacity continued expanding in recent years, and capacity regional structure and resource flow changed correspondingly. As of October 20, 2022, China’s PP capacity rose by 2,130kt/a this year, and therein, crude oil-based PP capacity occupied the most proportion. Small-scale PP producers face challenges at present with units’ scale-up. Large-scale producers introduce advanced production processes and are committed to the research and development of specific-purpose materials, so as to upgrade PP products and improve their own market competitiveness.

According to the geographical distribution, China’s PP capacity is mainly distributed in seven regions, involving Northwest China, North China, East China, South China, Northeast China, Central China and Southwest China. In recent years, newly added PP capacity has shifted to consumption regions. In the past five years, the proportion of capacity in Northwest China has been continuously compressed. The landed projects are mainly concentrated in East China, North China and Northeast China in 2022. Among them, the new capacity in East China can reach 1.5 million tons, accounting for about 70 % of the total. As of mid-October 2022, East China has enjoyed the largest capacity share, accounting for 23.55 % or so. North China witnessed capacity expansions at Tianjin Bohai Chemical Group and Weifang Shufukang New Material Technology. Comparatively, the development of PP capacity in Central China and Southwest China was still stagnant this year. More details regarding capacity change in 2022 were as follows:

2022 China PP Capacity Adjustment

Remarks: The above information regarding capacity expansion is updated as of mid-October 20.

As seen from the above table, the PP unit at Shandong Yuhuang with 100kt/a capacity was determined to be eliminated in May 2022. According to the methodology of SCI, China’s PP capacity and output data excluded this unit information from 2022.

Tianjin Bohai Chemical Group produced PP raffia 1102K after start-up in June 2022. Then, it arranged maintenance on September 28, and the restarting time was undetermined. Weifang Shufukang New Material Technology operates its 150kt/a unit to produce thin-walled injection BZ-70X now, and it operates another 150kt/a unit to produce PP powder 225. CNOOC Ningbo Daxie Petrochemical’s new units produce PP raffia 1102K at present.

The 500kt/a extrusion granulation unit of PetroChina Guangdong Petrochemical was officially put into a test run on October 13 and produced qualified PP granules, marking the successful commissioning of PP unit with the largest single extrusion capacity in the world.

The extrusion granulator set is the core of the PP unit. This PP sub-project department assaulted the whole process from three aspects including equipment installation, instrument debugging and physical material test.

On October 13, 2022, the extrusion granulation set of PP unit successfully produced the first batch of qualified PP granule at 10:14 after starting the main motor, pulling material, punching die, clamping die, starting granulator granulating, etc. So far, the 500kt/a PP unit at PetroChina Guangdong Petrochemical has seen unobstructed systems such as extrusion granulation, air delivery and mixing. But it needs some time for the PP unit at PetroChina Guangdong Petrochemical to be completely put into production because the unit’s upstream system has not been connected.

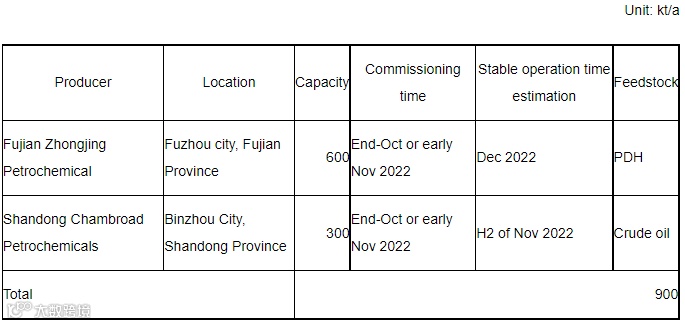

There will also be plans for capacity expansion in late October or early November.

Oct 2022 China PP Capacity Expansion Plans

PP supply is predicted to head up in October with maintenance decreases and capacity release. Besides, import cargoes will also impact China’s domestic PP supply. Maintenance peak season comes to an end. Meanwhile, there are commissioning plans in late October, and the capacity involved is large. Thus, the PP market will see large pressure from supply in November and December, if these two projects are put into operation as scheduled.

October still belongs to the traditional demand peak season for the PP industry. Downstream enterprises maintain relatively stable operating rates and stock up on a need-to basis at present. PP demand proves resilience. PP consumption is expected to grow intensively given stable orders in the previous stage and steady rigid demand now. However, PP inventory at downstream enterprises has increased a lot compared with September. If PP prices mount up, downstream users may show resistance to high-priced feedstock. Thus, the actual purchases of PP from downstream users will probably be fewer than expected. Demand is amid the dearth of continuity.

As for costs, crude oil prices remain high, but its mainstream prices have edged lower. That affects the operation of producers and downstream users, but the effect of crude oil price changes on market sentiment is weakening.

Generally, SCI predicts that PP prices may edge down in late October due to the supply increase and limited demand improvement.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.